[car home Information] In March 2024, more than 20 models, such as Ideal L Series, (|) DM-i Champion Edition, Aouita 12, Ideal MEGA and Tesla Modele 3/Y, welcomed the latest OTA upgrade. Some of them added new functions, while others optimized the existing menu and operation interface, which could enhance the use experience of the car system. We have arranged the specific upgrade information for you in this article, so you can see if there is your car in it.

OTA (full name: Over-The-Air technology) has become the most fashionable vocabulary at present, and it is also an important indicator to assess whether the products of car companies are intelligent enough. OTA is divided into FOTA and SOTA, in which SOTA refers to the software upgrade in the air, which is biased towards the software upgrade including the application of the vehicle system, just like the update of some application versions in smart phones; FOTA refers to the firmware upgrade in the air, which can upgrade and optimize the core modules such as vehicle three-electric system and control system, just like the operating system version update of smart phones.

● BYD

OTA involves models:Song Pro DM-i champion edition

OTA content:Add three functions: air conditioning reservation, closing screen and restoring factory settings, and optimize the visual experience and the stability of the car system.

OTA push time:December 29

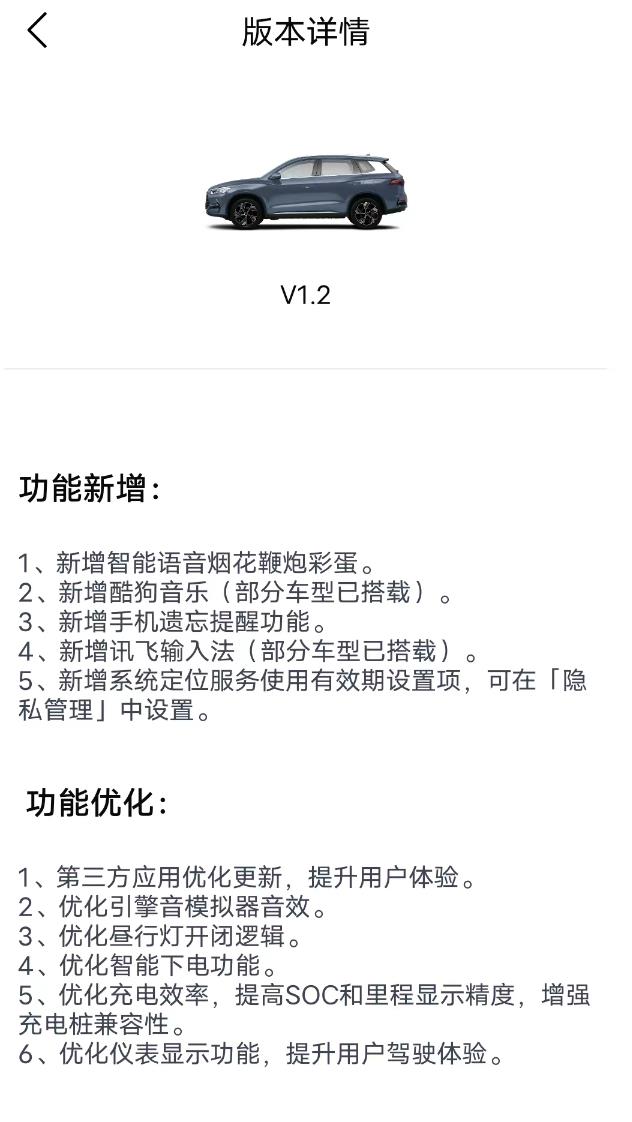

BYD Song Pro DM-i Champion Edition has now started the upgrade of OTA version V1.2, mainly adding five functions, such as intelligent voice fireworks, firecrackers and eggs, and mobile phone forgetting reminder. In addition, seven aspects, such as charging efficiency and instrument display, are ushered in optimization.

Specifically, this OTA adds five functions: 1. Intelligent voice fireworks and firecrackers eggs. 2. Add cool dog music (some models have been equipped). 3. Add mobile phone forgetting reminder function. 4. Add iFLYTEK input method (some models have been equipped). 5. Add the setting item of validity of system location service, which can be set in privacy management.

There are still six aspects of this OTA to be optimized: 1. Third-party application optimization and update. 2. Optimize the sound effect of engine sound simulator. 3. Optimize the switching logic of daytime running lights. 4. Optimize the intelligent power-on and power-off function. 5. Optimize the charging efficiency (improve the accuracy of SOC and mileage display and enhance the compatibility of charging piles). 6. Optimize the instrument display function, etc.

● Aouita

OTA involves models:Aouita 12

OTA content:For intelligent driving ability/active safety, 7 new functions were added, and more than 20 projects such as air conditioning and multimedia were optimized.

