[yesterday’s review]

On January 17, Hong Kong stocks surged in early trading, but their stamina was insufficient. Bears launched a counterattack, and major indexes turned down one after another. The Hang Seng Index closed down 0.78% and the Hang Seng Technology Index fell 0.14%.

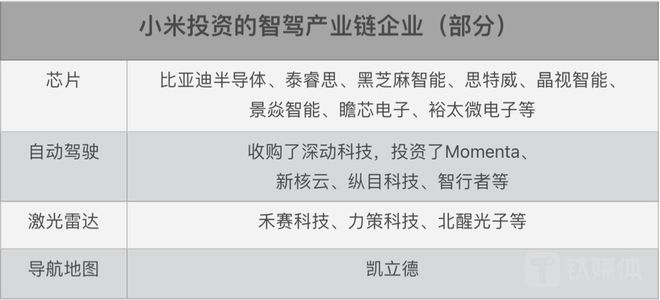

Large-scale technology stocks fell, JD.COM, Baidu, Xiaomi, Netease and Meituan all fell, while Alibaba and Tencent rose nearly 1% against the trend; Biomedical stocks pulled back significantly, while gambling stocks and auto stocks generally fell.

On the other hand, online education stocks, sporting goods stocks and semiconductor stocks are active.

[capital flow]

The net inflow of southbound funds yesterday was HK$ 4.288 billion. Simcere ranked first in net purchases, and China Construction Bank ranked first in net sales.

In terms of short-selling data, Far East Hongxin, Meidong Automobile and Prudential ranked in the top three; Alibaba, Tencent Holdings and China Ping An ranked the top three in short selling amount.

[breaking news]

Talk about collapse completely! The negotiation between Blizzard and Netease broke down, and the national service game service was terminated on January 23rd.

On January 17th, Blizzard China official Weibo announced that it contacted Netease again last week and sought assistance to discuss extending the existing agreement based on the agreed terms of Netease in 2019 for six months. However, Netease did not accept the proposal to postpone the existing game service agreement, so it will have to stop the national service game service on January 23 in accordance with Netease’s notice of stopping service.

Blizzard China also mentioned the progress in finding new partners in the announcement. Blizzard said that it has held talks with a number of potential partners, and its preferred potential partners should be able to provide players with high-quality and stable game services and create a positive game environment inside and outside the game.

Netease has previously announced that after the game server is closed, all game data such as account data and character data in each game will be sealed. Netease will properly handle game data in accordance with the requirements of laws and regulations to protect the legitimate rights and interests of users.

Gorgeous turn! New Oriental’s live online delivery is quite effective, and its revenue has soared by 590% in half a year.

After the Hong Kong stock market closed yesterday, New Oriental Online (to be renamed Oriental Selection) announced its results for the six months ended November 30, 2022 (that is, the first half of fiscal year 2023).

The data shows that the revenue of New Oriental’s continuing business during the online period was 2.08 billion yuan, a year-on-year surge of 590.2%; Even if the income from terminated business in the same period of last year was 272 million yuan, there was a year-on-year growth rate of 262.7%.

The gross profit of New Oriental during the online period was 982.5 million yuan, a year-on-year increase of 467.9%, and the gross profit rate was 47.2%. The net profit was 585.3 million yuan, compared with a loss of 108.7 million yuan from continuous operation in the same period of last year, which successfully turned losses into profits.

New Oriental Online also disclosed for the first time the performance of Oriental Selection within six months:

In the first half of fiscal year 2023, the total revenue of the self-operated products and live broadcast e-commerce division of the representatives selected by Dongfang was 1,765.8 million yuan, accounting for 84.9% of the total revenue of New Oriental Online, with a gross profit margin of 42.5%.

The total transaction volume (GMV) of the business of Dongfang Selection Office reached 4.8 billion yuan, with 35.2 million followers in Tik Tok and 70.2 million orders paid in Tik Tok.

