标签: 上海后花园

Dong people’s wrestling, a trip to the Shu Road, and a "Spring Banquet" on the Plateau … Special cultural tours make "small places" win "big flows"

CCTV News:On April 23rd, the annual traditional wrestling festival was held in shuang jiang, Liping County, Guizhou Province. The passionate martial arts performances and traditional wrestling competitions attracted tens of thousands of tourists to watch.

The wrestling scene was crowded with people. With the referee’s shouting, the two Dong strong men instantly grasped the green cloth belt around each other’s waist and tried to throw each other down. The purpose of wrestling competition is to keep fit and have fun. Participants can be rewarded and win glory for the village. The wonderful and fierce wrestling made the audience cheer from time to time.

Different from wrestling of other ethnic minorities, Dong wrestling needs to wrap a cloth belt around each other’s waist, and it is very skillful to pull and trip each other down through the cloth belt.

It is understood that the shuang jiang Wrestling Festival in Liping County has a history of more than 600 years. At present, wrestling has become a tourist card for Liping.

Guangyuan, Sichuan: Walking tour in Shu Road continues to heat up.

The ancient Shu Road, with a history of more than 3,000 years, is one of the earliest large-scale traffic remains preserved so far. The "May Day" holiday is approaching. In the Guangyuan section of the ancient Shu Road, a number of hiking routes of Shu Road are launched, so that tourists at home and abroad can feel the charm of Shu Road on foot.

Now is a good time to go for an outing, and hiking on the ancient Shu Road has become the first choice for many people. The section from Gaomiaopu to Songning Bridge of Shu Road is 2.2 kilometers. Every day, more than 2,000 people "meet" the relics of Shu Road such as ancient posts, ancient trees and ancient bridges, and the number of tourists hiking on the ancient Shu Road has increased by more than 50% compared with the same period of last year. In order to welcome the "May 1" holiday, Guangyuan City launched a number of hiking routes.

In the Zhaohua section of the ancient Shu Road, innovative new scenes such as the Shu Road Market and the Post Road Style Tea Shop have attracted countless tourists to come to the market and rest. Scene performances such as Zhang Fei’s war horse Chao and Jiang Wei’s point soldiers reproduce the Three Kingdoms era of Jin Ge’s iron horse. Rich and colorful interactive cultural activities and beautiful scenery of Shu Road make Chinese and foreign tourists feel the time and space crossing on the ancient Shu Road.

Jainca, Qinghai: Pear Blossoms in Full Bloom "Xiangxuehai" Country Tour with Fire

In late April, pear blossoms in Jianzha County, Qinghai Province are blooming one after another. People watch pear blossoms here, taste the "Spring Banquet" with plateau characteristics and feel the beauty of spring.

In Jianzha County, Huangnan Tibetan Autonomous Prefecture, Qinghai Province, 108 ancient pear trees in the Centennial Pear Garden gradually blossomed, and the competing flowers formed a "Xiang Xue Hai". It is understood that the oldest pear tree here has been more than 400 years old. Tourists dressed in Tibetan clothes stop to take pictures in the sea of flowers, experience the elegance of flower arrangement under pear trees, and taste the characteristic rural "spring banquet" on the Qinghai-Tibet Plateau. On the menu of "Spring Festival Banquet", besides the special delicacies such as pear dim sum, fragrant pear juice, palace milk tea and fresh rainbow trout, there are also "tropical fruits" made in the plateau.

It is understood that in the first quarter of 2024, Qinghai Huangnan Tibetan Autonomous Prefecture received 1,726,700 tourists, with a comprehensive tourism income of 614 million yuan.

In Jiangchuan District, Yuxi, Yunnan, the "fleshy kingdom" also welcomed a group of tourists. Everyone enjoys succulents of different shapes among the lakes and mountains.

At present, the local succulent industry covers an area of more than 3,000 mu and there are more than 60 growers.

Selling 200,000 vehicles this year? New energy VAN sold nearly 50 thousand vehicles in the first quarter

Speed reading:

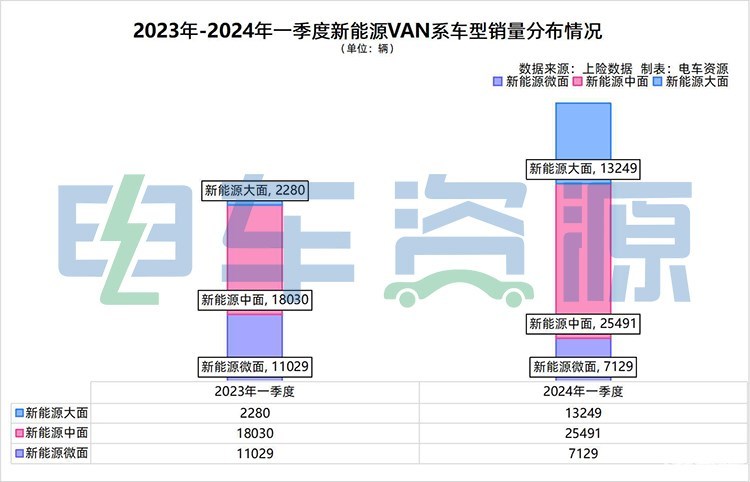

1. In the first quarter of 2024, the total sales volume of new energy VAN system was 45,869 vehicles, up 46.36% year-on-year;

2. In the first quarter, there were 7,129 micro-surface sales, including 25,491 medium-surface sales and 13,249 large-surface sales;

3. 7 Fangda led the rapid growth of VAN Department, with a year-on-year increase of over 480%.

With the release of sales in March, sales in the first quarter of 2024 also settled. According to the data of tram resources, the total sales volume of new energy VAN series vehicles in the first quarter of 2024 was 45,869, an increase of 46.4% compared with the first quarter of 2023, which was a successful conclusion for the first quarter.

This sales achievement of VAN series cars in the first quarter has greatly boosted the confidence of the industry. According to previous years’ experience, it is better to predict that the annual sales volume of VAN series cars is expected to reach 200,000 this year.

Sales volume: Sales volume rose in the first quarter, but it may fall back in April.

According to the data of tram resources in the first quarter, the new energy micro-surface sold a total of 7129 vehicles, down 35.4% year-on-year; A total of 25,491 vehicles were sold in the new energy market, up 41.4% year-on-year; A total of 13,249 new energy vehicles were sold, up 481.1% year-on-year.

The first quarter is often the key to the annual sales. In previous years, due to the car parking at the end of the year, the sales volume in the first quarter was low in the whole year. With the end of 2023, the sales system of new energy logistics vehicles has also turned to normal development. Overall, the sales volume in the first quarter of 2024 was a good start.

However, Tram Resources believes that April sales will not necessarily achieve further growth, but may fall back.

According to the monthly data, due to the influence of the Spring Festival holiday, the overall sales volume of new energy VAN series vehicles declined in February, but the rapid recovery in March brought about a large increase in the first quarter.

At the same time, according to the trend in 2023, March is the peak of sales in the first quarter, and after the peak, it will fall back briefly, so the sales of new energy VAN series vehicles may fall back in April 2024.

Model: The pattern of sales focusing on a single model is breaking.