OTA push time:March 28

On March 28th, Aouita announced the launch of OTA upgrade push for 12 users in Aouita. The software version number of this upgrade is AVATR.OS 3.2.0, which is mainly aimed at intelligent driving ability/active safety, adding seven functions, and optimizing more than 20 projects such as air conditioning and multimedia.

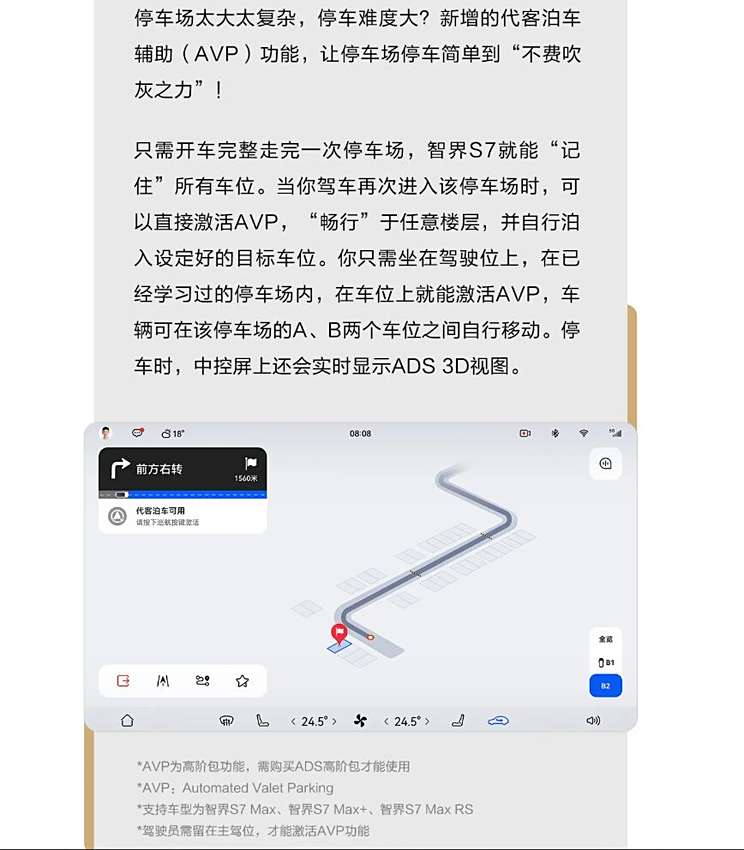

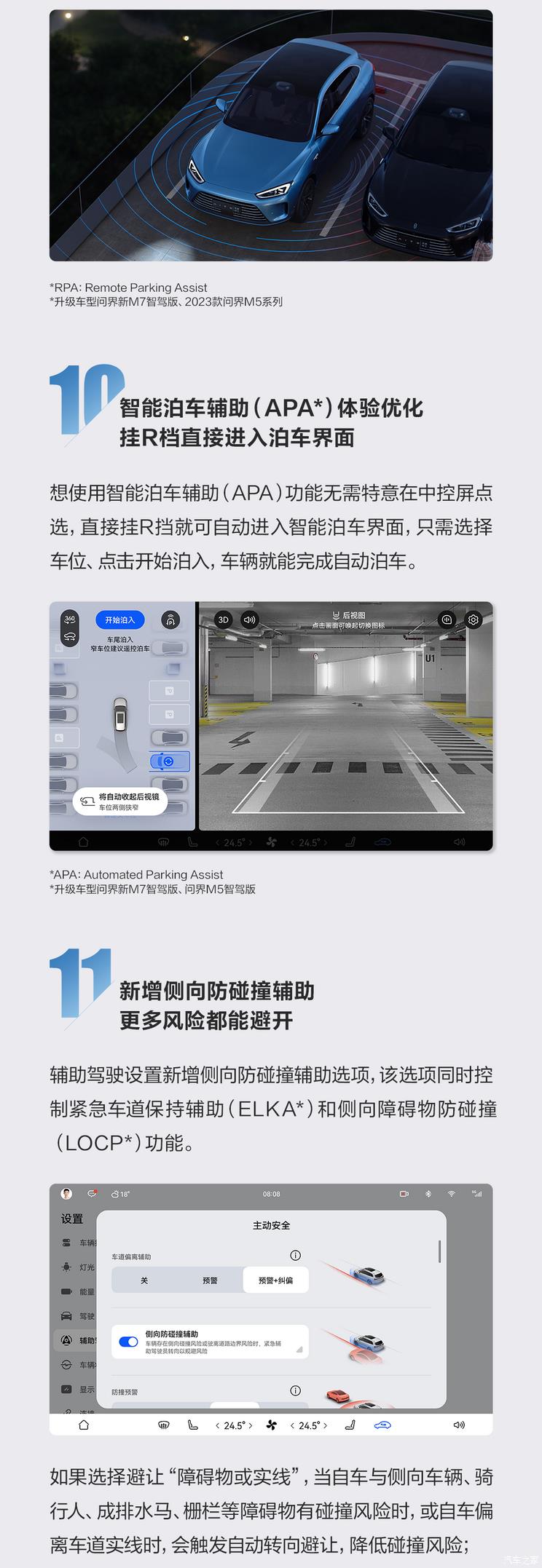

In this OTA upgrade, NCA (Intelligent Pilot Assistance) is added to automatically rise to the road speed limit. At the same time, NCA mute function is added to actively slow down when entering the toll station and guide the first use of APP, which can freely switch between NCA and LCC (Lane Center Assistance) modes. In urban LCC and urban NCA, the traffic identification ability of tidal lane and bus lanes and the function of changing lanes left and right are added. This OTA upgrade for AVP (parking service System) only needs to walk through the parking lot once, and the collection parking space is selected by default. The road can be directly calculated and AVP can be activated when entering the map, and the AVP interface can be displayed on the central control panel. After upgrading, AVP can also be activated in the parking space, which supports the escape movement of the same basement from parking space A to parking space B.