More than 60 kinds of self-operated agricultural products have been selected by the East, bringing in more than 1 billion yuan in revenue. The orders for self-operated agricultural products plus orders for third-party products totaled 70.2 million.

In 2023, the first batch of domestic online games were released! Tencent Netease’s heart is in the air.

On the evening of January 17th, official website, the State Press and Publication Administration, announced the approval information of domestic online games in January 2023, and a total of 88 domestic online games were successfully registered. Tencent and Netease, the two major head game manufacturers, have gained something.

Tencent was awarded the titles of Dream Star, Dawn Awakening: Vitality and Aurora at White Night respectively. Netease won a version number, and its survival shooting mobile game "Extraordinary Pioneer" appeared in this approval list.

In addition, Netease’s MMORPG "Going Against the Water" was added to the mobile version, which means that its key product "Going Against the Water" was officially approved.

In addition to the two major head game manufacturers, the games of Mihayou and Heartbeat Company also appeared in this approval list.

Junshi Bio: COVID-19 oral medicine VV116 new drug application was accepted.

Junshi Bio announced that its holding subsidiary, Shanghai Wangshi Biomedical Technology Co., Ltd., received the Notice of Acceptance approved and issued by the Food and Drug Administration, and the application for the listing of a new drug for treating novel coronavirus infection (hereinafter referred to as "COVID-19"), an oral nucleoside anti-novel coronavirus (SARSCoV-2) drug jointly developed by Juntuo Bio and Suzhou Wangshan Wangshui, was accepted.

New energy car companies start another round of price war? Xpeng Motors announced a price cut.

Driven by Tesla’s price reduction, some domestic new energy brands choose to follow suit, and the latest one to join the price war is Xpeng Motors.

On January 17th, Xpeng Motors announced that the new New Year price system for G3i, P5 and P7 would be launched from 14: 00 on that day. The starting prices of the three models were 148,900, 156,900 and 209,900 respectively, with the biggest drop of 36,000 yuan.

At the same time, Xpeng Motors said that the first car owner who ordered G3i/P5/P7 within one year before the announcement will also give back in the Spring Festival at the same time, including extending the vehicle warranty to 10 years/200,000 kilometers and giving four years of basic maintenance.

Strong alliance! Contemporary Amperex Technology Co., Limited and Weilai signed a comprehensive strategic cooperation agreement

On January 17th, () signed a five-year comprehensive strategic cooperation agreement with Weilai in Ningde.

Officially, the signing of the comprehensive strategic cooperation agreement is another deepening and upgrading of the strategic cooperation relationship between the two sides, involving technical cooperation in new brands, new projects and new markets.

It is understood that on the basis of giving full play to their respective resource advantages, the two sides will build an efficient and coordinated battery supply system based on advanced battery technology to enhance innovation capability and efficiency.

Tencent’s withdrawal of the 15-storey office building of Netac Technology belongs to the normal adjustment of office buildings.

A-share listed company () announced that Tencent intends to terminate the lease contract of Netac Building in advance.

In response, Zhang Jun, the public relations director of Tencent, said that the rent withdrawal was a normal adjustment of office buildings.

The major shareholder of Yaoming Bio plans to place 56 million shares and cash in HK$ 4 billion.

Yaoming Bio announced on January 17th that its major shareholder, WuXi Biologics Holdings Limite, plans to place 56 million shares of the company at HK$ 71 per share, and cash out nearly HK$ 3.98 billion.

According to the announcement, Morgan Stanley will act as the agent for this placement. If the placement is completed, the shareholding ratio of Biologics Holdings will be reduced from 15.14% to 13.82%.

According to public information, behind Biologics Holdings is Li Ge, chairman of Yaoming Bio and founder of ().

Xiaomo reduced its holdings of Vanke by about 1,658,400 shares and cashed in nearly HK$ 30 million.