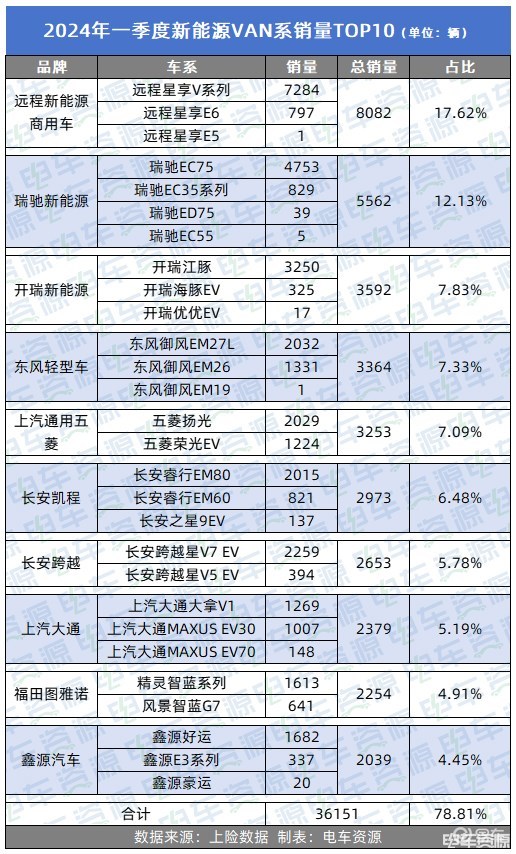

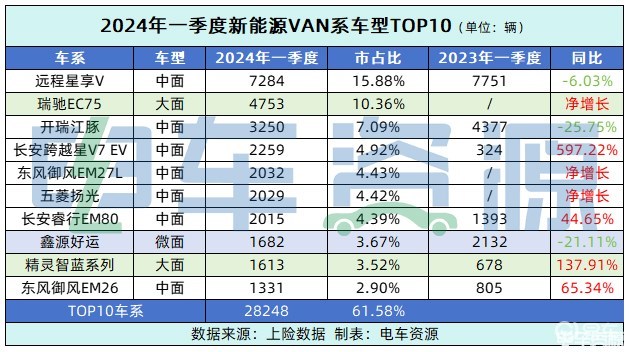

Judging from the specific hot-selling models, the series is far ahead with a market share of 15.88%. In the first quarter of 2024, the total sales volume of Remote Star Enjoy V was 7,284 vehicles, down 6.03% year-on-year. With the support of the sales volume of remote Star V series vehicles, the total sales volume of remote new energy commercial vehicle VAN series products in the first quarter was 8082, accounting for 17.62% of the new energy VAN series vehicles in the first quarter.

According to the tram resources, the long-range new energy commercial vehicle has accelerated the layout of new energy products. In the first quarter, two VAN series products have been listed, namely, the remote star enjoys the V7E, and the latter is a 7-party model with the family-style design of the remote star. The official guide price starts from 112,800 yuan. It is understood that remote new energy commercial vehicles are also building their differentiated competitive routes. By building a remote e-home, a three-dimensional user service ecology of "buy, use, return and exchange" is created, and it is also one of the few car companies that have introduced the insured repurchase policy.

Ranked second is Ruichi EC75, which sold 4,753 vehicles in the first quarter of 2024, accounting for 10.36% of the market. In terms of sales volume, the sales focus of Ruichi New Energy has been biased towards Ruichi EC75, accounting for 85.5% of the sales volume of VAN series vehicles in the first quarter of Ruichi New Energy. However, Tram Resources has learned that Ruichi New Energy is also adjusting and controlling the situation of five-sided micro-surface, and launched the champion version of Ruichi EC35II in a targeted manner to test the market at a relatively low price, but its use remains to be seen in the subsequent market performance.

The third-ranked Kairui, as the VAN series model promoted by Kairui New Energy, sold 3,250 vehicles in the first quarter of 2024, down 25.75% year-on-year. In terms of overall sales volume, the sales volume of Kairui New Energy in VAN series models mainly depends on Kairui finless porpoise models, accounting for more than 90%. However, according to the tram resources, at present, Kairui New Energy is also subdividing products for market segments, and launching five Kairui finless porpoises E5 and seven Kairui finless porpoises E7, which may effectively improve the situation of "putting eggs in one basket" in the future.

It is worth noting that the product sales of Dongfeng light vehicle, SAIC Chase and Futian are more balanced in market segments. In addition, at present, major OEMs are also launching new models for sub-sectors, such as Kairui’s finless porpoises E5 and E7, Remote Star Enjoy V7E and Beiqi Letch bedding. However, the time to market of these models is relatively late, and the pulling effect on the subsequent sales growth of OEMs remains to be tested by the market.

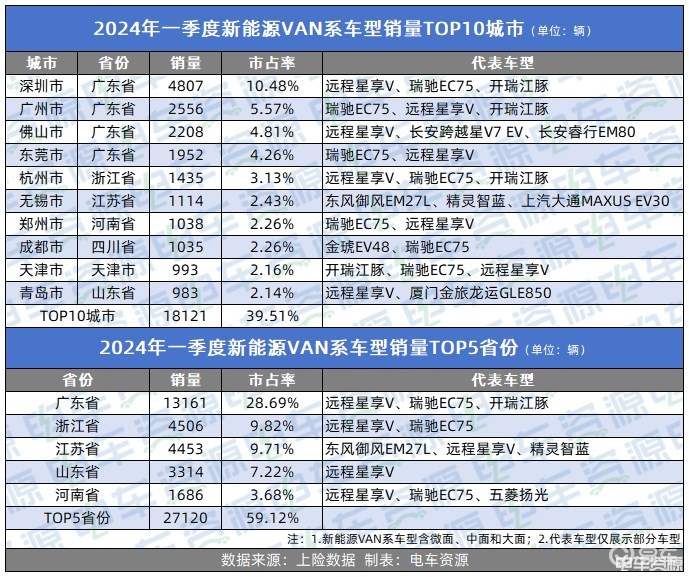

Cities: Four cities in Guangdong are on the list, and "new gameplay" deserves attention.

In the first quarter city sales list (below), the top four in the TOP10 list are all cities in Guangdong. With a total sales volume of 4,807 vehicles in the first quarter, Shenzhen was far ahead with a market share of over 10.48%, ranking first. In terms of models, the three best-selling models in Guangdong are: Remote Star Enjoy V, Ruichi EC75 and Kairui finless porpoise.

According to the statistics of Collaborative Innovation Center, in 2023, the penetration rate of light new energy cargo logistics vehicles in Shenzhen was close to 70%, far exceeding the national level of 14%. In other words, the fuel light trucks in Shenzhen have been replaced by pure electric vehicles in large quantities, which has formed a replicable and operable model for other cities.

The Pearl River Delta region, with Shenzhen, Guangzhou, Foshan and Dongguan as the core commercial logistics regions, has established the sales pattern of the new energy VAN market. According to the tram resources, the distribution operators in Shenzhen, Foshan and Dongguan have set up a live broadcast system on vehicle sales and leasing, and the role of this new gameplay in driving sales is gradually emerging. At the same time, the four cities have developed economies, close business linkages and prosperous green logistics industry, creating unique conditions for the iterative demand for new energy VAN.

Except for Guangdong, the sales volume of Zhejiang and Jiangsu provinces is equal, and the market share is above 9.5%. Zhejiang’s best-selling models are Remote Star Enjoy V and Ruichi EC75, while Jiangsu’s best-selling models are Dongfeng Yufeng EM27L and Remote Star Enjoy V and there are certain differences in selection.