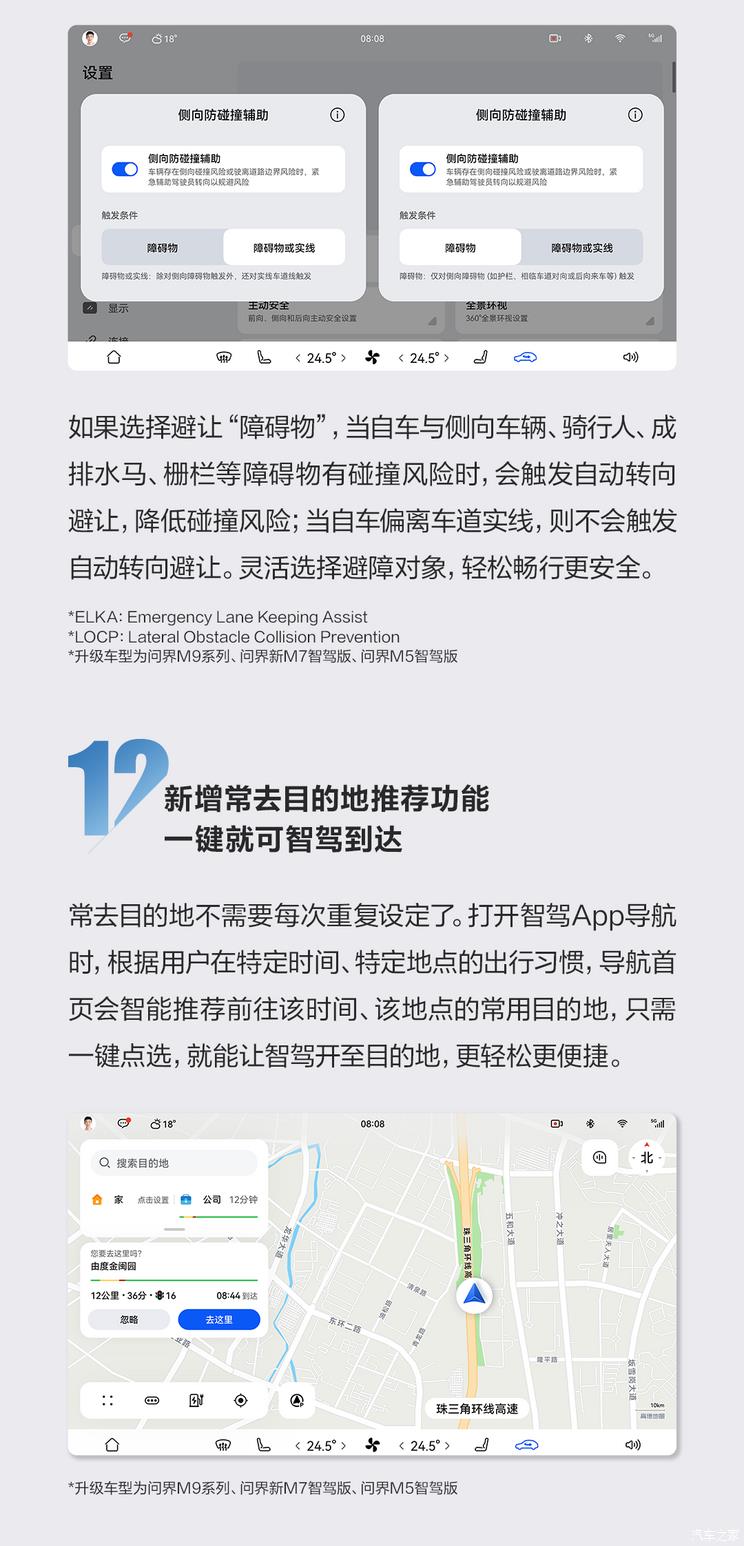

In addition, ADS (Advanced Intelligent Driving System) adds a hands-off reminder option, adding two options of standard and comfort, and also adds a quick navigation recommendation function for frequent destinations, which will intelligently recommend common destinations on the navigation home page to realize one-click intelligent driving. This OTA upgrades the lateral active safety system of ADS: it adds the lateral active safety function LOCP. When the vehicle has the risk of colliding with obstacles such as lateral drainage horses and fences, the system will automatically trigger emergency intervention and automatic steering to avoid or reduce the collision risk. In addition, the lateral anti-collision function configuration item also adds obstacles and solid line options.

After this OTA upgrade, the App can automatically judge whether there is a new version and ask the user whether to confirm the remote download and upgrade. At the same time, if multiple versions have not been upgraded, they can be directly upgraded to the latest version of the system. In terms of cockpit experience optimization, this OTA has upgraded the air conditioning system, fragrance system and multimedia sound effects. After upgrading, it can remember the user’s fragrance settings, solve the basic sound experience problems and optimize the sky surround entertainment sound effects of high-equipped models.

