On the evening of March 24th, China Fund Industry Association disclosed the latest ranking of the asset management of securities firms, special accounts of fund companies and special accounts of fund subsidiaries.

With the gradual implementation of the new asset management regulations, the effect of breaking the cash pool model and curbing the channel business has appeared. The supervision of the asset management industry has continued to "prevent risks and return to the essence of investment", and the active management ability has been steadily improved, especially for securities companies. As of the fourth quarter of 2019, except for brokers with unparalleled data, the average monthly size of 19 of the top 20 brokers has all declined compared with the third quarter. At the same time, the improvement of active management ability of brokers is more obvious. In the fourth quarter of last year, six companies accounted for more than 50% of the active management scale, of which more companies accounted for more than 80% of the active management scale.

Average monthly scale of brokerage asset management:

oneThe scale of nine companies has declined, and this ranking has risen rapidly.

Under the trend of shrinking asset management scale, on the whole, in the fourth quarter of last year, except for brokers with unparalleled data, the average monthly size of 19 of the top 20 brokers all declined compared with the third quarter.

Specifically, in the fourth quarter of last year, there were six companies with an average monthly scale of 500 billion yuan, a decrease from the third quarter, namely, Guojun Asset Management, Huatai Asset Management, China Merchants Asset Management, and Securities. Among them, the average monthly scale is 1.1 trillion yuan, and it is still the only brokerage company with an average monthly scale of 1 trillion yuan. Guojun Asset Management is closely followed by 707.667 billion yuan, which is obviously different from the third place.

Compared with the last quarter, in the fourth quarter of 2019, there were 14 brokers whose asset management decreased by more than 5%, of which 6 brokers decreased by more than 10%, with the largest decline. In the fourth quarter of last year, the average monthly scale reached 129.129 billion yuan, down 13.02% from the third quarter.

The rankings of five companies have increased, among which the scale in the fourth quarter of last year was 140.147 billion yuan, ranking 16th, ranking four places higher, with the fastest growth rate. The six rankings have declined compared with the third quarter. Among them, the scale in the fourth quarter of last year reached 523.676 billion yuan, ranking sixth, and the ranking dropped by two places.

The latest list, in the fourth quarter of 2019, the average monthly scale reached 140.011 billion yuan, ranking 17 th.

In addition, the pattern of the top five is changing. In the fourth quarter of last year, securities fell out of the top five, while investment promotion and asset management made up for it, ranking fourth and fifth respectively. It should not be overlooked that the differentiation among brokers is still increasing. Among the 20 brokers, the brokerage ranked first is more than 8 times higher than the brokerage ranked last.

The active management scale of brokerage asset management:

The scale of 7 companies increased, and 6 companies accounted for more than 50%.

Since the release of the new asset management regulations, various regulatory rules and detailed rules have been gradually implemented, and a new operational framework for the asset management industry has been basically established. The return of business to active management and the completion of net worth transformation and upgrading have begun. Judging from the current progress, various families have made efforts to actively manage, and the effect is more obvious.

In the fourth quarter of last year, among the top 20 brokers, the scale of active management of 7 brokers increased to varying degrees compared with that of the third quarter, and two of them increased by more than 10%, namely BOC International Securities and China Merchants Asset Management. In the fourth quarter of 2019, the average monthly scale of assets actively managed by BOC International Securities was 72.065 billion yuan, up 15.91% from the third quarter, with the largest increase; The scale of active management of China Merchants Asset Management in the fourth quarter of last year was 181.441 billion yuan, an increase of 12.26% over the third quarter. In addition, the increase of,, and all exceeded 5%.

In addition, the proportion of active management of brokerage asset management is gradually increasing. Except for the brokers with unparalleled data, in the fourth quarter of last year, among the 15 brokers, 6 took the initiative to manage more than 50%, namely CICC, Huarong Securities, Zhongtai Asset Management, Guangfa Asset Management, Guojun Asset Management and Guangzheng Asset Management. Among them, in the fourth quarter of last year, CICC’s active management scale accounted for 81%, and it was the only company among 15 brokers that accounted for more than 80%. Huarong Securities took the second place with 72.5% active management scale. The proportion of active management scale of Zhongtai Asset Management and Guangfa Asset Management also exceeded 60%.

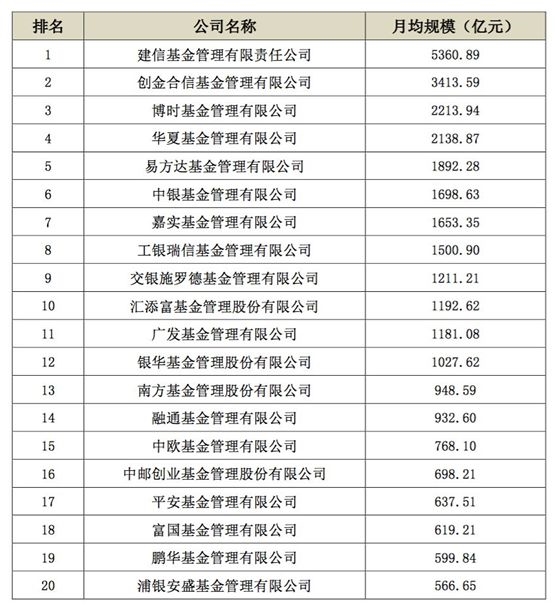

The scale of special accounts of fund companies is listed: 12 companies exceed 100 billion yuan.

According to the latest data, in the fourth quarter of 2019, 12 of the top 20 fund companies’ average monthly private asset management scale exceeded 100 billion yuan, a decrease from the third quarter. It is worth noting that in the fourth quarter of last year, the top five patterns of fund companies’ special accounts remained unchanged, namely Jianxin Fund, Chuangjin Hexin Fund, Bosera Fund, Huaxia Fund and E Fund, with average monthly scales of 536.089 billion yuan, 341.359 billion yuan, 221.394 billion yuan, 213.837 billion yuan and 189.228 billion yuan respectively, and the head effect was more obvious.

Pension management scale of fund companies:

ICBC Credit Suisse, E Fund and Boss ranked in the top three.

The pension scale of fund companies was also released last year. By the end of the fourth quarter of 2019, ICBC Credit Suisse, E Fund and Boss ranked in the top three, while harvest fund and Huaxia Fund ranked in the top five.

Average monthly size of special accounts of fund subsidiaries:

Jianxin Capital, China Merchants Wealth Asset Management and Agricultural Bank Huili Asset Management ranked in the top three.

In the fourth quarter of last year, among the top 20 private equity management companies of fund subsidiaries, 11 companies exceeded 100 billion yuan, of which CCB Capital ranked first with a scale of 580.137 billion yuan, and was far ahead, with a gap of more than 200 billion yuan from the second investment wealth management company, and ABC Huili Asset Management ranked third with an average monthly scale of 273.484 billion yuan, ranking one place higher than that in the third quarter.

In addition, Shenzhen Hongta Asset Management Co., Ltd. is the latest on the list. In the fourth quarter of 2019, the average size of the company was 59.997 billion yuan.