It is also worth noting that Zhengzhou, Henan Province, as the only city in the Central Plains among the TOP10 cities, has the best-selling models of Ruichi EC75 and Remote Star Enjoy V, but there is no big gap between the sales of the two cars and other models behind, indicating that the overall sales system is also relatively healthy.

summarize

Judging from the sales of hot-selling models, the overall sales of head enterprises are still supported by a single model. However, judging from the vehicle model planning disclosed by the OEM, this pattern is being broken.

Some people in the industry have told Tram Resources that the cost gap of the previous 5-party, 6-party and 7-party models is not big, but there is a big gap in pricing. After the bright price sales model has become the industry consensus, coupled with the poor logistics market, the price difference between generous and large-capacity models and other models is no longer obvious, and end users are more willing to buy generous models.

However, judging from the overall sales trend in the first quarter, the sales volume of new energy VAN has exceeded the same period of last year, and many new models have been on the hot-selling list, indicating that the new energy VAN system as a whole continues to improve and the industry confidence has been greatly boosted. Therefore, some people optimistically predict that the sales volume of VAN series cars is expected to exceed 200,000 this year. What do you think about this? You can discuss it in the comments section.

For more information, please pay attention to tram resources.

The defendant in the pornographic photo case is expected to be jailed, and the first publisher remains a mystery

China News Service, April 30, according to Hong Kong’s "Wen Wei Po" report, Hong Kong artist Chen Edison and a number of actress bed photos have been circulating on the Internet for more than a year, accused of being the source of the issuance of lewd photos of computer maintenance staff Shi Kejun, after 6 days of trial, 29 days in Kowloon City Magistrates’ Court was found guilty of three counts of dishonest access to computers, real-time remand cell waiting for sentencing next month 13.

The chief judge said the charges were so serious that imprisonment was inevitable. Although Shi’s conviction appears to have ended the case, who was the first "Qina" to post lewd photos of an artist on the Internet remains a mystery.

The chief judge read out the verdict, saying that he accepted the prosecution’s argument that the defendant had downloaded bed photos from an external hard drive to a computer, and then used the computer to upload bed photos to a server connected to the Internet to obtain photos that did not belong to him. On June 8, 2006, while Shi was repairing the computer at the Home Products Store, he used the computer to log in to the server to download 1,300 lewd photos, showed the photos to two female designers of the Home Products Store on the computer screen, and burned them into a CD and sent them to Liang Tingxin.

The chief judge also analyzed the evidence of Chen Edison and 14 prosecution witnesses, saying that most of the key witnesses in the case were honest and reliable, and the two female designers Cai Yufen and Liang Tingxin were unswerving under cross-examination by the defense lawyer. As for Cai’s ignorance that his colleague Liang Tingxin was given a bed photo CD, the chief judge believed that the defendant’s purpose in the home store was to repair the computer, so Cai did not know whether the defendant was burning the disc or repairing the computer, which is very normal.

The president judge also pointed out that Xie Liqiao’s evidence was straightforward and unevasive. Although the defense questioned that Xie Liqiao, a salesperson, was responsible for repairing Chen Edison’s computer, it was unusual, but the president judge pointed out that in a small computer store, it was not uncommon for a staff member to also perform maintenance and sales work. Moreover, he only repaired the computer according to the established steps, and it was impossible to know in advance that the computer contained lewd photos. If Xie wanted to frame the defendant, he would not have truthfully stated that he did not see the process of copying the bed photos from the external hard drive.

As for Ye Zhaoshan, the owner of the computer shop, the evidence was straightforward and simple. Since Xie Liqiao took the initiative to inform him that he found a lewd photo during maintenance, he had no reason to question Xie’s concealment of the incident. Another maintenance worker, Chen Weiming, also said in court that due to salary issues, he was no longer friends with the boss Ye Zhaoshan, reflecting that he would not "make a confession" with Ye.

The defense lawyer said in court that the defendant understood that the charge was serious and imprisonment was inevitable, but pointed out that the defendant was only 21 years old when he committed the crime, and hoped that the court would take into account the defendant’s age and request a social service order report.

After hearing the arguments of both the prosecution and the defense, the magistrate said that the defendant’s violation of good faith in the case made the case particularly serious, so he would not consider imposing a social service order, but would request a report from the ********** to preserve the option of sentencing, and showed that real-time imprisonment was inevitable. The request for a report did not give the defendant false expectations.

Reminder | New scam! Do you know the mobile phone extension? Someone lost 50 thousand overnight

CCTV News:Pretending to be an acquaintance to borrow money, pretending to be a public security bureau, a procuratorate or a court officer to investigate a case, and hiding a Trojan link &hellip in short messages and QR codes; … These tricks must have made everyone immune, but do you know? Some telecommunications services that you have never heard of have also begun to become new traps set by scammers!

The mobile phone was locked and more than 50,000 yuan was stolen.

When he woke up, Mr. He in Shenzhen found that his mobile phone was locked. At the same time, a shopping platform account was stolen by strangers. Criminals used white bars to spend and apply for loans, and robbed more than 50,000 yuan overnight.

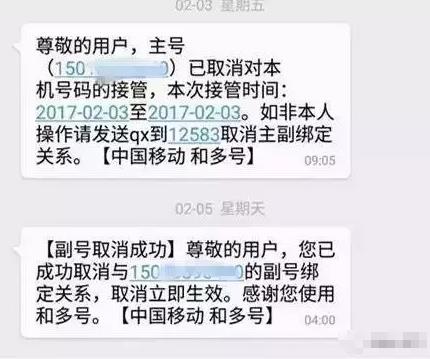

Later, Mr. He discovered that his mobile phone had been taken over by a strange number. The short message from the operator shows that this is a business to add a secondary number, and Mr. He’s mobile phone number was added as a secondary number by criminals. When the secondary phone is turned off, all short messages will be received by the primary phone, and criminals will receive Mr. He’s short message verification code during this period, and then commit crimes.

"Subnumber" ≠ "kinship number"

Without an ID card, a bank card or even a real name, the money is gone. What the hell is a minor number?

Many people think of "family number" at first, but "deputy number" and "family number" are not the same thing.

Family number usually refers to the phone bill package opened by different owners and different numbers in order to make calls between them cheaper, and the secondary number is the "one card with many numbers" service provided by operators. On the basis of not changing mobile phones and SIM cards, users can add up to three real mobile phones as secondary numbers. The main and auxiliary numbers can stand by at the same time, and you can freely choose any number to dial, answer the phone and send and receive short messages as needed.

Don’t reply to text messages too casually.

Then, how did Mr. He’s mobile phone number become the "secondary number" of criminals?

Reduction of criminal modus operandi

Step 1: Buy materials.Criminals buy leaked names, bank card numbers, ID numbers and reserved mobile phone numbers online, commonly known as "four big pieces".

Step 2: Fishing.Criminals apply to the users who have mastered the bank card information, initiate the business application of binding the sub-number, and find the target of the crime by casting a net widely. Once you reply by mistake, you are hooked.

Step 3: Forced shutdown.Because the main number can only take over the SMS when the secondary number is turned off, criminals usually use two means at this time. One is to use SMS bombing to force the target to turn off the mobile phone, and the other is to use the mobile phone cloud service to remotely operate the mobile phone.

Step 4: White Wolf with Empty Gloves.Using the SMS verification code received by the main number, criminals ransacked the online shopping account bound to the mobile phone number.