● Ideal

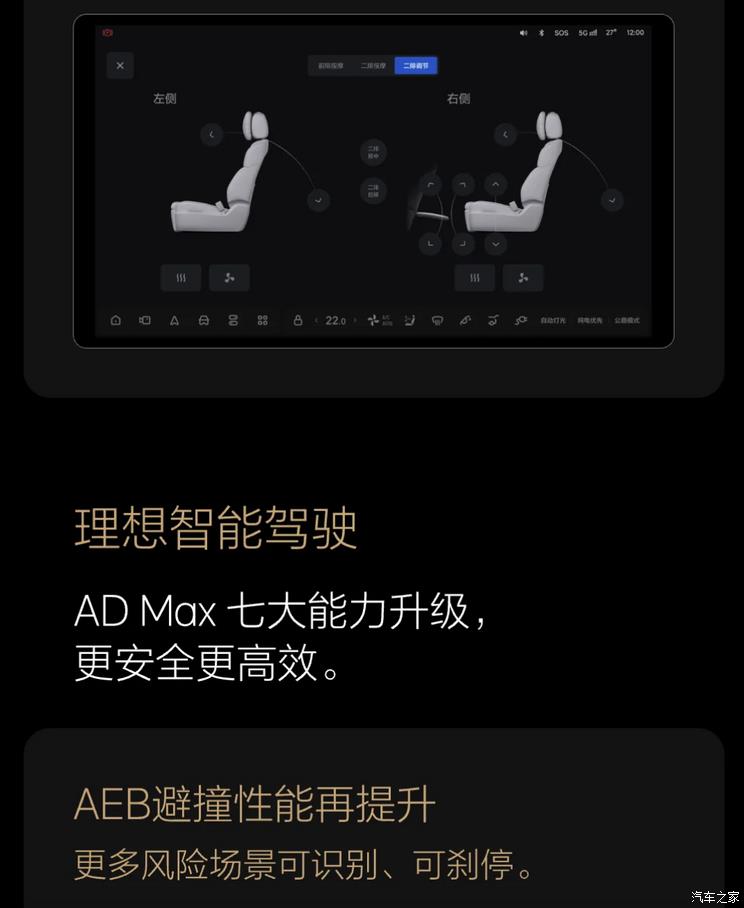

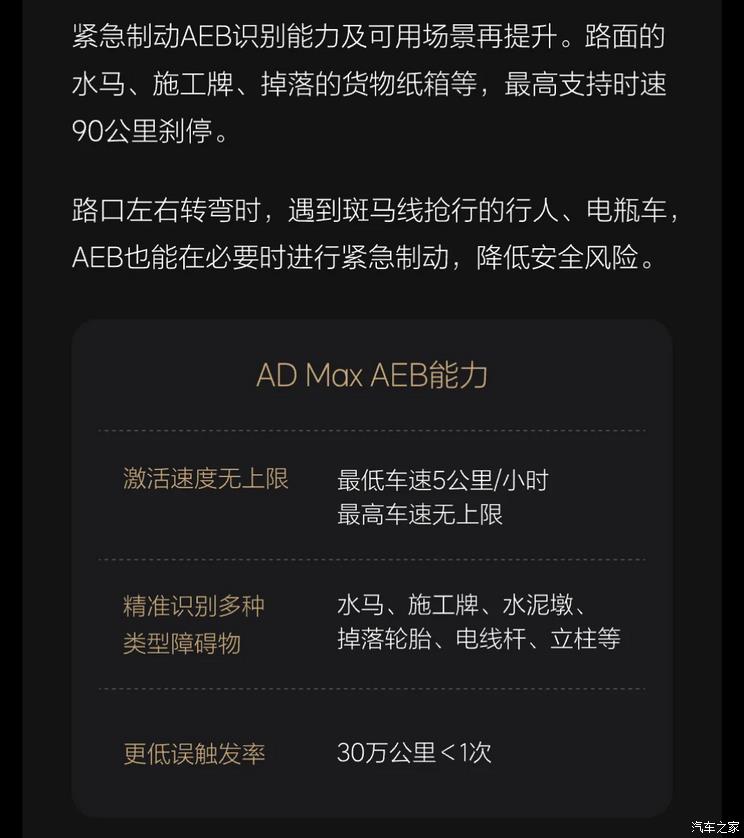

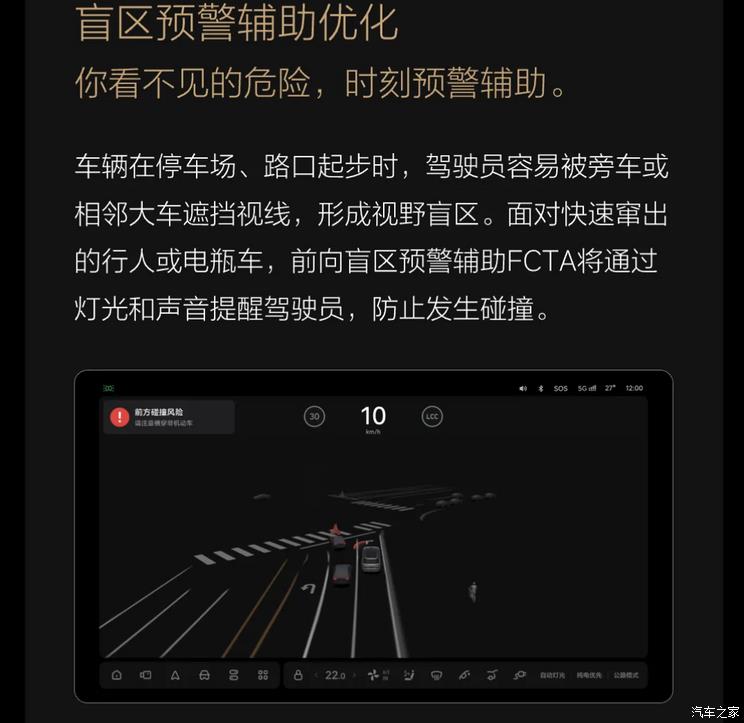

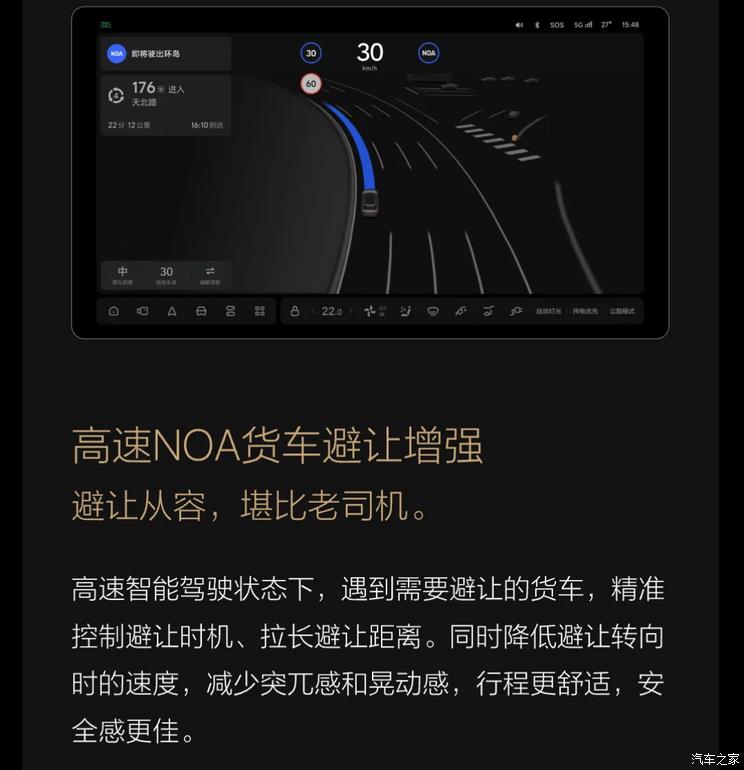

