Text |connected mobility Xiong Chaoge

Editing | Pony

Walking on the road of cost performance, the zero-run car is "full of determination".

On June 28th, Zero Run C16 was officially launched. This model is positioned as a medium and large SUV within 200,000 yuan, and is equipped with many configurations that are not lost to high-end models, which has triggered heated discussions in the industry.

After tasting the sales sweetness brought by the 2023 C11, Zero Run no longer adheres to the slogan of "exceeding Tesla", but positions itself as the "Uniqlo" of the automotive industry.

On the other hand, the gross profit margin of Zero Run in 2023 has just turned positive, and it has fallen back to negative figures in the fierce price war competition in the first quarter. NIO MONA, Xiaopeng Ledao and other sub-brands have joined the battlefield, and BYD in the mid- and low-end market is still pushing the price to roll in, and the pressure of Zero Run is not small.

Recently, it has been reported that Zhang Weili, senior vice president and chief marketing officer of Zero Run Auto, will leave. In the past six months, Zeng Lintang, Wu Baojun and other senior executives of Zero Run Auto have left. With the reform of Zero Run’s marketing system, Zero Run adjusts its combat effectiveness in the midst of market changes.

At present, Zero Run is focusing on "large rolls and special rolls" at the price of 150,000 yuan, and has released 4 series models and product layout plans for the next 3 years in one breath.

What will this help Zero Run achieve in 2024?

1. With more than 100,000 cars, the investment in zero running is very large?

Looking back at the Zero Run C16 that has not been listed for a long time. This smart 6-seat medium and large SUV includes two power modes of pure electricity and range extension, three versions of smart enjoyment, exclusive enjoyment and smart driving, a total of 6 models, and the listing guide price is 15.68~ 185,800 yuan, that is, the top match does not exceed 200,000.

Zero Run C16 price chart, picture source Zero Run Car official website

Combined with the price range, Zero Run’s investment in this model is considerable.

In terms of spatial layout, the C16’s body size is 4915 * 1905 * 1770mm, which is up to the standard line of medium and large SUVs. In the 2 + 2 + 2 seat layout, it is equipped with a 14.6-inch central control screen, a 15.6-inch rear entertainment screen, a 21-speaker stereo, and a three-temperature zone independent air conditioner.

On the smart cockpit, the C16 uses a smart cockpit based on the Qualcomm Snapdragon SA8295P chip, with AI computing power reaching 30 TOPS.

On the power battery, the C16 pure electric version uses a global 800V silicon carbide high-voltage platform, with 800V fast charging from 30% to 80% for the fastest 15 minutes. It also provides a 215kW drive motor, equipped with a 67.7kWh battery, and the CLTC pure electric battery life reaches 520km. The C16 extended range version uses a new generation of range extender, equipped with a 28.4kWh battery. The CLTC pure electric battery life is 200km, and the CLTC comprehensive operating conditions range reaches 1095km.

Intelligent driving configuration, C16 is equipped with NVIDIA Orin-X chip, Hesai laser radar, and 8 million pixel camera and other 30 sensing hardware, the vehicle computing power reaches 2048TOPS, to achieve urban NAC navigation auxiliary cruise, high-speed, urban expressway intelligent pilot NAP;

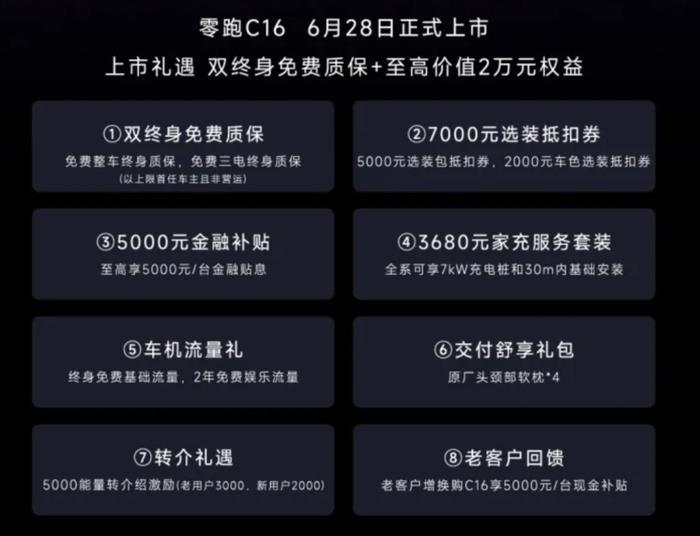

In addition, in the car purchase rights and interests, zero run also gives the vehicle lifetime quality assurance, three electricity lifetime quality assurance, 5,000 yuan optional package voucher, 5,000 yuan subsidy, 5,000 yuan discount, 3680 yuan worth of charging pile installation and other discounts.