Patterns are stacked, and it is impossible to prevent them! For this kind of fraud, after receiving all kinds of SMS notifications, you must read the content of the SMS clearly and do not reply at will.

"SMS custody" business is also not very secure.

After the SMS storage service is opened, you can save your mobile phone messages on the server of the operator. Now, many mobile phone manufacturers’ cloud services are doing the same thing. However, this is a hidden danger function.

Case review

One morning, Miss Ding saw two short messages from banks and mobile phone operators on her mobile phone, which were sent at 3:43 am and 4:12 am respectively. As soon as the account is checked, the balance of more than 100,000 yuan will be zero overnight! Not only that, Miss Ding also suffered a credit card theft and was "applied" for a bank universal loan of 70,000 yuan.

How on earth did all this happen?

Reduction of criminal modus operandi

Step 1: Hit the database to get all kinds of account information.The so-called "library collision" means using software to try a high probability digital sequence. Using this simple and rude method, the user’s network identity, online banking account number, mobile phone business hall and other accounts can be seen at a glance. Insiders said: "The speed of library collision is very fast, at least thousands per minute. If some good equipment is used, the efficiency is higher and the success rate is above 50%."

Step 2: Open SMS storage and SMS interception services to obtain verification code.This is the most critical step. After the opening of this service, the dynamic verification code to ensure the safety of landing has successfully become the bag of criminals.

Step 3: Open the physical SIM card.At this point, criminals can pretend to be victims and apply for 4G card replacement service in the online business hall. For the convenience of the people, some operators can express the card directly to the designated address.

By intercepting short messages and copying SIM cards, fraudsters can "do whatever they want".

As we all know, many important services rely on mobile phone authentication. If you back up the SMS to the server synchronously, it will increase the exposure opportunity. Once the service password of the online business hall is stolen, or the login permission of the cloud service is stolen, it is equivalent to "swimming naked".

The loopholes in the unpopular business are targeted by scammers.

The "Research Report on the Trend of Online Fraud in 2016" released by the anti-fraud reporting platform "Hunting Network Platform" proposes that since 2016, online fraud has mainly shown several obvious characteristics:

Mobile phone cards have become new theft targets;

Jump to the phishing website by using short URL and weiyun sharing link;

Well-known recruitment websites and voice platforms for open recruitment;

A phishing website that is difficult to distinguish between true and false;

The implementation of precision fraud;

Fraud professionalism is getting higher and higher;

Using loopholes in new business and unpopular business to commit fraud;

Use cloud disk and synchronization software to steal information.

Among them, the loopholes in mobile phone cards and unpopular business are mentioned.

Security experts suggest that we should develop good online habits, don’t click unfamiliar links, don’t fill in our personal information in the website interface with unknown security, and regularly modify the password of social accounts to avoid information such as mobile phone contact information being leaked; Improve safety awareness, develop good habits of using mobile phones, and avoid being infected by mobile phone viruses.

Is it more expensive to change TV screens than to buy a new TV? Insiders: overhaul of digital products is not recommended.

Recently, a video about the price of changing TV screens exceeded that of buying a new TV, which attracted attention. Many consumers are puzzled that the cost of changing TV screens has reached 70% to 80% or even exceeded the price of the whole TV. In this regard, some people in color TV companies said that it is normal to change the screen more expensive than buying a new TV. Especially for low-end TVs with lower prices, the screen cost accounts for a higher proportion of the whole machine price. If you add increasing labor costs, the screen change price will exceed the price of new machines.

Professionals also remind consumers that from a technical point of view, it is not recommended to replace the core components of digital products separately, and it is not recommended to change the screen of TV sets that have been used for a long time.

Why does it cost 4600 yuan to change the screen of a TV bought for 2700 yuan?

Recently, a video of "2,700 yuan to buy a TV replacement screen actually needs 4,600 yuan" has attracted attention. The author said in the video that he spent 2700 yuan to buy a 75-inch TV set, but the accidentally broken screen needs to be replaced. After contacting the official customer service of the manufacturer, the price of changing the screen was as high as 4600 yuan. Consumers are dissatisfied with this. "Why is the price of changing a screen so much more expensive than buying a new machine?" The consumer said that he understood the fact that the TV screen can account for 70% to 80% of the cost of the whole TV set, and he could accept it if he spent more than 2,000 yuan on maintenance, but why did he quote as much as 4,000 yuan?

In this regard, the Beijing Youth Daily reporter got in touch with the relevant personnel of a color TV manufacturer. The other party said that it is true that the TV screen can account for 70% to 80% of the cost of the whole TV set, but consumers ignored the labor cost of changing the TV screen. In the era of intelligent production, it is not surprising that the labor cost of the same process is much higher than that of automatic production. According to industry practice, the labor cost of changing the screen of 75-inch TV will not be less than 2000 yuan.

TV LCD screen accounts for 70% to 80% of the total cost.

It is understood that TV screen is the biggest cost in TV production. Since the popularization of LCD TV, the cost of LCD screen can account for 60% to 70% of the total cost of the whole machine. If the module cost closely related to the screen is added, the proportion will even exceed 80%. In recent years, with the development of technology, although the proportion of screens has declined, it is still an absolute big head.

With the continuous promotion of panel localization, the cost of LCD screen has dropped rapidly, and the market price of LCD TV has also dropped sharply. This is why the 75-inch LCD TV only sells for more than 2,000 yuan, which is only equivalent to the price of a low-end mobile phone. However, this has also caused new problems, that is, the ratio of labor cost to TV price in TV after-sales maintenance is getting higher and higher, so consumers often complain that TV maintenance price is even higher than buying a new machine.

The reporter of Beiqing Daily inquired from the Internet that in recent years, consumers have repeatedly vomited or complained about this matter online. In May last year, Shaoxing consumer Ren Shifu spent 3,450 yuan to buy an LCD TV. Because the inner screen was broken, it needed to be changed. As a result, he was told that it would cost 3,400 yuan to change the screen. In December, 2021, Ms. Wang, a consumer in Chengdu, reported to the media that the Xiaomi TV she bought just had a three-year warranty, and there was a screen splash phenomenon. In the after-sales process, Ms. Wang was told by Xiaomi TV maintenance personnel that "only the screen can be changed", and the overall cost was over 3,000 yuan, accounting for about 80% of the original price of the TV. "It’s too exaggerated, which is to let consumers give up maintenance."

Digital products often have the problem that the maintenance price exceeds the new machine.

In fact, it is not a TV "patent" that the maintenance price exceeds the new machine. In the interview, the reporter of Beiqing Daily learned that there are many similar problems in digital products with high degree of automatic production, especially the replacement of core components with high cost, and the total price often reaches or even exceeds the price of buying new machines. For example, the price of replacing the motherboard with notebooks, mobile phones and digital cameras will be significantly higher than the price of new machines.

China electronic chamber of commerce Consumer Electronics Survey Office has paid attention to such issues as "the price of replacing lenses is almost 1,000 yuan" and "the price of screen maintenance exceeds that of new machines". However, in the survey, it was found that most of the digital products repaired by consumers were old products that had been used for several years, and the components of the old models were in short supply, and the production cost at that time was more expensive. If consumers compared with the same products with better performance now, the "cost performance" would definitely be uneconomical. Consumer Miss Zhang bought a 3,000-yuan digital camera in early 2018. After four years of use, there was an unusable fault, which was displayed as a motherboard fault according to the error code. When she found the seller who bought the camera at that time, she got the answer that she could only repair it at her own expense after the shelf life, and the total price exceeded 2,000 yuan. "Now the digital camera of the same grade only costs 2000 yuan, but I am used to this machine and I really can’t bear it." Miss Zhang is in a dilemma.