OTA involves models:Ideal l series, ideal MEGA

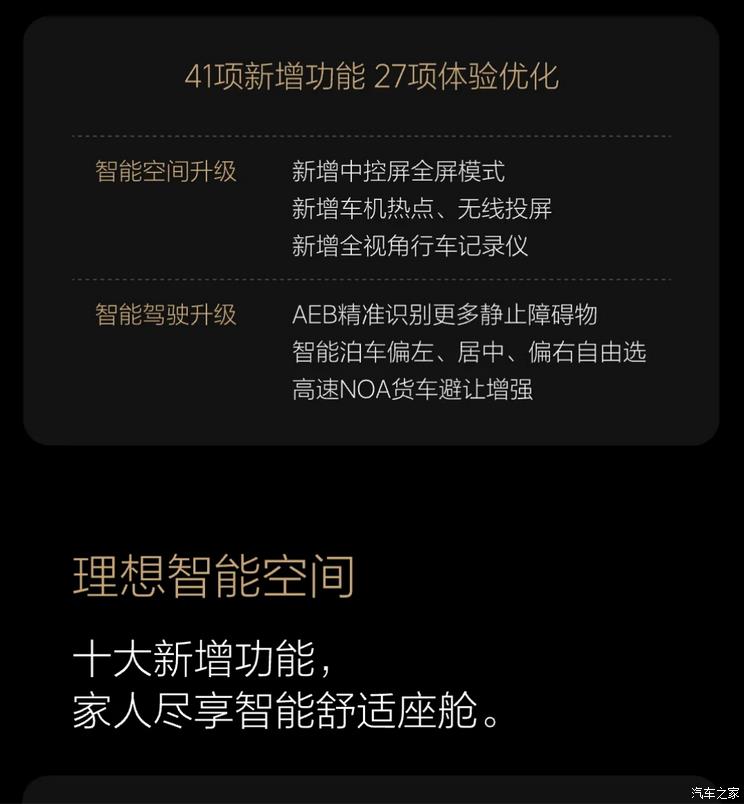

OTA content:41 new functions and 27 experience optimizations were added.