Zero Run C16 car purchase rights and interests, picture source Zero Run Auto official website

In other words, the price of 161,800 C16 Smart Enjoy pure electric version, for the pre-order activities of 1,000 yuan to 5,000 yuan before the listing, and the zero-run owners who have replacement needs, only 157,800 yuan can complete the selection and landing.

From the price to the configuration, to the promotion activities, the Zero Run C16 feels like a "price butcher". From the market feedback, this model does show the same signs of explosion as the Zero Run C11. Within 48 hours of listing, the Zero Run C16 has been ordered to be 5,208 units. Previously, Zero Run officials had expected that the C16 will be delivered in July about 2,000 units, and in August more than 5,000 units will be delivered in batches.

With so much investment in a 100,000-plus model, what is Zero Running up to?

"C16 selects top BBA suppliers, which not only sets the price down, but also provides better materials and experience." Zhu Jiangming, founder, chairperson and CEO of Zero Run, said at the C16 launch that Zero Run’s goal is to become the "Uniqlo" of the automotive industry and adhere to the route of low price and high matching.

In 2021, when Zero Run opened the "2.0 era", Zhu Jiangming had set ambitious goals such as "surpassing Tesla in three years" and "the top three in new power car manufacturing", but in recent years it has become more and more realistic – starting from the best-selling of the C series models in 2023, low-cost and high-end models have become the main label of Zero Run.

In 2023, the previous sales force of the Zero Run T03 gradually declined in the fierce competition of the minicar, while the sales share of the Zero Run C series jumped from 44.3% in 2022 to over 73%.

Compared with tens of thousands of yuan of T03, C11, which opens the 15 yuan market, will send Zero Run to a stage with more room to play, and Zero Run has the opportunity to implement more high-end technologies in the product, thus completing the Uniqlo-style "flat replacement".

In March this year, Zero Run released the "2024 New Product Family Bucket", launching the first C10 and 2024 versions of T03, C11, and C01.

Zero Run "2024 New Product Family Bucket" tweet, picture source Zero Run Car official WeChat official account

Taking the main sales model C11 as an example, the 2024 new C11 is equipped with leaf 3.0 vehicle architecture, Qualcomm Snapdragon SA8295P cockpit, FSD variable damping shock absorber, NVIDIA Orin-X chip and many other upgrades, which are placed on the new C11 model with the whole series instead of the top, and the starting price is only 148,800 yuan. Compared with the new C16, it is not difficult to see that the zero-run is a strategy to achieve low-cost and high-end, and basically takes out "all the belongings".

However, in the red sea of price wars, the road to low prices and high matching requires great determination and investment.

2. To break through the encirclement, it still depends on "cost performance"

On the road to "cost performance" of Zero Run, Zero Run C11 is an indispensable product.