Digital products that have been used for a long time are not recommended for maintenance, and it is more appropriate to directly replace them with new ones.

Some digital manufacturers told the reporter of Beiqing Daily that for such digital products that have been used for a long time, it is actually not recommended for consumers to choose maintenance, and it is more appropriate to directly replace them with new ones. "This is not only a cost consideration, but also a technical suggestion. The first is the matching degree between various components. According to this person, in the product design, manufacturers will take the service life of each component into account as a whole, and the service life is matched with each other as a whole, thus avoiding the cost waste caused by the fact that some components have reached the service life and other components can operate normally for a long time. Take an ordinary digital camera as an example. If we don’t consider the outdated performance indicators, it is recommended to use a machine for about six years. If the motherboard fails after four years of use, we may encounter problems with other components two years later. "At that time, if you give up maintenance and replace it directly, it is equivalent to the fact that this new motherboard was laid off in only two years, which actually caused more waste." Of course, he also said that if it is only a minor fault of non-core components, it is worthwhile to spend a lower cost on maintenance.

On the other hand, the precision integration of digital products is high, and the precision and standardization of manual maintenance and installation are definitely not as good as integrated manufacturing. Theoretically, there are also cases where the service life and performance of the same parts after manual installation are not as good as the original ones. Therefore, consumers are advised to be cautious about the overhaul of the core components of digital products.

Text/Reporter zhangqin Coordinator/Chi Haibo

[Pingliang Wenlv Federation of Trade Unions Walking in Spring] Magnificent Kongtong Mountain

step on

spring

The height of the stars is swallowed by the peaks, and the mountains and rivers are stunned.

Cut off the clouds like the sea, and open Tianluling as the door.

Loose the Xiao Han’s struggle, and the stone bears the fur coat and carries the beast.

Looking around at peach blossoms and full of valleys, you should not still ask Wulingyuan.

-[Qing] Tan Sitong’s "Kongtong"

Activity introduction

In order to promote the short-distance tour, city tour, Zhou Bianyou tour and rural tour in Pingliang, promote the rapid warming of Pingliang tourism market and expand the consumption of cultural tourism, the Municipal Bureau of Cultural Tourism and the Municipal Federation of Trade Unions jointly issued a notice to all levels of units and enterprise trade unions in the city, proposing to organize trade union members, and making efforts to carry out the activity of "Spring outing for trade union members in rural areas to help restore the cultural tourism market".

one

From March 15th to May 31st, spring outing will be organized by all units in batches by means of overtime vacation for epidemic prevention and control, annual paid vacation, rest and recuperation vacation for employees and weekends.

two

The tourist range is all scenic spots (spots) and rural tourist spots in the city, and it will be round-trip on the same day. The activity funds can be implemented in accordance with the Detailed Rules for the Implementation of the Fund Revenue and Expenditure Management of Grass-roots Trade Unions in Gansu Province (Provisional) and the Opinions on Doing a Good Job in Workers’ Rehabilitation (Trial) (No.28 [2020] of Gan Zongfa).

three

Actively encourage employees to buy local agricultural products at their own expense to help farmers and tourists consume.

four

Encourage all units to travel by entrusting travel agencies to do a good job in epidemic prevention and traffic safety to ensure healthy and safe travel.

five

Travel agencies actively plan the "Pingliang People Tour Pingliang" one-day tour boutique route. They can refer to the relevant provisions of Article 2 "Citizen Tour" of Pingliang City’s Measures for Encouraging Organizations to Introduce Tourism Groups from Outside the City, and organize Pingliang local tourists to travel in the city and visit more than two scenic spots, with more than 10 people at a time, and every 50 people can be rewarded with the standard declaration award of 1000 yuan.

kongtong mountain

Kongtong Mountain, a national 5A-level tourist attraction, is located 12 kilometers west of Pingliang City, Gansu Province. Kongtong, also known as Kongtong, contains the Taoist ideological realm of "nothing" and "great harmony". Kongtong Mountain, with its magnificent peaks and misty cages, is surrounded by "eight buildings, nine palaces and twelve courtyards, forty-two buildings and seventy-two caves in stone houses", which combines the natural landscape with the exquisite and quaint humanistic landscape, and has extremely high ornamental, cultural and scientific research value.

According to Records of the Five Emperors in Historical Records, Huangdi, the ancestor of humanity, personally boarded Kongtong Mountain and asked Guang Chengzi, a wise man, for advice on how to govern the country and how to keep in good health. Qin Shihuang, Han Wudi and countless literati all boarded Range Rover, and Kongtong Mountain was therefore known as the "Taoist Holy Land".

Kongtong Mountain has successively won many awards, such as national key scenic spots, national geological parks, the first batch of national 5A-level tourist attractions, national nature reserves, and "Top Ten scenic spots that customers are most satisfied with in China".

Kongtong Mountain takes the peak as the bone, the forest as the flesh, the peak is majestic, and the forest is vast, so the ancients commented that "the water in Kongtong Mountain is better than that in Guansai" and that "there are mountains in the north and mountains in the south".

Watching peach blossoms in spring, enjoying red leaves in autumn, being green in summer and silvery in winter, there are beautiful scenery in all seasons, especially when peach blossoms are in full bloom, which is colorful, like a fairyland on earth, and is the best travel season for spring outing.

In spring and summer, sometimes the smoke cage is locked in fog, sometimes the sea of clouds falls, watching the sunrise in the morning and looking at the setting sun in the evening, all of which give people unlimited enjoyment. Ask about the philosophy of life in the field of Kongtong. Looking at the magnificent scenery on earth, Kongtong Mountain is the paradise in your dream.

There are mountains without water that can’t show tolerance, and water without mountains can’t show spirit. The zither lake at the foot of the mountain is as smooth as a mirror, with swift water and exciting water, so it is like a piano, so the front gorge of Kongtong Mountain is also called zither gorge. The Rouge River in the north of Kongtong Mountain comes from around the mountain. In spring, peach blossoms are like chardonnay, and the flowers are colorful and floating all over the water, so it is also called Rouge River. Two rivers and one lake surround the Kongtong Mountain, which makes the scenery of the mountains more beautiful.

It is a miracle created by nature that there is such a wonderful sight in the northwest loess plateau. No wonder Tan Sitong’s mountaineering poem said: "Cut off the dust and clouds like the sea, and open Tianluling as the door. Looking at the peach blossoms and the valleys, you should not still ask Wulingyuan. "

(Aerial photography of Kongtong Mountain)

The breeze is sweet and intoxicating, and the earth is beautiful and charming.

The spring breeze is ten miles, so it is better to have you in the picture.

Spring outing-is the serious business!

(Some pictures are from Kongtong Mountain tourism. If there is any infringement, please contact and delete.)

Original title: "[Pingliang Wenlv Federation of Trade Unions Walking in Spring] Magnificent Kongtong Mountain"

Read the original text

The cold air caused the temperature in the north to dive and ushered in the first snowfall in the second half of the year.

