All banking insurance regulatory bureaus, insurance companies and insurance intermediaries:

According to the Insurance Law of People’s Republic of China (PRC), Measures for the Supervision of Internet Insurance Business and other laws and regulations, in order to strengthen and improve the supervision of Internet life insurance business, standardize market order, guard against business risks, promote fair competition, and effectively protect the legitimate rights and interests of insurance consumers, with the consent of China Banking and Insurance Regulatory Commission, we hereby notify the relevant matters concerning the operation of Internet life insurance business by insurance institutions as follows:

First, strengthen capacity building and improve the level of business services.

(1) The term "Internet life insurance business" as mentioned in this Notice refers to the business activities of insurance companies to publicly publicize and sell Internet life insurance products, conclude insurance contracts and provide insurance services by setting up self-operated network platforms or entrusting insurance intermediaries on their self-operated network platforms. The insurance institutions mentioned in this Notice include all insurance companies (including mutual insurance organizations and Internet insurance companies) and all insurance intermediaries (including professional insurance intermediaries and part-time insurance agencies).

Insurance companies that meet the relevant conditions of this notice may conduct Internet life insurance business without setting up branches nationwide. If the relevant conditions are not met, the Internet life insurance business may not be carried out. An insurance company entrusts an insurance intermediary to carry out Internet life insurance business, and the insurance intermediary should be a national institution. Involving online and offline integration to carry out life insurance business, Internet life insurance products shall not be used, and the business area shall not be extended to areas without branches.

(2) Insurance companies and insurance intermediaries should have corresponding technical, operational and service capabilities to carry out life insurance business on the Internet, choose life insurance products that meet the characteristics of Internet channels for online sales, strengthen the management of sales process and improve the risk management and control system.

Insurance companies should use scientific and technological means to optimize product supply, improve insurance services, improve operating efficiency, and promote life insurance products with risk protection or long-term savings functions.

(3) An insurance company (excluding Internet insurance companies) shall meet the following conditions when conducting Internet life insurance business:

1 for four consecutive quarters, the comprehensive solvency adequacy ratio reached 120%, and the core solvency was not less than 75%.

2. The comprehensive risk rating for four consecutive quarters is in Class B or above.

3. The coverage rate of liability reserve is higher than 100% for four consecutive quarters.

4. The corporate governance assessment of the insurance company is Grade C (qualified) or above.

5. Other conditions stipulated by China Banking and Insurance Regulatory Commission.

Internet insurance companies shall comply with the relevant conditions of the Measures for the Supervision of Internet Insurance Business when conducting Internet life insurance business. At the end of last quarter, the solvency, comprehensive risk rating and coverage ratio of liability reserve meet the requirements of the preceding paragraph.

(4) An insurance company shall have an efficient and stable business system to carry out Internet life insurance business. It can support the exclusive management of life insurance business on the Internet, has the concurrent processing ability suitable for business needs, and has a perfect network security protection means and management system.

An insurance company should have a financial system that meets the needs of Internet life insurance business, and conduct independent accounting for Internet life insurance business.

(5) An insurance company shall have the corresponding online operation ability to carry out Internet life insurance business and meet the following requirements:

1. Online insurance. Support online display of all insurance information to consumers and remote acquisition of necessary insurance information, which can realize basic functions such as location confirmation of the insured and the insured, and personal identification.

2. Online underwriting. We should fully realize automatic underwriting as soon as possible, encourage insurance companies to apply scientific and technological means to improve underwriting quality, enhance underwriting efficiency, further improve anti-fraud ability and level, and explore differentiated and intelligent underwriting.

3. Online underwriting. Support online confirmation of insurance intention, completion of premium income and expenditure, realization of surrender in hesitation period and other functions, and issue legal and effective electronic insurance policies.

4. Online service. All sales platforms have realized the comprehensive online service entrance of consumer consultation, inquiry, security, surrender, claims, complaints, etc., continuously improved the online service level, and ensured the continuous provision of service support not lower than the offline service standards of similar sales businesses within the validity period of the policy.

(6) An insurance company shall establish a convenient and efficient online service system to carry out Internet life insurance business, and the service standard shall not be lower than the following requirements:

1. The insurance company shall guarantee daily uninterrupted online service, and the connection rate of consumer consultation or service request shall not be less than 95%.

