The new energy vehicle market continues to thrive, but Landmap’s performance is lackluster.

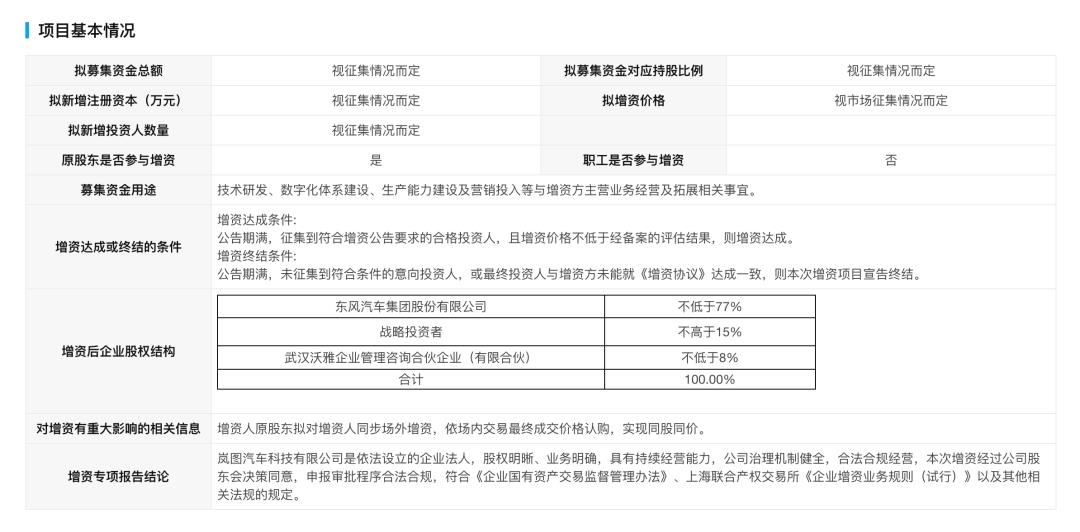

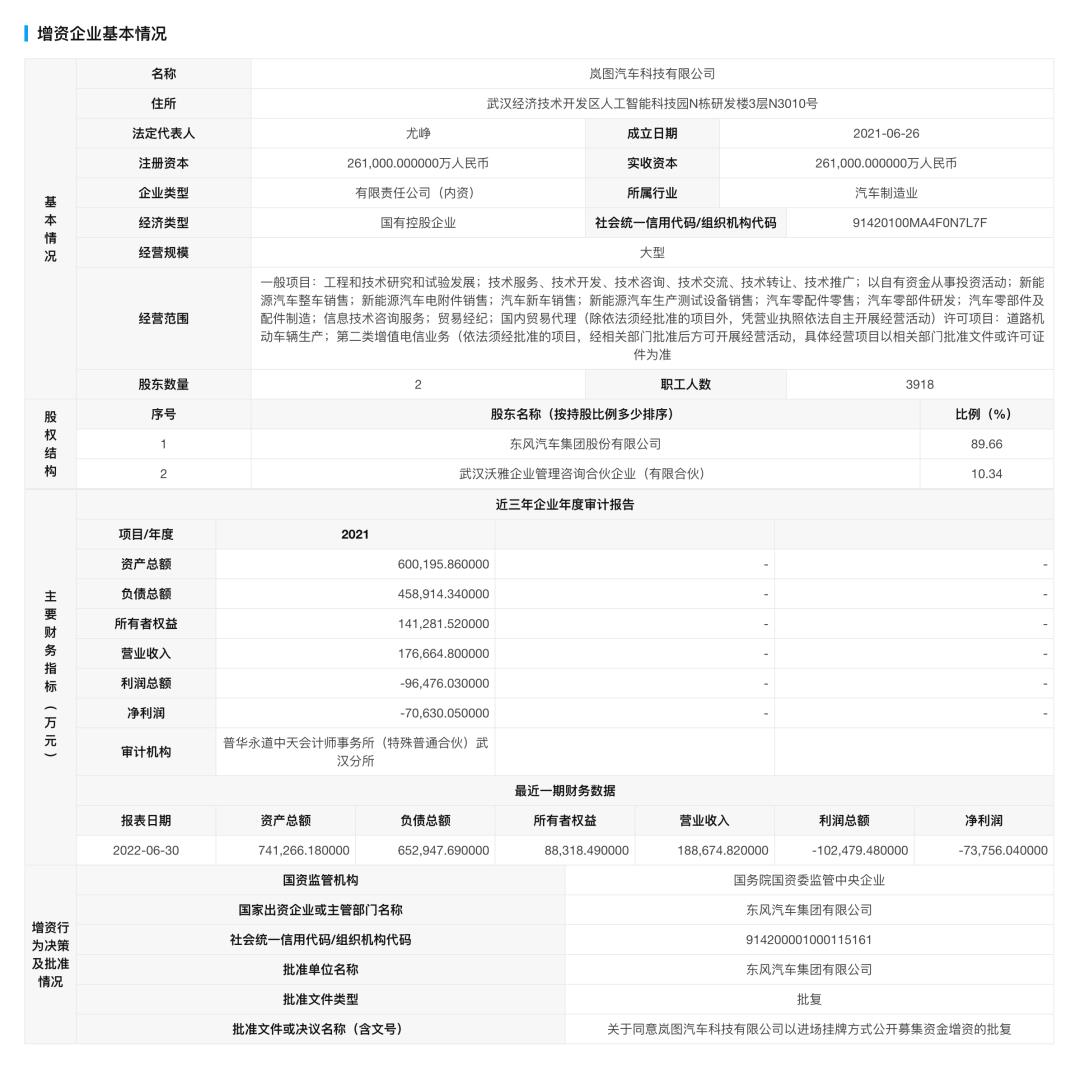

A few days ago, the Shanghai United Equity Exchange disclosed the information of the capital increase project of Lantu Automotive Technology Co., Ltd. (hereinafter referred to as "Lantu"). The content shows that before the capital increase, 89.66% of the equity of Lantu Automobile was held by Dongfeng Group, and the remaining 10.34% equity was held by employees. After the capital increase is completed, it is expected that Dongfeng Group will hold no less than 77% equity, strategic investors will hold no more than 15% equity, and the employee stock ownership platform will hold no less than 8% equity. It is understood that the proceeds raised by Lantu Automobile will be used for "technology research and development, digital system construction, capacity construction and marketing investment and other matters related to the main business operation and expansion of the capital increase party."

At the same time, Dongfeng Group disclosed the operating data of Landmap. The operating data shows that, In the first half of 2022, the operating income of Lantu Automobile was 883 million yuan, and the net loss was 738 million yuan. As of June 30, 2022, the total assets of Lantu Automobile were 7.413 billion yuan, and the total liabilities were 6.529 billion yuan.

Sales data show that in the first half of 2022, Lantu accumulated sales of 5676 vehicles, with an average monthly delivery of 946 new cars, and the annual sales target completion rate of 46,000 vehicles was only 13.5%. In contrast, Geely’s high-end new energy brand, JK, delivered a total of 19,010 new cars in the first half of 2022. In contrast, Lantu, which is also a high-end electric brand under traditional automobile companies, has a slightly dismal market performance.

Founded on June 26, 2021, Landmap has high hopes as the vanguard of Dongfeng Group’s impact on the high-end new energy market. Lu Fang, CEO of Landmap Automobile, once said: "Landmap is an important strategic layout for Dongfeng’s transformation and upgrading, carrying the dual mission of Dongfeng’s brand upward and exploring a new model of independent brand development."

At present, Landmap has two models on sale, namely SUV Landmap FREE and MPV Landmap Dreamer, of which Landmap FREE was officially launched in June 2021. According to the official data, Landmap FREE completed the delivery of 10,000 vehicles in only 205 days.

After entering 2022, the development of Lantu is also very unsmooth. According to the production and sales express released by Dongfeng Group, the cumulative sales of Lantu in January-August 2022 are 11100 units, of which 2429 units are sold in September. According to the sales target of 46,000 units expected to be set at the beginning of the year, 24.13% of the annual target has been completed; according to the sales target of 31,000 units adjusted in the middle of the year, 35.81% of the annual target has been completed, and the timeline of 2022 has passed 75%.