BEIJING, Beijing, Oct. 10 (Xinhua)-The 9th is the first working day at the end of the Eleventh Golden Week. Beijing, Tianjin, Hebei and other places have experienced heavy rainfall, and Qinghai, Inner Mongolia and other places even ushered in the first snowfall this autumn. The cooling wind made it difficult for many office workers returning to work to adapt for a while, shouting "I want to wear long pants".

According to the latest weather forecast, the temperature in Northeast China, North China, Shaanxi, Sichuan, Chongqing and other places will drop by 6-10℃ today and tomorrow, and the local temperature drop can reach 12℃. There is strong precipitation in the southeast of northwest China and North China, and moderate to heavy snow in parts of Ningxia and Gansu.

On October 9, the temperature dropped sharply in many places in Inner Mongolia. On the streets of Hohhot, pedestrians riding electric cars put on "cotton-padded clothes" to travel. China News Service reporter Liu Wenhua photo

Just entering October, I "want to wear long pants"

— —Rainfall in many places in the north has cooled down, and the local temperature drop has exceeded 10℃

In October, after enjoying the Golden Week holiday, office workers need to overcome not only the "holiday syndrome", but also the windy and cool weather. With the arrival of cold air, there has been a sharp cooling in many places in the north in recent days. On social platforms, many netizens shouted "to wear long pants" in their circle of friends.

According to the report of the Central Meteorological Observatory on the evening of the 9th, due to the influence of cold air, at 14: 00 on the 9th, compared with 14: 00 on the previous day, the central and eastern Jilin, Liaoning, central Inner Mongolia, northern Hebei, western Shanxi, central and northern Shaanxi, Ningxia, central and southern Gansu and other places experienced a temperature drop of 6-8 C, and the local temperature drop reached 10-12 C.

In addition, heavy rainfall, fog and other weather in many places have also added traffic pressure to the first working day after the Golden Week. Among them, Weibo Meteorological Beijing, the official of Beijing Meteorological Bureau, reported that the average precipitation in Beijing reached 29.8 mm from 4: 00 to 16: 00 on the 9th.

According to media reports, on the morning of the 9 th, the rainy and foggy weather in Beijing continued, and several high-speed sections of Jingha, Beijing-Tianjin and Jingping were closed; Rain and fog also affected flights at the Capital Airport. As of 11: 00 on the 9th, more than 100 inbound and outbound flights were delayed and more than 50 flights were cancelled.

Cold air comes with snow

— — Many places welcomed the first snowfall in the second half of the year, and the temperature hit a new low in the second half of the year.

In addition to strong winds and rainfall, snowfall occurred in some places in the north. According to a report from the Central Meteorological Observatory on the evening of the 9th, 1-7mm snowfall or sleet occurred in central Gansu, eastern Qinghai and central Inner Mongolia during the daytime on the 9th.

According to media reports, due to the influence of cold air, Xining, Qinghai Province ushered in the first snowfall since autumn on the 9th. The daily minimum temperature dropped to 0.9℃, and the temperature hit a new low since the second half of this year. The meteorological department of Qinghai Province issued several yellow warnings for cold waves.

The staff of Qinghai Meteorological Bureau told the media that the first snow in Xining this year was 20 days earlier than last year, and the low temperature weather will continue. It is understood that at present, Xining has not yet entered the heating season, but due to the obvious drop in temperature, citizens have put on winter cotton clothes and masks.

Some areas in Inner Mongolia also ushered in the first working day after a long holiday in the wet and cold. According to media reports, the first snowfall occurred in many places in Inner Mongolia since the second half of the year, with obvious snowfall in Alxa League, Bayannaoer, Baotou, Wulanchabu and Hulunbeier. The snowfall time in central and western Inner Mongolia was the earliest in recent 10 years, and the maximum snow depth in Hulunbeier boketu has reached 13 cm.

Zhang Fanghua, chief forecaster of the Central Meteorological Observatory, said that the cold air process affected a wide range and lasted for a long time, with a large cooling range, long precipitation duration and large accumulated precipitation in the northern region.

Zhang Fanghua suggested that the cold air process not only brought about obvious cooling, but also accompanied by a wide range of precipitation weather, and the body temperature will be very low, and the temperature in most areas in the next 10 days will be lower than that in the same period of the year. At present, most areas have not been centrally heated, and the public needs to take cold-proof and warm-keeping measures.

National gale cooling forecast map (from 20: 00 on October 9 to 20: 00 on October 11). Image source: Central Meteorological Observatory official website

Cold air will continue to go south.

— — The cumulative cooling range in Wuhan and Chongqing can reach 15℃

As the saying goes, an autumn rain is cold, and ten autumn rains put on cotton. In the next few days, the cooling weather will continue.

According to the official website news of the Central Meteorological Observatory, it is estimated that there will be a temperature drop of 6-10℃ in the central and eastern parts of Northeast China, most of North China, southwestern Shaanxi, northeastern Sichuan, Chongqing, Huanghuai, Jianghan, Jianghuai and northern Jiangnan from 20: 00 on the 9th to 20: 00 on the 11th, and the local temperature drop can reach 12℃. There are 4-6 winds in most of these areas.

For example, under the influence of rain and cold air, the temperature in Beijing will continue to drop. According to media reports, the highest temperature in Beijing during the day on the 10th was only 11℃, and the lowest temperature in the morning on the 11th will drop to 7℃, both of which will hit new lows since the second half of this year.

In addition, the cold air continues to go south. According to media reports, Hubei will usher in a "roller coaster" decline in temperature from the 10th, and the highest temperature in northwest Hubei will be the first to drop to 18-21 C; On the 11th, the temperature will drop further, and the highest temperature in Wuhan will drop to 16℃, and the cumulative cooling rate can reach 15℃.

According to local media reports in Chongqing, a cooling and rainy weather process began in Chongqing on the evening of the 9 th, which lasted until the 12 th, and the daily average temperature will drop by 6-9 C. From the perspective of the whole city, the highest temperature will drop from 33℃ to 18℃, and the cooling rate will be as high as 15℃.

In addition, it is expected that there will be heavy rain and local heavy rain in parts of Sichuan, Shaanxi, North China, Liaoning and Jilin from 20: 00 on the 9 th to 20: 00 on the 10 th; In Inner Mongolia, Hebei, Shaanxi, Ningxia, Gansu, Qinghai and other places, rain will turn to sleet or snowfall. Among them, there are moderate to heavy snow in parts of southern Ningxia and central Gansu, and there are heavy snow in mountainous areas.

It is understood that on October 12, the cold air force will weaken and the cooling will end. At that time, only Jiangnan and northern South China will have a temperature drop of 2 C to 4 C.

Attention financial holding company! The central bank zoomed in, and super-strict supervision is coming! (20 points)

On the afternoon of July 26th, the central bank and relevant departments drafted the Trial Measures for the Supervision and Management of Financial Holding Companies (Draft for Comment) (hereinafter referred to as the Measures). A few days ago, it officially solicited opinions from the public.

The central bank publicly solicited opinions on the pilot measures for supervision and management of financial holding companies.

In order to promote the standardized development of financial holding companies, effectively prevent and control financial risks, and better serve the real economy, the People’s Bank of China, together with relevant departments, drafted the Trial Measures for the Supervision and Management of Financial Holding Companies (Draft for Comment) (hereinafter referred to as the Measures). A few days ago, it officially solicited opinions from the public.