According to the latest data of the Hong Kong Stock Exchange, on January 11th, Xiaomo reduced its holdings of 1,658,392 H shares of Vanke, with a price of HK$ 170,095 each, and cashed in about HK$ 28,208,400.

After the reduction, the latest shareholding of Xiaomo is about 114 million shares, and the latest shareholding ratio is 5.96%.

At the same time, the auditor of Evergrande III listed platform will be replaced, and the meeting will sincerely succeed PricewaterhouseCoopers.

On the evening of January 16th, China Evergrande, Evergrande Property and Evergrande Automobile announced at the same time that PricewaterhouseCoopers resigned as auditors at the suggestion of the above-mentioned companies, with effect from that day. To appoint Shanghui Baicheng Certified Public Accountants Limited as the new auditor, which is a member of Shanghui Certified Public Accountants (special general partnership) in Hong Kong.

In his resignation letter, PricewaterhouseCoopers pointed out that it had not obtained the audit materials and evidence needed for the audit in 2021, including the fact that the deposit pledge guarantee of 13.4 billion yuan disclosed by Evergrande Property on July 22, 2022 was transferred by relevant banks.

In addition, PricewaterhouseCoopers said that it is impossible to determine the scope of the audit work to be carried out in the future, and it is difficult to reasonably estimate the time required to complete the audit work in 2021. Therefore, Luo Bingxian agreed to resign as the auditor of the Company.

Aauto Quicker CTO Chen Dingjia resigned and two senior vice presidents shared relevant responsibilities.

Aauto Quicker announced that Chen Dingjia would resign as Chief Technology Officer (CTO) due to his intention to devote more time to his family and personal affairs, with effect from January 18th. In view of Chen Dingjia’s great contribution, after his resignation, he will be transferred to the company as a lifelong honorary consultant and continue to provide guidance and support for the company.

The announcement shows that after Chen Dingjia resigned, two senior vice presidents in related fields will share the relevant management responsibilities of the previous CTO and report to CEO Cheng Yixiao.

Hansen Pharmaceutical: Covid-19 oral small molecule 3CL protease inhibitor obtained notice of clinical trial.

Hansen Pharmaceutical announced on the evening of January 17th that the first-class new drug "HS-10517 Tablet" against novel coronavirus oral 3CL protease inhibitor, which was jointly developed by the Group and Beijing Huayi Health Drug Research Center (also known as Global Health Drug R&D Center for short), has been approved and issued by China Food and Drug Administration, and it is intended to be used for the treatment of mild and moderate adult novel coronavirus infection patients.

[financial data]

1. () (02601.HK): In 2022, the accumulated original insurance business income of CPIC Life Insurance was 222.342 billion yuan, up 6.1% year-on-year; CPIC Property Insurance accumulated 170.824 billion yuan of original insurance business income, up 11.6% year-on-year.

2. China Resources Power (00836.HK): In 2022, the cumulative electricity sales of affiliated power plants reached 185 million MWh, up 4.1% year-on-year. Among them, the cumulative electricity sales of affiliated wind farms reached 35.2555 million MWh, an increase of 10.4% year-on-year; The cumulative electricity sales of affiliated photovoltaic power stations reached 1,351,900 MWh, up 17.8% year-on-year.

3. China Petrochemical Co., Ltd. (00386.HK): In 2022, the oil-gas equivalent output was about 489 million barrels, up by 1.94% year-on-year; The output of crude oil was about 280 million barrels, up by 0.39% year-on-year; Natural gas production was 1.25 trillion cubic feet, up 4.11% year-on-year.

4. () (01186.HK): Recently, 12 major projects were awarded, with a total project amount of 103.295 billion yuan, accounting for 10.13% of the company’s audited operating income in 2021.

5. CGNPC Nuclear Mining (01164.HK): In the fourth quarter, a total of 771.9tU of natural uranium was produced, with a planned completion rate of 94.3%.