2. Insurance companies should provide comprehensive technical support for consumers’ independent purchase and self-service. Customer service personnel of insurance companies can provide online personal insurance business consultation and services at the request of consumers, and the exchange page displays their insurance institutions and customer service numbers in real time. Customer service personnel of insurance companies shall not take the initiative in marketing, and their salaries shall not be linked to the sales assessment indicators of Internet life insurance business.

3. Internet personal insurance business should fully realize real-time underwriting and real-time underwriting as soon as possible. If it is necessary to carry out procedures such as physical examination and survival investigation, it should notify the applicant within 1 working day after receiving the complete insurance information and complete the underwriting as soon as possible.

4. Internet life insurance business shall use electronic insurance policies, which shall specify the information of the entrusted intermediary institutions (if any) and shall be delivered to the insured within 2 working days after underwriting. During the insurance period, an insurance company shall provide a paper policy in time according to the requirements of the insured.

5. The insurance company shall continuously provide online security services to consumers during the insurance period, and the online security matters shall be handled within 2 working days after the application is submitted. If it cannot be completed within the prescribed time limit due to special circumstances, it shall promptly explain the reasons to the applicant and inform the processing progress.

6. After receiving the notice of insurance accident from the applicant, the insured or the beneficiary, the insurance company shall give a one-time claim settlement guidance within 1 working day; After receiving the request for compensation or payment of insurance benefits from the insured or beneficiary, if the insurance company considers that the relevant certificates and materials are incomplete, it shall notify the applicant, the insured or the beneficiary to supplement them at one time within 2 working days; After receiving the request for compensation or payment of insurance benefits from the insured or beneficiary and complete materials, make a verification within 5 working days, and notify the applicant within 1 working day after making the verification; In case of complicated circumstances, the approval period can be extended to 30 days.

7. Online application for surrender of Internet life insurance business shall be approved and notified to the applicant within 1 working day; In case of complicated circumstances, the approval period can be extended to 3 working days.

8. Internet personal insurance business should strengthen complaint management, set up online complaint channels, get in touch with the complainant within 1 working day after receiving the complaint, improve handling efficiency, and explore the establishment of a complaint return visit mechanism.

(7) When an insurance company entrusts an insurance intermediary to carry out Internet life insurance business, it shall carefully screen the partners, strictly control the sales behavior and ensure the service quality.

Insurance intermediaries to carry out Internet life insurance business, should strengthen the system construction, and have the operation and service capabilities that meet the requirements of Article (5) and (6). Customer service personnel of insurance intermediaries shall not take the initiative to market, and their salaries shall not be linked to the sales assessment indicators of Internet life insurance business.

Two, the implementation of exclusive business management, standardize the market competition order.

(8) Insurance companies shall implement exclusive management of Internet life insurance business, use Internet life insurance products that meet the relevant provisions of this Notice, and follow the business rules such as network layout and sales management. The development of Internet life insurance products by insurance companies should conform to actuarial principles, with clear insurable benefits, and the design of terms and the determination of rates are legal, compliant, fair and reasonable. Encourage insurance companies to apply digital tools and scientific and technological means to provide differentiated pricing and refined services to meet the growing personal risk protection and long-term savings needs of the people.

Internet life insurance products are limited to accident insurance, health insurance (excluding nursing insurance), term life insurance, ordinary life insurance with an insurance period of more than ten years (excluding term life insurance), ordinary annuity insurance with an insurance period of more than ten years, and other life insurance products stipulated by China Banking and Insurance Regulatory Commission. Internet life insurance products that do not meet the requirements of this notice shall not be operated online, and the insurance links of products shall not be publicly displayed or directly pointed to through the Internet.

(9) An insurance company applying for approval or filing of Internet life insurance products shall meet the following requirements:

1. The product name should contain the word "Internet", and the sales channel is limited to Internet sales. Non-Internet life insurance products shall not use related words.

2. Product design should reflect the characteristics of direct operation of Internet channels. The scheduled surcharge rate for Internet life insurance products with an insurance period of one year or less shall not be higher than 35%; Internet life insurance products with an insurance period of more than one year shall have a predetermined additional charge rate of no more than 60% in the first year and an average additional charge rate of no more than 25%.