According to the central bank, financial holding companies invested by non-financial enterprises blindly expand into the financial industry and regard financial institutions as "cash machines". There is a regulatory vacuum and risks are constantly accumulating and exposed. In order to rectify and restrain the risks of financial holding groups that have actually formed in an orderly manner, and at the same time effectively regulate the increment and prevent the cross-industry and cross-market transmission of financial risks, the Measures, in accordance with the decision-making arrangements of the CPC Central Committee and the State Council, fill in the shortcomings of the supervision system, follow the concept of macro-prudential management, and conduct comprehensive, sustained and penetrating supervision on the capital, behavior and risks of financial holding companies on the basis of consolidated supervision.

There are 7 chapters and 56 articles in the exposure draft, the main contents of which include:

The first is to clarify the scope of supervision.That is, financial holding companies that meet certain conditions and whose actual controllers are domestic non-financial enterprises and natural persons shall be supervised by the People’s Bank of China.

For integrated financial groups formed by financial institutions investing in other types of financial institutions across industries, the relevant financial supervision departments shall implement supervision according to the Measures and be responsible for formulating specific implementation rules.

The second is to take market access as the first threshold for risk prevention and control., clear the qualifications of directors, supervisors and senior management personnel, and implement continuous supervision of financial holding companies during and after the event. The administrative licensing matters involved will be decided by the State Council according to law.

Third, strict shareholder qualification supervision., through the positive list and negative list, stipulate the conditions and prohibited acts of becoming a shareholder of a financial holding company. The major shareholder, controlling shareholder or actual controller of a financial holding company shall have prominent core business, standardized corporate governance, clear ownership structure and good financial status.

The fourth is to strengthen the supervision of the authenticity of capital sources and the compliance of capital utilization.. The source of funds shall be true and reliable, and non-owned funds such as entrusted funds shall not be used to invest in financial holding companies. A financial holding company shall not inject capital falsely or circularly into financial institutions.

Fifth, strengthen corporate governance and related party transaction supervision.. A financial holding company should have a concise, clear and penetrating shareholding structure, participate in the corporate governance of the financial institutions it controls according to law, and must not abuse its substantive control rights. Shall not conceal related party transactions and the true whereabouts of funds.

Sixth, improve the risk "firewall" system. Financial holding companies should establish a unified comprehensive risk management system to reasonably isolate internal cross-employment and information sharing.

Seventh, set a reasonable transition period.. Allow existing enterprise groups that do not meet the requirements of the Measures to carry out rectification within a certain period of time to promote a smooth transition.

After the public consultation, the People’s Bank of China will further revise and improve the Measures in conjunction with relevant departments according to feedback from all walks of life.

Here come the 20 main points.

From the central bank’s answer to reporters’ questions and the full text of the draft for comments, the following 20 points can be sorted out.

1. Why is this method formulated?

Financial holding companies invested by non-financial enterprises blindly expand into the financial industry, and there is a regulatory vacuum, and risks are constantly accumulating and exposed.

The main manifestations are as follows: First, the risk isolation mechanism is missing, and financial risks and industrial risks are cross-transmitted.

Second, some enterprises have complex control or benefit relationships and strong hidden risks.

Third, there is a lack of overall capital constraints, and some groups as a whole lack real capital that can resist risks.

Fourth, some enterprises improperly interfere in the operation of financial institutions, and use related party transactions to conceal their interests and harm the rights and interests of financial institutions and investors.

2. Penetrating supervision

In view of the complex structure of financial holding companies, it emphasizes the thorough supervision of equity and funds, accurately identifies the actual controller and the ultimate beneficiary, and prevents the real control relationship from being hidden.

Through the verification of the authenticity of the sources of funds, including the sources of funds for investment in financial holding companies and the sources of funds for investment in financial institutions, to prevent false capital injection and circulating capital injection.

3. The central bank implements supervision.

The People’s Bank of China shall supervise the financial holding companies that meet the conditions for the establishment of the Measures, and the financial supervision department shall supervise the financial institutions controlled by the financial holding companies.

Financial supervision departments supervise financial groups formed by cross-industry investment and holding of financial institutions. When the risk occurs, according to the principle of "who supervises, who is responsible", the corresponding regulatory body will take the lead in risk disposal. Strengthen supervision cooperation and information sharing among various departments to jointly guard against the risks of financial holding groups and financial groups.

4. What are the financial holding companies?

A financial holding company is defined as a limited liability company or a joint stock limited company that is established according to law, has substantial control over two or more different types of financial institutions, and only conducts equity investment management and does not directly engage in commercial business activities.

The Measures apply to financial holding companies whose actual controllers are domestic non-financial enterprises and natural persons. For financial groups formed by cross-industry investment and holding of financial institutions, the financial supervision department shall implement supervision according to the Measures and formulate specific implementation rules.

5. Financial institutions include the following six types:

Commercial banks (excluding village banks), financial leasing companies, trust companies, financial asset management companies, securities companies, fund management companies, futures companies, life insurance companies, property insurance companies, reinsurance companies, insurance asset management companies, and other financial institutions recognized by the financial management department.

6, to apply to the central bank in advance to set up a financial holding company.

Non-financial enterprises and natural persons who meet the conditions stipulated in Article 6 of the Measures shall apply to the People’s Bank of China for the establishment of a financial holding company or for the parent company of the group as a financial holding company. Among them, those who have met the requirements of Article 6 before the implementation of the Measures shall apply to the People’s Bank of China within 6 months from the date of implementation of the Measures. After the implementation of the Measures, if it intends to substantially control two or more different types of financial institutions, and it has the circumstances stipulated in Article 6 of the Measures, it shall also apply to the People’s Bank of China. Relevant implementation rules will be formulated separately.

7. These cases are not registered.

If an institution that meets the requirements for the establishment of a financial holding company fails to apply to the People’s Bank of China in accordance with the Measures, or the People’s Bank of China may, in conjunction with the relevant financial regulatory authorities, order it to make corrections. If it fails to make corrections within the time limit, it shall be ordered to transfer the equity of the financial institution it holds. Without the approval of the People’s Bank of China, a financial holding company shall not be registered as a financial holding company, and the words "financial holding", "financial control" and "financial group" shall not be used in its name.

8. What are the business scopes of financial holding companies?

The main business of a financial holding company is equity management of the financial institutions it invests in. In addition, in order to urge financial holding companies to strengthen the overall liquidity management and risk management and control of the group, so that they can provide liquidity support to the financial institutions they hold, or play a self-help role to the financial institutions they hold in case of risks, the Measures allow financial holding companies to carry out other financial businesses except equity management on the premise of obtaining approval from the People’s Bank of China.

9. Strictly isolate the financial sector from the industrial sector.Block, a financial holding company shall not engage in non-financial business.

From the perspective of based on the main business and risk prevention, financial holding companies are enterprises specializing in equity investment and management of financial institutions, and are not allowed to engage in non-financial business, so as to strictly isolate the financial sector from the industrial sector and effectively prevent cross-infection of risks.

Under the premise of strictly isolating risks, financial holding companies established by enterprise groups are allowed to invest in institutions related to financial business identified by financial management departments, but the book value of total investment shall not exceed 15% of the net assets of financial holding companies in principle.

For existing enterprises that do not meet the requirements, they are allowed to gradually adjust the proportion of investment in non-financial enterprises during the transition period. If the enterprise group as a whole is recognized as a financial holding group, its non-financial total assets shall not be higher than 15% of the total assets of the group.