OTA push time:Push is about to start

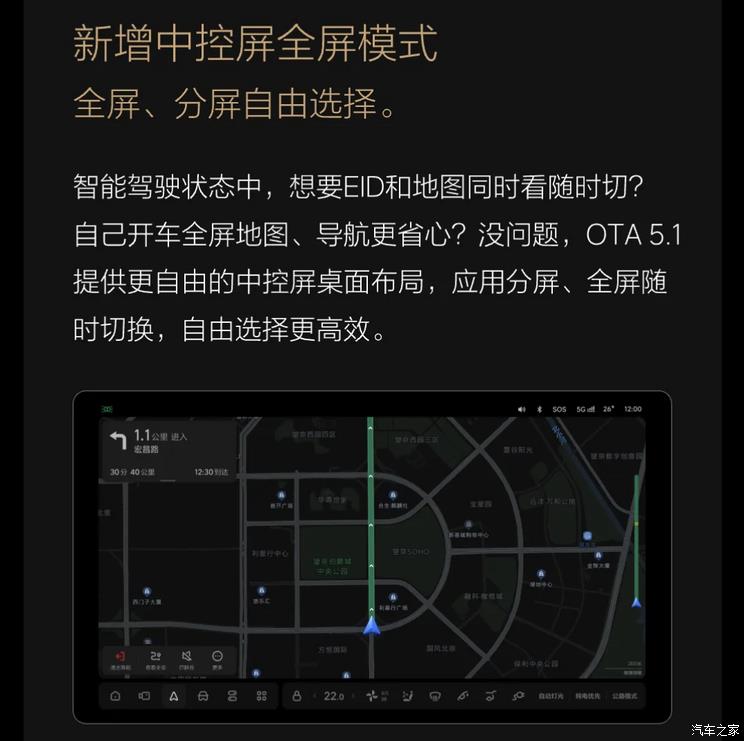