3. Products can provide flexible and convenient payment methods. If the Internet life insurance products with an insurance period of one year or less are paid in installments, the payment amount of each installment should be consistent, and the Internet life insurance products with an insurance period of more than one year should comply with the relevant regulations of China Banking and Insurance Regulatory Commission.

4. The product design shall ensure that the insurance period is consistent with the actual duration, and the actual duration shall not be changed in disguise by surrendering the insurance fee or adjusting the cash value interest rate.

5. The calculation of the minimum cash value of Internet life insurance products with an insurance period of one year or less shall adopt the calculation method of the unexpired net premium, and its calculation formula is: minimum cash value = net premium ×(1-m/n), where m is the number of days that have taken effect and n is the number of days during the insurance period, and if the elapsed date is less than one day, it shall be counted as one day.

6. Other conditions stipulated by China Banking and Insurance Regulatory Commission.

(10) When an insurance company applies for approval or filing of Internet life insurance products, the materials submitted shall not only comply with the insurance clauses and relevant regulatory provisions on insurance rate management, but also submit an actuarial report, and the pricing basis of the products shall be listed in the actuarial report.

Internet life insurance products with an insurance period of one year or less shall specify the expected payout ratio in the actuarial report; If the Internet life insurance products with an insurance period of more than one year are priced by reinsurance data or empirical data, the latest occurrence rate table issued by China Banking and Insurance Regulatory Commission or designated relevant institutions shall be indicated, and the average conversion ratio shall be listed.

Internet life insurance products shall specify the upper limit of intermediary fee rate in actuarial report, and shall not directly charge the information technology support and information technology service fees arising from the operation of Internet life insurance business, and shall not break through or break through the upper limit of predetermined additional fee rate in disguised form.

When an insurance company applies for approval or filing the Internet life insurance products listed in Article (13) of this Notice, it shall also list the branches and cooperative institutions in the submitted materials.

(11) An insurance company applying for approval or using newly filed Internet accident insurance and term life insurance products shall comply with Articles (3) to (6) of this Notice.

An insurance company applying for approval or using newly filed Internet health insurance (except nursing insurance) products shall not only meet the requirements of the preceding paragraph, but also meet the requirement that it has not been subjected to major administrative punishment for illegal operation of Internet insurance business in the previous year.

An insurance company applying for approval or using the newly filed ordinary life insurance (except term life insurance) and ordinary annuity insurance products with an insurance period of more than 10 years shall meet the following conditions:

1. The comprehensive solvency adequacy ratio exceeds 150% for four consecutive quarters, and the core solvency is not less than 100%.

2 for four consecutive quarters, the comprehensive solvency surplus exceeded 3 billion yuan.

3. The comprehensive risk rating for four consecutive quarters (or six quarters within two years) is above Class A..

4. It has not received any major administrative punishment for the operation of Internet insurance business in the last year.

5. The corporate governance assessment of the insurance company is Grade B (good) or above.

6. Other conditions stipulated by China Banking and Insurance Regulatory Commission.

(12) When an insurance company entrusts an insurance intermediary to carry out Internet life insurance business, it shall specify the rights and obligations of both parties, the cooperation period, the dispute settlement plan, the liability for breach of contract and the customer complaint handling mechanism.

Insurance intermediaries selling ordinary life insurance (except term life insurance) and ordinary annuity insurance products with an insurance period of more than ten years shall meet the following conditions:

1 with more than three years of experience in Internet life insurance business.

2. It has a complete sales management, policy management and customer service system, as well as a safe, efficient and real-time information system and capital settlement process for online payment and settlement business.

3. It did not receive any major administrative punishment for the operation of Internet insurance business last year.

4. Other conditions stipulated by China Banking and Insurance Regulatory Commission.

(13) An insurance company shall, in addition to meeting the above-mentioned basic conditions, set up a provincial branch in its business area or cooperate with other insurance companies and insurance intermediaries that have set up branches to operate through the Internet, so as to ensure offline service capabilities in its sales area.

Insurance companies conducting other Internet life insurance businesses should have offline service capabilities no less than those of similar businesses for sale.

(14) When an insurance company operates or entrusts an intermediary agency to carry out Internet life insurance business, it should make an appropriate assessment before applying for insurance, scientifically assess the behavioral ability of consumers to purchase insurance products online and enjoy insurance services, and insist on selling insurance products to consumers that are compatible with their risk protection needs and payment ability.

