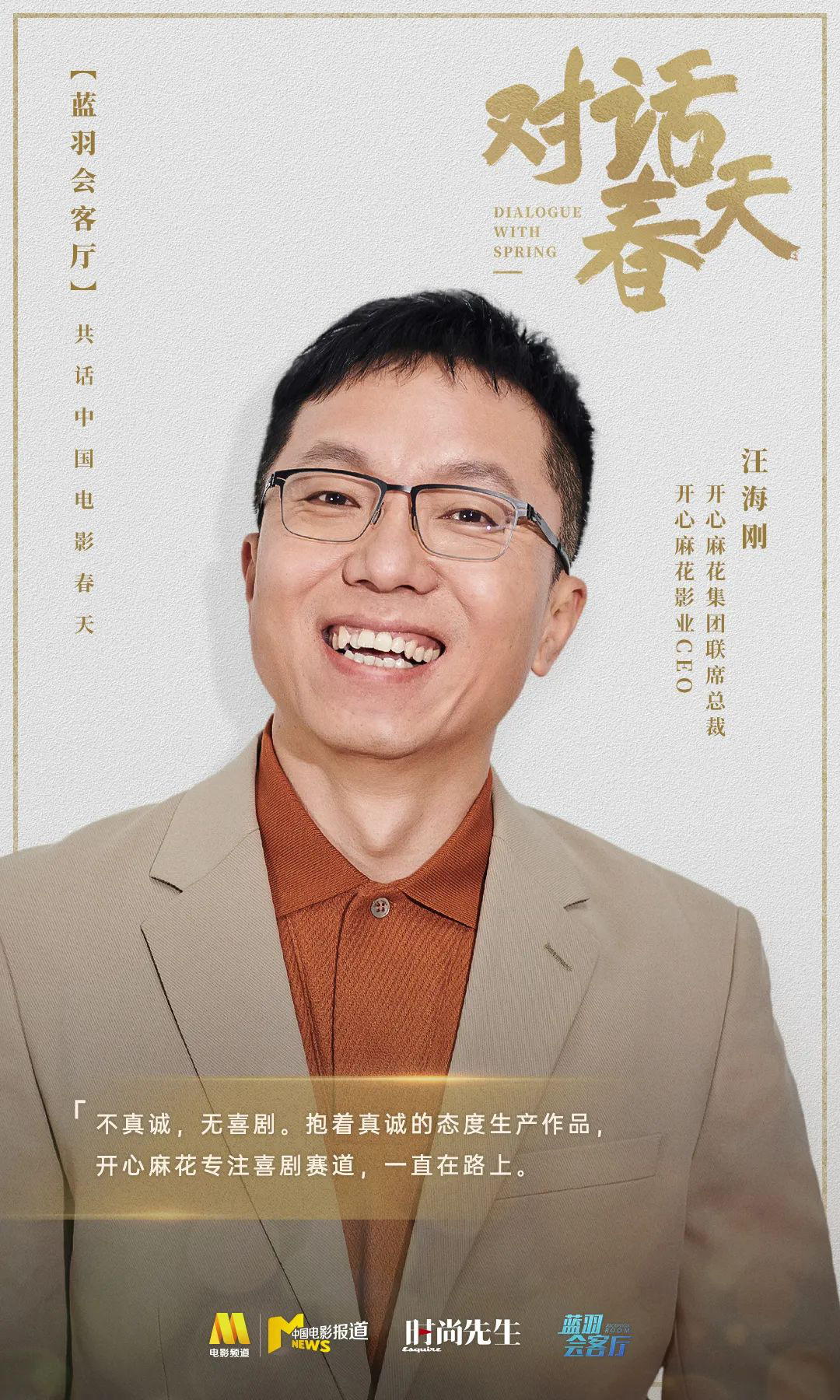

Special feature of 1905 film network "Not sincere, no comedy. With a sincere attitude to produce works, Mahua FunAge focuses on the comedy track and has been on the road. "

Follow the footsteps of the movie channel host, step into the Mahua FunAge film industry, and other explosive movie posters come into view. Fruit tea and coffee named after movies, such as "the richest tomato" and "what berries", also appeared in the twist cafe.

These posters and derivatives bear witness to Mahua FunAge’s fruitful achievements in the film field all the way.

Mahua FunAge film industry has always regarded creation as its greatest strength and foothold. Although they have contributed a lot of high-quality works on the comedy track, they don’t want to stop there, but continue to think about the combination of comedy and other types.

In order to thoroughly publicize and implement the spirit of the 20th National Congress of the Communist Party of China, on the occasion of the convening of the two sessions of the National People’s Congress, the film channel will launch "Blue Feather Meeting Room" at 22:00 every night — — Dialogue spring. Lan Yu, the host, talked with the heads of China film leading enterprises and wrote a new look of China film from different angles.

In this program, Lan Yu talks with the co-president of Mahua FunAge Group and the CEO of Mahua FunAge Film Industry, focusing on how Mahua FunAge Film Industry can deepen comedy, broaden the track, and explore new possibilities for the integration of film mining types in China.