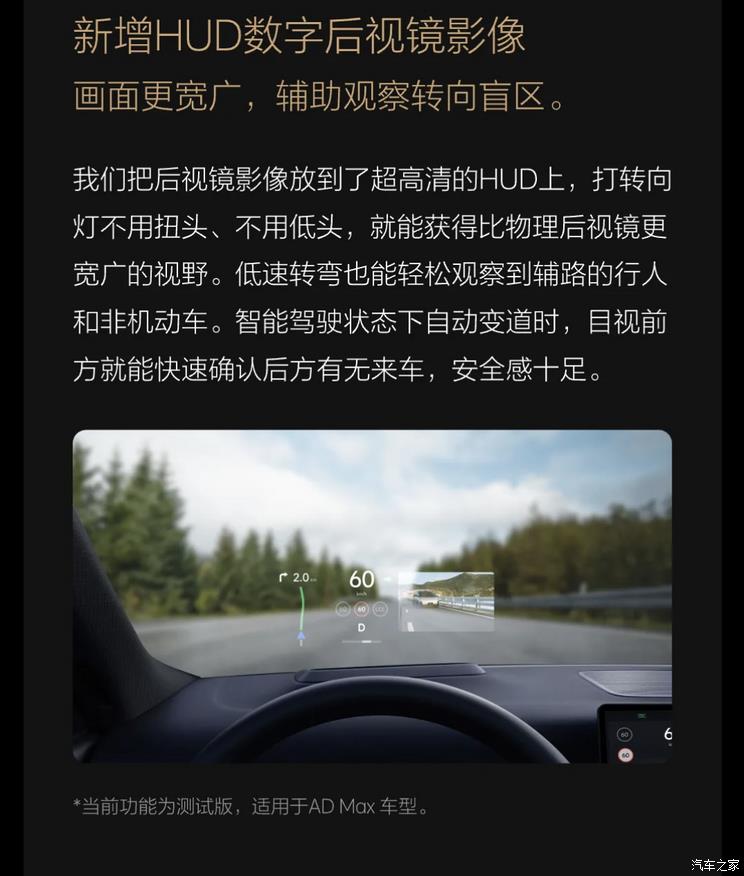

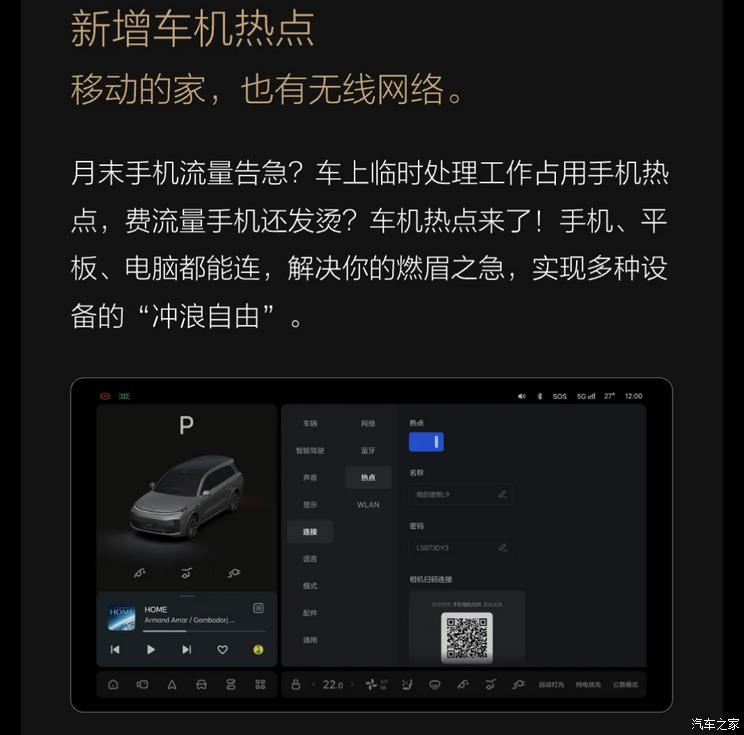

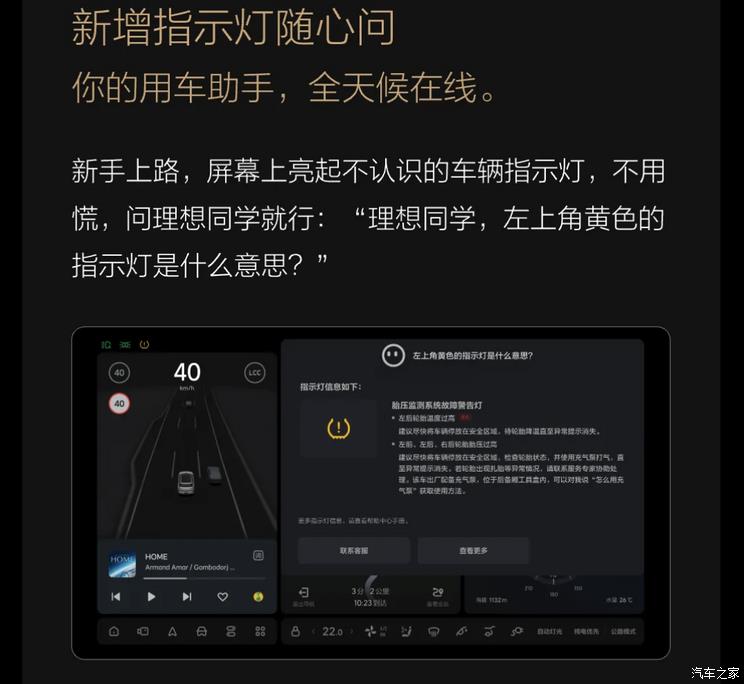