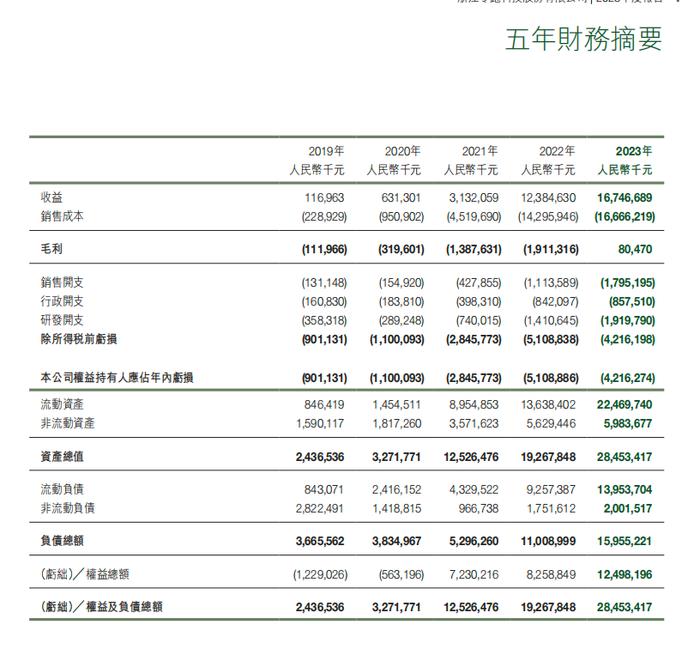

At the market end, the main sales model of Zero Run completed the "succession" from T03 to C11, and with the help of this model, the delivery volume of Zero Run in 2023 reached a record high of 144,155 vehicles, ranking among the top three sales of new forces, and achieving a positive gross profit margin of 1.2% in the third quarter of 2023, and then a positive gross profit margin of 0.5% for the whole year.

Zero Run 2024 T11, picture source Zero Run Car official website

The Zero Run C11 once sold more than 10,000 yuan, becoming the sales champion of medium-sized new energy SUVs in the range of 15-200,000 yuan in 2023, accounting for 56% of Zero Run’s sales that year. In the annual report, Zhu Jiangming concluded: "We redefine the selection criteria for new energy vehicles in the RMB 150,000-200,000 yuan level."

Previously, Zhu Jiangming said that in the future, Zero Run will deeply cultivate models of more than 150,000 yuan, and strive to sell 30,000 vehicles per month. In 2025, the first product of the A series with a price of 100,000 yuan will be listed, and 3 B series models in the range of 100,000 yuan to 150,000 yuan will be listed. In 2026, Zero Run will launch 3 models of the D series 200,000 yuan.

From the product layout, the 150,000 yuan is the "anchor point" of the zero-run car in the low-end market. The first stop is the current C series focusing on the price segment of 150,000 yuan to 200,000 yuan, while the A, B, and D series models are respectively arranged at both ends of the price segment.

At present, from the layout of the model, with the C11 as the stepping stone, the main strategy of Zero Run has been fully transferred to "cost performance", challenging the product positioning of high-end models.

In addition to the intelligent pure electric minicar T03 and the intelligent sedan C01, Zero Run’s main sales products are concentrated in the SUV, a new energy must-compete model, including two medium-sized SUV products C10 and C11, and a medium-sized and large SUV product C16, which are mostly similar to the ideal L6, L7, L8, and Qjie M7 and M9.

In the face of netizens’ ridicule of C16 "ideal flat replacement" and "half-price ideal L8", Zhu Jiangming responded to the media that Zero Run did not mind this statement. "Users who are used to buying Chanel occasionally buy Uniqlo and buy products like C16. After using it, they find that it is the same, and they may become loyal fans of Zero Run."

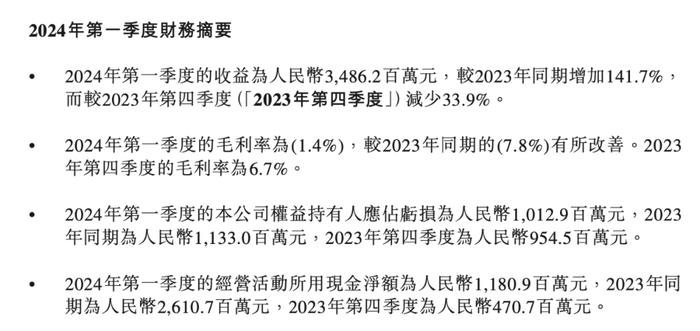

In the first quarter of this year, Zero Run Auto recorded revenue of 3.486 billion yuan, an increase of 141.7% year-on-year, and net loss narrowed to 1.013 billion yuan, a decrease of 10.59% year-on-year. In addition, as of the end of the first quarter, Zero Run cash and cash equivalents, restricted cash, financial assets at fair value into profit and loss and bank time deposits totaled 17.584 billion yuan.