Broaden the track,Comedy+fantasy

Starring in the new film as a comedy of women’s emotions

This year marks the 20th anniversary of the founding of Mahua FunAge. From stage plays to film and television variety shows, Mahua FunAge has blossomed in an all-round way and has become an important brand that continues to create high-quality comedy content in China.

In film, Mahua FunAge has made great achievements. Goodbye mr. loser, The Iron Fist of Shame, The Richest Man in Xihong City, and those who were nominated for the Golden Rooster Award in Chinese movies and won the awards, achieved a double harvest at the box office. Among them, Moon Man created the highest box office record in Mahua FunAge with a cumulative box office of 3.103 billion.

At the same time, the Mahua FunAge team is also thinking about how to by going up one flight of stairs. "The audience’s vision, taste and requirements are constantly changing and improving. We can’t always rely on the crutch that we have achieved in the past. We also need development and innovation." Wang Haigang said.

He introduced that Mahua FunAge officially holds a film topic selection meeting every month, and there are more than 100 topics each year. In fact, there are only about two topics that enter the script creation and final shooting.

Wang Haigang believes that there are two main reasons for "two out of a hundred": First, the threshold for watching comedy is low, but the threshold for creation is high. "It is very difficult for everyone to really be happy and burst into heartfelt laughter in two hours. Therefore, we have always been in awe in creation. " Second, with the development of China’s films, the audience’s aesthetic requirements are getting higher and higher. "We can only screen the seeds of more accurate works through a larger number of funnels."

Comedy creation comes from real life and pays attention to freshness and strangeness. Nowadays, the prevalence of short content has brought great impact and quickly consumed comedy resources. In order to cope with these challenges and problems, Mahua FunAge must strive for perfection, and create a high-level comedy that "makes everyone laugh heartily, and there are waves in his heart when he leaves".

Mahua FunAge will continue to focus on genre integration, exploring the possibility of combining comedy with other types of themes, and more sparks will collide. Moon Man is a comedy added to science fiction. The Super Family, which is scheduled to be released this year, is a comedy added to the fantasy ability setting, and it is the first time to play the villain role, with a unique shape and uncharacteristics.

Wang Haigang revealed that Mahua FunAge’s new film, which is planned to be filmed in March this year, is a "comedy+"film with a female theme and an emotional orientation, starring Mary. "This genre will be rare, but this is what we are doing to broaden our comedy track."

"insincerity, no comedy" is the principle repeatedly emphasized by Wang Haigang. Mahua FunAge Film Industry is not a company that stipulates how many works must be produced every year. They are more focused on sincere creative attitude. Every work that meets the audience should be sincere. "The day we decided to do it, we did our best. After passing your own level, you may be able to pass the audience. "

Mahua FunAge has developed in many fields, and telling good stories is fundamental.

Cultivate new comedies and look for the next Shen Teng Mary.

Mahua FunAge is not only deeply involved in stage plays and movies, but also deeply involved in variety shows, short plays, online dramas, online movies, live broadcasts and other fields in recent years. Hai Wang just bluntly said that these are carriers, and Mahua FunAge’s main business is still a story — — Telling good stories, telling interesting stories and telling stories that make everyone happy is our mainstream and will not change.

"The main purpose of our participation in variety shows is more from the perspective of cultivating and discovering new people." Wang Haigang said that the audience is now familiar with Shen Teng, Mary, and other star actors. There are about 300 or 400 comedians in Mahua FunAge all over the country, and there are many talented performers, but they are rarely really remembered by everyone, so I hope to let the audience see them through the platform of variety show.

As for whether they can achieve fame and achievements like Shen Teng and Mary one day, Wang Haigang admits that it is hard to predict. "Because Shen Teng and Mary are both talented actors and hardworking actors. Before the Spring Festival Evening and the first film "goodbye mr. loser", they had been on the stage for at least ten years, and there were still many opportunities given to them by many times. "

"Comedy needs to be soaked," Wang Haigang said. Mahua FunAge selected comedians to pay attention to the rhythm of comedy performance. The rhythm of comedy is a kind of perception, which requires talent and experience. "Shen Teng and Mary have been in the comedy tank for ten years. People say that Shen Teng is relaxed, but when he needs to get up, he can get up. This is Shen Teng. Therefore, comedy is a rhythm that is between tight and loose and needs to be comfortable. "

In addition to training new comedians, Mahua FunAge also actively explores comedy creators. Wang Haigang introduced that they mainly start from two aspects: First, give full play to the advantages of Mahua FunAge’s traditional stage and incubate and cultivate talents through stage plays; The second is to cooperate with major venture capital platforms to find young directors who have the potential to create comedies from external channels.

Start with comedy and don’t stop at comedy; Mahua FunAge hopes to bring stable product supply and fresh creative direction to China film market. In Wang Haigang’s view, the film industry is a "high-light" industry. Film practitioners have more spotlights than other industries, but they should be flat-minded and down-to-earth in order to win the hearts of the audience.

He looked forward to, "producing works with a sincere attitude, and all kinds of films are supported and paid. This is the real spring of movies in my mind."