(15) Insurance companies should strengthen underwriting management, grasp the full amount of underwriting information, ensure the independence of underwriting, and must not lower underwriting standards and reduce underwriting responsibilities when conducting Internet life insurance business.

The notification text of Internet life insurance business is formulated and provided by insurance companies, which meets the basic requirements of clear content, easy-to-understand text and concise and smooth expression, and reduces the use of uncommon terms. Insurance intermediaries shall not change or reduce the contents of the notification without authorization, and shall not induce the insured to make false statements.

Third, enrich the supervision mechanism and strengthen the supervision of innovative business.

(sixteen) insurance companies to carry out Internet life insurance business, should establish and improve the business backtracking mechanism. Insurance companies should regularly carry out Internet life insurance business backtracking as required, focusing on key indicators such as payout ratio, incidence rate, expense rate, surrender rate and return on investment, backtracking the deviation between actual operating conditions and actuarial assumptions, and taking the initiative to take measures such as attention, adjustment and improvement, active reporting and information disclosure. The chief actuary of an insurance company is the person directly responsible for the retrospective work of Internet life insurance business, and should organize and implement the retrospective work as required to ensure that the data used are comprehensive and true, the calculation method conforms to actuarial principles, and the rectification measures are timely and effective.

(XVII) An insurance company that conducts Internet life insurance business shall submit a report on the operation of the previous year through the information system related to Internet insurance supervision before March 20th of each year (see Annex 2 for the template, and the report data shall be as of December 31st of the previous year), and complete the registration of Internet life insurance business operation and information disclosure.

If an insurance company needs to adjust the business scope of personal insurance on the Internet, it should make a continuous announcement 10 days in advance on the self-operated platform, the self-operated platform of the agency and the sales page of each product. The contents of the announcement shall include the business scope adjustment decision, reasons and service guarantee measures, etc., and the adjustment shall be completed before April 1 of each year. If the business scope of Internet life insurance is narrowed, it should also give special tips to insured customers through effective channels.

(18) If an insurance company violates the relevant provisions of this Notice, it shall, as appropriate, take regulatory measures such as regulatory talks, risk warnings and prohibiting the declaration of new Internet life insurance products within a certain period of time according to law, and impose administrative penalties according to relevant laws and regulations.

If an insurance company entrusts an intermediary agency to carry out Internet personal insurance business in violation of the relevant provisions of this Notice, the insurance company and the intermediary agency shall be investigated at the same place, and a unified standard of discretion shall be maintained for similar businesses.

(XIX) China Banking and Insurance Regulatory Commission will initiate supervision procedures such as inquiry, investigation and inspection according to the retrospective situation of Internet life insurance business of insurance companies, and investigate and deal with illegal matters according to law. In the event that the insurance company fails to backtrack regularly according to the notification requirements, the backtrack data is untrue, and the pricing risk has not improved for a long time, China Banking and Insurance Regulatory Commission will not only deal with it according to Article 18, but also remind the board of directors of relevant risks, and at the same time, investigate the responsibilities of the company’s principal responsible persons and relevant management personnel according to law.

(20) If an insurance company is subject to administrative punishment for serious violations of laws and regulations and serious violations of consumers’ legitimate rights and interests due to Internet life insurance products, it shall promptly formulate consumer rights protection and rectification plans and make an announcement to the public.