But in the fierce price war of the industry, Zero Run launched many promotional activities, and the gross profit margin fell back to negative -1.4% again. This means that Zero Run, which has accumulated sales of 33,400 vehicles in the first three months, lost an average of 1,460 yuan for each one sold, and accidentally slipped off the "wire" and returned to the situation of "selling more and losing more".

But for the price war, Zero Run is already mentally prepared. Zhu Jiangming said that "the market is mature, and it is unrealistic for everyone not to fight a price war." He believes that the price war will continue for three years, the competition will remain fierce, and the process of new energy vehicles will be completed in three years. At that time, pure fuel vehicles will account for less than 10%. During this period, new energy vehicle companies will fully compete and seize positions.

In the red ocean of price involution, cost performance is the main focus, which means that how to balance costs will be a long-term proposition for zero runs.

3. Cost control will be a long-term problem for zero running

After 2023, when the strategy is gradually clear, Zero Run gradually focuses on "cost control".

In 2024, Zero Run officially proposed a sales target of 250,000 to 300,000, and it is expected to achieve profitability by the end of 2025 and early 2026. Before that, around the cost, Zero Run cars need to continue to withstand two tests.

First, increase sales. In 2023, Zero Run failed to meet 200,000 sales target. In the first half of 2024, Zero Run accumulated sales of 66,500 vehicles in the first five months, and in June it ushered in the outbreak, delivering 20116 vehicles, breaking through 20,000 sales for the first time, but overall, Zero Run sold 86,696 units in the first half of the year, only completing the annual sales target of about 35%. Zero Run’s sales volume is not low among its peers, but the strategy of focusing on small profits but quick turnover makes it particularly need sales scale.

Second, to further reduce costs. To achieve the route of low price and high matching, Zero Run must allow its own products to have cost advantages while benchmarking with competitors in exchange for price and configuration. At present, Zero Run relies on global self-research, making the product self-made rate exceed 70%, of which more than 60% of the core parts of the vehicle cost are self-developed. Zhu Jiangming previously said that the three rounds of technical cost reduction that Zero Run has completed will reach 40% in 2023, and it is entering the fourth round of cost reduction cycle.

In fact, the increase in the scale of sales, zero running can get more in the production and manufacturing has the voice over, and reducing costs means directly improving the competitiveness of products.

Zhu Jiangming, founder, chairperson and CEO of Zero Run Auto, pictured on the official website of Zero Run Auto

In an interview with Late Auto, Zhu Jiangming said of sales and costs, "At this stage, the annual sales 500,000 can survive, 1 million have stronger vitality, and the best way to live is more than 3 million". When the scale is large enough, the advantages of refined management will appear. He said that Zero Run paid attention to the cost issue when it launched the C11, and used cost optimization to set more convincing prices for all models in March last year, which promoted sales to rise all the way.

Zero Run Auto’s financial summary in the past five years, picture source Zero Run Auto’s 2023 financial report

In the past five years, Zero Run has lost more than 14 billion yuan. Under the background that the stock price of Hong Kong stocks has been declining and has not yet risen back to the issue price, Zero Run Auto must face the next challenges cautiously. Now, in addition to products, Zero Run is also constantly seeking reforms and opportunities.

On the one hand, Zero Run is reforming its marketing system and further deploying the lower-tier market. In May, Zero Run merged its three original sales departments into a "sales department", and plans to increase the number of lower-tier market outlets from more than 500 to 800. It will open a 4S store in the Motor City, using the "1 + N" model of many display stores in the surrounding area of the 4S store to cover cities without outlets.

On the other hand, Zero Run’s overseas cooperation with Stellantis is progressing steadily. In May this year, Zero Run and Stellantis joint venture Zero Run International were officially established. It plans to land in 9 European countries in September. It will enter India and Asia Pacific (excluding Greater China), the Middle East and Africa, and South America from the Q4 quarter. It will cover major markets outside North America within a year. In the asset-light model that is not responsible for marketing and production, Zero Run is expected to obtain a healthy cash flow.

On the one hand, it covers the product layout planning for the next three years, and on the other hand, it strives to reduce costs and seek to go overseas. The ambition of Zero Run is fully demonstrated. Low price and high matching is a sharp blade with pressure. How effective it can be depends on the specific operation of Zero Run this year.