10, positive list and negative list, clear financial holding company shareholders’ conditions.

Some enterprises are not strong in strength, impure in investment motives, weak in risk management and control ability and compliance management concept. They set up or become shareholders in financial holding companies only to obtain more financial licenses, or even use financial holding companies to carry out improper related party transactions and extract funds from financial institutions, which brings greater risks to financial institutions and financial holding companies.

The Measures clarify the conditions for becoming a shareholder of a financial holding company through a positive list and a negative list.

From the positive list, the major shareholders, controlling shareholders or actual controllers of financial holding companies should highlight their core business, have pure investment motives, formulate reasonable financial investment business plans, not blindly expand into the financial industry, and have perfect corporate governance structure, clear ownership structure and organizational structure, transparent shareholder and beneficial owner structure, strong management ability, effective risk management and internal control mechanism, and good financial status.

From the negative list, it is clear that the controlling shareholder of a financial holding company is prohibited from engaging in acts, and that it is not allowed to become a major shareholder, controlling shareholder or actual controller of a financial holding company. For example, it has made false investments and injected capital into financial institutions in a circulating way, and it has been responsible for the failure or major violations of financial holding companies or financial institutions.

11, strengthen the supervision of financial holding companies’ sources of funds.

Some enterprises, through controlling financial institutions at different levels and cross-holding financial institutions, contributed with debt funds, which pushed up the overall leverage ratio and manipulated shell companies to make false capital injection and circulating capital injection, resulting in the whole group not having much real capital to resist risks.

To this end, the supervision of financial holding companies’ sources of funds emphasizes authenticity:

First, the source of funds is true and reliable. Shareholders of a financial holding company shall invest in the financial holding company with legally owned funds, and shall not invest in the financial holding company with non-owned funds such as entrusted funds, debt funds and investment funds, and shall not entrust others or accept others’ entrustment to hold the equity of the financial holding company.

Second, a financial holding company shall invest in holding financial institutions with its own legal funds, and shall not make false capital injection or circulating capital injection into financial institutions, and shall not withdraw funds from financial institutions.

The third is to carry out penetrating management on the capital compliance of financial holding companies, check the source of funds of investment holding financial holding companies upwards, and check the source of funds of investment holding financial institutions downwards.

The fourth is to establish a capital adequacy supervision system.

12. Concise, clear and penetrating ownership structure

Some enterprise groups have complex ownership structure, cross-shareholding, multi-level shareholding, insufficient information disclosure, unclear beneficial owners, and nested groups within the group.

The Measures stipulate that a financial holding company should have a concise, clear and penetrable shareholding structure, which can be identified by the actual controller and the ultimate beneficiary, and the legal person level is reasonable, which is suitable for its own capital scale, operation and management ability and risk management and control level. The financial institution it controls shall not hold shares in reverse or cross-shareholding.

13, the ownership structure does not meet the need for timely rectification.

An enterprise group that should apply for the establishment of a financial holding company from the date of implementation of the Measures, but its shareholding structure does not meet the requirements, shall formulate a plan for the rectification of its shareholding, and after being approved by the financial management department, reduce the complexity of its organizational structure and simplify the legal person level during the transition period. In the process of equity transfer, if the assets involved in equity integration, transfer and transfer within an enterprise group are in compliance with the provisions of tax policies, they can enjoy corresponding preferential tax policies; Where the approval of shareholder qualification is involved, the financial management department shall apply the shareholder qualification conditions suitable for the financial holding company.

14, shall not exceed level 3.

After the implementation of the Measures, the newly-added financial holding companies, shareholders of financial holding companies, financial holding companies and financial institutions controlled by them shall not exceed level 3 in principle.

15. A financial holding company shall not abuse its substantive control rights.

A financial holding company shall not abuse its substantive control right, interfere with the independent operation of its controlled institutions, and damage the legitimate rights and interests of its controlled institutions and their related stakeholders.

16. Strengthen related party transaction management.

Strengthening the management of related party transactions is an important measure of strict risk isolation. In practice, some enterprises use the hidden ownership structure to transfer benefits through improper related party transactions, and regard financial institutions as "cash machines", which seriously damages the legitimate rights and interests of financial institutions and investors.

17. Establish a negative list of prohibited related party transactions.

First, financial holding companies should strengthen the management of related party transactions, and their intra-group transactions with controlled financial institutions, between controlled financial institutions and between controlled financial institutions and other institutions in the group, as well as related party transactions with other related parties, should be in compliance with the law.

Second, a financial holding company and its financial institutions and other related parties shall not conceal related party transactions and the true whereabouts of funds, and shall not transfer interests, evade supervision or regulatory arbitrage, damage the legitimate rights and interests of others, or damage the stability of the financial holding company through related party transactions.

Third, except for financial companies, financial institutions controlled by financial holding companies are prohibited from providing financing to financial holding companies or providing unsecured financing to other related parties. The financing or guarantee provided to related parties shall not exceed 10% of the registered capital of the financial institution or 20% of the registered capital of the related party. Financial institutions and non-financial institutions controlled by financial holding companies are prohibited from accepting the equity of financial holding companies as pledge targets, and the guarantee balance of financial holding companies outside financial holding groups shall not exceed 10% of the net assets of financial holding companies.

18. The central bank has these regulatory means and measures.

First, establish a unified supervision information platform for financial holding companies, and require financial holding companies to report and disclose information according to regulations.

The second is to establish and improve the risk assessment system of financial holding groups, and comprehensively use macro-prudential policies, financial institution ratings and other policy tools to assess the management and risk status of financial holding groups.

Third, according to the needs of performing their duties, conduct supervision talks with relevant responsible persons, conduct on-site inspections of financial holding companies, and conduct on-site inspections of financial institutions controlled by financial holding companies with the approval of the State Council when necessary, on the basis of supervision and cooperation.

Fourth, the financial holding company is required to formulate the overall recovery and disposal plan of the financial holding group.

Fifth, when a financial holding company violates the Measures or has a major risk, it will take regulatory measures such as restricting its business activities, restricting dividends or related rights, ordering it to replenish capital within a time limit, and ordering it to transfer its equity, and give it warnings, fines and other penalties.

Sixth, if it is difficult for financial holding companies to operate continuously, which will seriously endanger the financial order and harm the public interest, they should withdraw from the market according to law. Relevant implementation rules shall be formulated separately by the People’s Bank of China in conjunction with relevant departments.

19. Transition period

If an enterprise group that existed before the implementation of the Measures and meets the conditions for the establishment of a financial holding company fails to meet the regulatory requirements stipulated in the Measures in terms of the ownership structure, the proportion of institutions related to investment and financial business, and the part-time jobs of senior managers, it will be rectified within a certain period of time with the consent of the financial management department, and the specific period will be determined by the financial management department according to the actual situation of the enterprise group. At the end of the transition period, these enterprises should meet the regulatory requirements of the Measures and be accepted by the financial management department. For the increment, it will be implemented in strict accordance with the requirements of the Measures.

20. What is the impact on the financial market?

The impact on financial institutions, non-financial enterprises and financial markets is positive and the risks are controllable.

Some enterprise groups that do not meet the requirements need to carry out equity integration, but the equity transfer is carried out within the group and the actual controller has not changed, so the impact on financial institutions is limited.

In the long run, the "Measures" are conducive to controlling financial chaos, rectifying financial order, and ultimately preventing systemic financial risks.