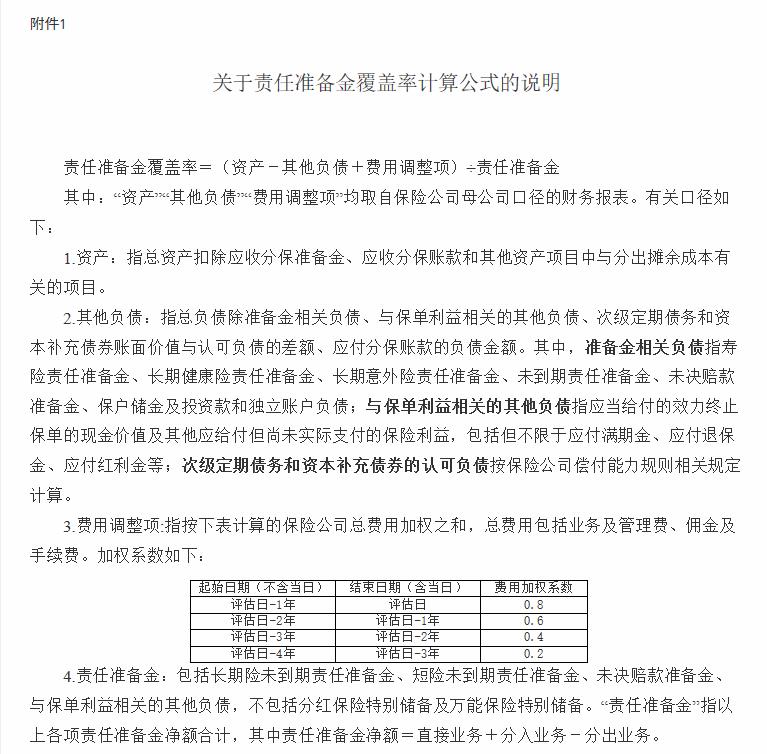

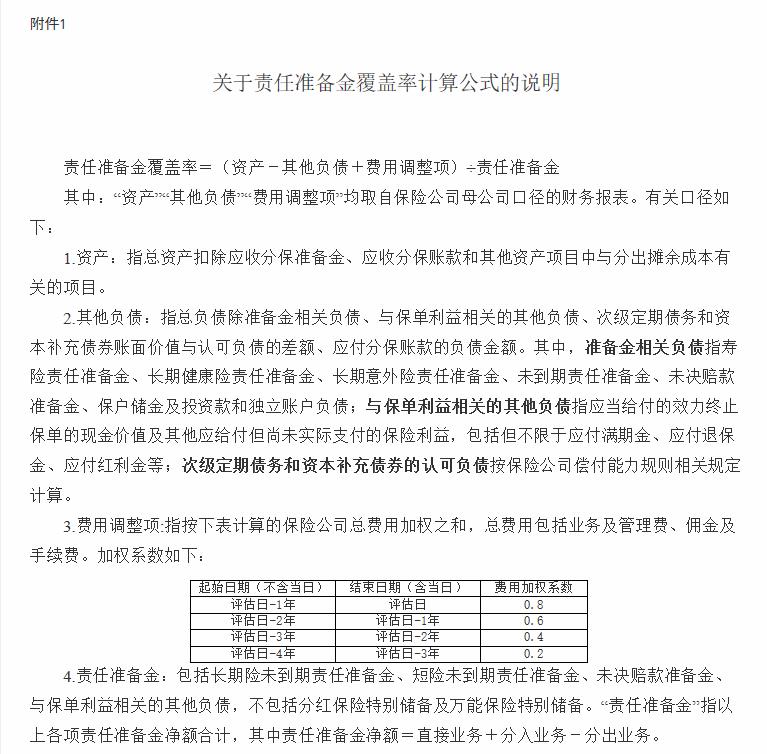

(twenty-one) the actuarial liability reserve coverage ratio mentioned in this notice, the calculation formula is shown in Annex 1.

The major administrative penalty referred to in this Notice refers to the following administrative penalties imposed on insurance institutions for Internet insurance business: limiting the business scope, ordering them to stop accepting new business, ordering them to suspend business for rectification, revoking their business licenses, revoking the qualifications of company executives or prohibiting them from entering the industry.

(twenty-two) from the date of issuance of this notice, if the previous provisions are inconsistent with this notice, this notice shall prevail.

Give a transition period to insurance companies that have already started Internet life insurance business. Insurance companies shall, based on the protection of consumers’ legitimate rights and interests, promote the rectification of existing Internet life insurance business on the premise of fully evaluating and making good plans, and fully meet the requirements of this notice before December 31, 2021.

The insurance company shall start the trial operation of the Internet life insurance business backtracking mechanism in the second quarter after the issuance of this notice, and China Banking and Insurance Regulatory Commission shall designate industry organizations to assist in the implementation of relevant work. The retrospective mechanism of Internet life insurance business has been officially implemented since January 1, 2023.

Annex: 1. Description of the formula for calculating the coverage ratio of liability reserve.

2.2XXX years Internet life insurance business report

General Office of China Banking and Insurance Regulatory Commission, China

October 12, 2021