first quarterReach new heights.

May 10, (Nasdaq:LI;; 02015.HK) released the financial report for the first quarter of 2023. The financial report shows that the revenue in the first quarter was 18.79 billion yuan, a year-on-year increase of 96.5%, a record high, slightly higher than the market estimate of 18.68 billion yuan;It was 934 million yuan, and the net loss in the first quarter of 2022 was 10.9 million yuan, up 252% from 265 million yuan in the fourth quarter of 2022.

LI’s outstanding financial performance in the first quarter was supported by the substantial increase in sales. In terms of delivery volume, in the first quarter of this year, LI delivered a total of 52,600 vehicles, up 65.8% year-on-year, achieving the best single-season delivery result.

For the second quarter of this year, LI gave delivery guidelines of up to 76,000 to 81,000 vehicles, up 164.9% to 182.4% year-on-year; It is estimated that the revenue will reach 24.22 billion yuan to 25.86 billion yuan, a year-on-year increase of 177.4%-196.1%.

Annual grossThe target is 20%, and the sales of management fee rate will be reduced to 9.8%.

JiumaoOn the whole, LI’s gross profit margin and automobile gross profit margin both decreased year-on-year and increased month-on-month. The gross profit margin was 20.4% in the first quarter, 22.6% in the same period last year and 20.2% in the fourth quarter of 2022. The gross profit margin of automobiles was 19.8%, compared with 22.4% in the same period last year and 20% in the fourth quarter of 2022.

Li Tie, CFO of LI, said that in the first quarter of this year, the sales in Li ONE led to a decrease in the gross profit margin of the whole vehicle in the quarter, and it is expected that all the sales in Li ONE will be completed in the first half of this year. At the same time, there is still room for improvement in the profit margin of the ideal L7 and Air models. However, considering other potential factors, we still maintain the goal of 20% gross profit margin for the whole year.

Between LI CEO Li Xiang and a few days agoSpeaking at the meeting, LI’s expenses have further become.The focus of attention.

Recently, Li Xiang announced: "LI brand market expense rate is 0.6%, including all public relations, activities, advertisements, auto shows, press conferences, car owners’ operations, etc. I have to approve the expenses of tens of thousands of yuan to avoid spending money indiscriminately." At the same time, he also mentioned that the market expense ratio of mainstream brands is 2%-3%, which is 4-5 times that of LI.

The ideal, which has always been called "picking factories", has been evaluated by many analysts as properly controlling the expense ratio. The financial report for the first quarter shows that in the first quarter of 2023, LI’s sales, general and management expenses were RMB 1.65 billion, up 36.8% year-on-year and 0.9% quarter-on-quarter, accounting for 9.8% of revenue, further decreasing compared with 2022. In 2022, LI’s sales, general and management expenses were 5.665 billion yuan, accounting for 12.5% of the total revenue. In contrast, Tucki andThis figure is over 20%.

LI’s R&D expenditure is also rising. In the first quarter, it invested a total of 1.85 billion yuan in R&D, up 34.8% year-on-year, and the R&D expenditure rate remained at around 10%, which was in line with LI’s previous expectations. Li Tie said that the R&D expenditure will remain the original annual plan, at around 10 billion to 12 billion yuan. Sales management expenses depend on the profit level and will be further optimized.

In June, it hit 30,000 vehicles, and in the fourth quarter, it pushed pure electric vehicles.

In response to sales expectations, Li Xiang said that he should strive to achieve the goal of delivering 30,000 vehicles in a single month in June this year.

If this goal is achieved, then LI and the car,The new car-making forces will further widen the gap. At present, other new car-making forces have not touched the threshold of monthly sales of 20,000 vehicles. In the past April, only Nezha’s car sales reached 11,000 vehicles, and the sales of other new car-making forces did not exceed 10,000 vehicles.

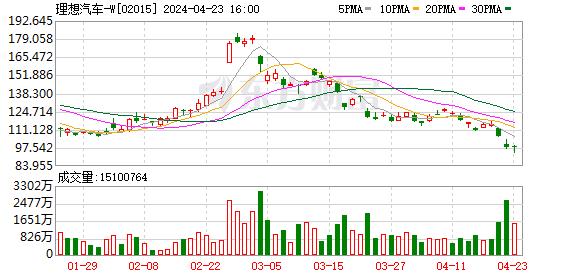

Judging from the ideal sales volume in the first four months of this year, it is not difficult to achieve this goal. The delivery data of LI from January to April this year is constantly rising, with 15,100 vehicles delivered in January, up 23.4% year-on-year; 16,600 vehicles were delivered in February, a year-on-year increase of 97.5%; 20,800 vehicles were delivered in March, an increase of 88.7% year-on-year; In April, the delivery volume exceeded 25,000 vehicles for the first time, reaching 25,700 vehicles, a year-on-year increase of 516.3%.

Since this year,The price of raw material lithium carbonate has dropped sharply. Some analysts asked LI if there was any plan to reduce the price. Li Xiang replied, "At present, there is no consideration of reducing the price, because when we make detailed long-term planning and pricing, we have already set the price at the most competitive price in the corresponding price range according to the grade and size of each vehicle, and both upward and downward fluctuations will be problematic. This is the fundamental reason why we have been very cautious in pricing and insist on long-term consideration. "

Li Xiang also said that ideally, the market share is still the first important factor, and the core goal in the second quarter is more than 200,000 yuan.In the automobile market, the market share of 11% in the first quarter was raised to 13%.

In the face of LI’s record financial data, many people shouted "Ideal is crazy", but some analysts expressed concern about the pure electric vehicles in LI. LI’s achievements are inseparable from the extended-range power model, and it has the first-Mover advantage. However, in the pure electric track where car companies gather, the ideal will face more intense challenges, and it is not easy to stand out.

During the recent Shanghai Auto Show, LI officially released the "Double Energy Strategy", saying that it will exert all efforts in "intelligence" and "electric energy". By 2025, it will form a product layout of "one super flagship model+five extended-range electric vehicles+five high-voltage pure electric vehicles", which will face more than 200,000 markets and fully meet the needs of home users. At the same time, ideally, it is estimated that more than 3,000 charging stations will be built by 2025.

Recently, there are market rumors that LI pure electric vehicles will be postponed until next year. At the earnings conference call, Li Xiang revealed that the pure electric vehicles in LI will be released in the fourth quarter of this year. After the release, they will start the test drive in the store and gradually start the delivery, which will keep the same release and delivery rhythm as the L9, L8 and L7 models.

In order to support the development of multi-vehicles, LI is also continuously expanding its network layout. As of April 30, 2023, LI has 302 retail centers nationwide, covering 123 cities; There are 318 after-sales maintenance centers and authorized car body panel spraying centers, covering 222 cities.