6. China Xinlianxin Chemical Fertilizer (01866): On January 16th, the second phase DMF project of Jiangxi Xinlianxin Chemical Industry Co., Ltd. was successfully put into production, and the DMF production capacity of the group increased to 200,000 tons/year.

Jiangxi base has planned three phases of DMF project, of which the first, second and third phases are all DMF with an annual production capacity of 100,000 tons.

7. Chizicheng Technology (09911): In 2022, the cumulative download volume of social services reached 481 million, up 5% year-on-year; The total revenue of the annual delivery business is estimated to be 540 million yuan to 2.57 billion yuan, a year-on-year increase of 20%; The average monthly activity of social business reached about 22.91 million, a year-on-year increase of about 20%. In addition, the total annual revenue of innovative business is expected to be 230-260 million yuan.

The decline in revenue from the Group’s innovative business narrowed quarter by quarter, mainly due to the smooth progress of the boutique game business.

8. Yongda Automobile (03669.HK): It is estimated that the net profit attributable to shareholders will decrease by no more than 43% in 2022, mainly due to the repeated COVID-19 epidemic during the reporting period, which affected sales.

9. Chanyou Technology (02660.HK): It is estimated that the net profit attributable to shareholders in 2022 will increase by about 30% to 42% compared with that in 2021, mainly due to the group’s iterative product innovation and sustained and steady channel growth.

10. Fenmei Packaging (00468.HK): It is estimated that the comprehensive profit will be 168-188 million yuan in 2022 and 285 million yuan in the same period in 2021. Mainly due to the pressure of profit margin brought by the rising cost of raw materials.

[investment operation]

1. () (00564.HK): Signed an asset management plan with Zhongtai Asset Management at a cost of 200 million yuan.

2. Chunli Medical (01858.HK): entered into an agreement with Bank of Beijing to subscribe for 525 million yuan of structured deposit products.

3. Kangxinuo Bio (06185.HK): purchased a structured deposit with a principal of 200 million yuan from Bohai Bank.

4. Xinneng Low Carbon (00145.HK): We are negotiating with several potential strategic business partners in China and Europe on potential cooperation, and exploring business opportunities in Asia (including China) for energy-saving equipment and low-carbon service product supply, carbon sink resource development and management, and agricultural and forestry development.

5. () (02196.HK): The drug registration of roxatidine acetate hydrochloride for injection was accepted by National Medical Products Administration, which is mainly used to treat upper gastrointestinal bleeding. According to the latest data of IQVIA CHPA, in 2021, the sales of roxatidine acetate hydrochloride for injection in China was about RMB 1.44 billion.

6. Fosun Pharma (02196): FCN-016 eye drops have been approved by the clinical trial of drugs. This new drug is an innovative small-molecule chemical drug independently developed by the Group, which is a Rho kinase (Rock) inhibitor, and is intended to be mainly used to reduce the intraocular pressure of patients with open-angle glaucoma or ocular hypertension.

7. Fudan Zhangjiang (01349.HK): The FDA022 antibody coupling agent for injection developed by the company was used in the phase I clinical study of drugs for the treatment of advanced solid tumors, and the first subject was successfully enrolled recently. This drug is the first new generation ADC drug on BB05 platform, and it is intended to be used to treat advanced solid tumors with positive HER2 expression, such as breast cancer, gastric cancer, lung cancer and colorectal cancer.

8. Fuhong Hanlin (02696.HK): National Medical Products Administration approved the application for listing and registration of Hans-like combination carboplatin and etoposide as new indications for first-line treatment of extensive small cell lung cancer.

[Repurchase cancellation]

1. Tencent Holdings (00700.HK): It spent HK$ 351 million to buy back 950,000 shares at a repurchase price of HK$ 366.2-375.4.

2. AIA (01299.HK): It spent about HK$ 225 million to buy back 2,608,600 shares at a price of HK$ 85.4-87.3.

3. Zhongjiao Holdings (00839.HK): 147 million shares were issued on January 17th at an issue price of HK$ 10.94 per share.