Compared with major competitors such as Ideal and AITO, Landmap’s positioning of the target consumer group is not clear, which results in a low user perception of its recognition and value, further affecting consumers, especially those with family car needs.

As a new high-end new energy brand, Lantu chose an extremely difficult route at the beginning. The price range of 30-400,000 yuan belongs to the high-end consumer market. In this price range, consumers considering fuel vehicles will mostly choose traditional luxury brands such as BBA, while consumers considering new energy vehicles may consider high-end new energy models such as Model Y, NIO ES6, and Ideal ONE.

Although LANTU FREE provides two power versions of pure electric and extended range, the factors that affect consumers’ car purchases are not only the product itself, but also the brand influence. In other words, although LANTU is positioned as a high-end new energy vehicle brand, the development of Dongfeng Automobile behind it is mediocre. Its passenger car brands, including Fengshen, Scenery, Fengxing, etc., are the main 100,000-level car market, while LANTU is at the 30-400,000 level, with huge differences before and after.

Wang Chuanfu, chairperson and president of BYD, once pointed out to "new players" who build cars: "Maybe losing 5 billion yuan is not much, but losing three years, how much is it worth? You can’t buy it with money."

On July 19, Lantu made the largest personnel adjustment since its establishment: Lantu CEO Lu Fang no longer served as the Chief Technology Officer (CTO), and the position was held by Wang Junjun, deputy director of the DONGFENG MOTOR CORPORATION Technology Center. In addition, Qin Jie served as the interim party committee member and party secretary of Lantu Automobile; Liu Mingjiao served as the interim party committee member, disciplinary committee member, and disciplinary committee secretary of Lantu Automobile; Gong Xuesong and Shao Mingfeng served as the assistant general manager of Lantu Automobile.

Of course, Dongfeng’s expectations for Lantu would not only depend on three to five years of development, nor would it require it to reach a new height in the industry in the short term. Perhaps, with Dongfeng Group, Lantu did not have much advantage, but the latter two like NIO and Ideal might have stronger strength. Therefore, how to make up for the shortcomings and take the long board and compact the competitiveness of the product may be what Lantu needs to study in depth next.

The importance of Landmap to Dongfeng was self-evident, representing Dongfeng’s expectation of attacking the independent high-end market. Behind the personnel adjustment, Dongfeng was dissatisfied with the current situation of Landmap, trying to inject new blood into the management team and open up a new development situation. As for whether Landmap could seize this opportunity, it might determine whether there would be a place for Dongfeng in the second-tier pattern of new forces in the future.

Responsible editor: Yanlin