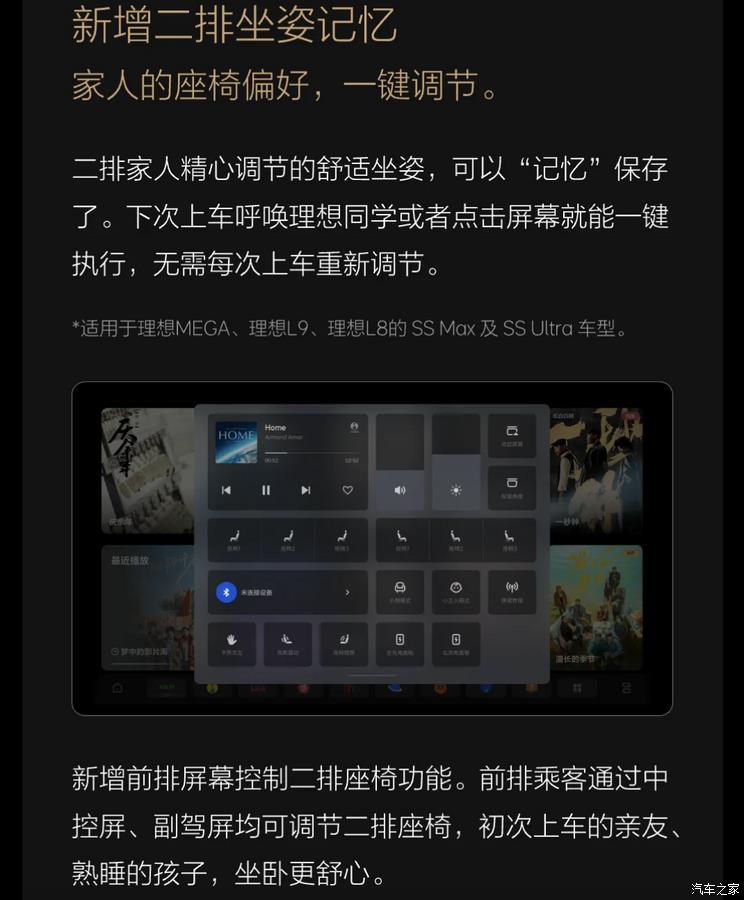

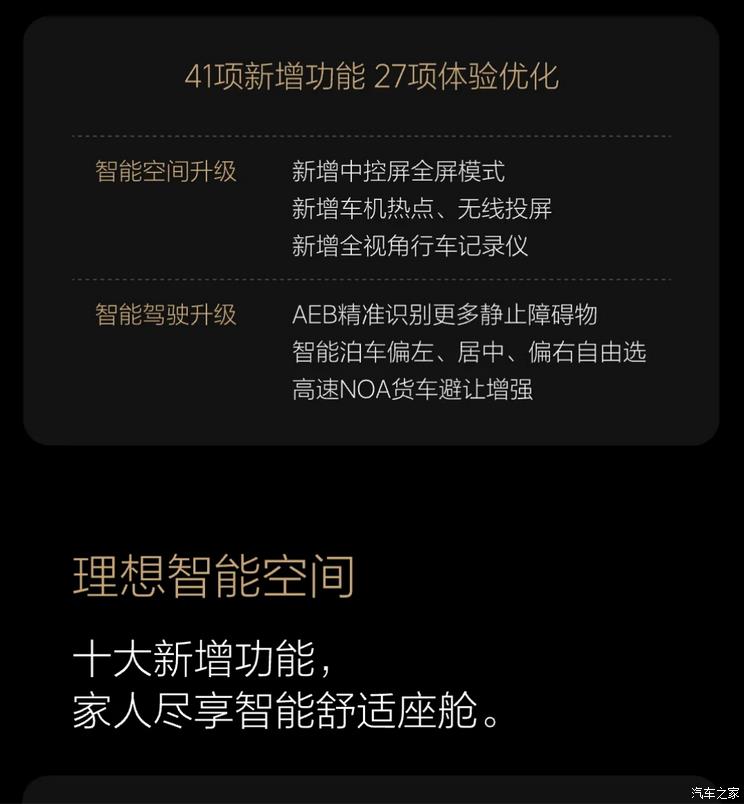

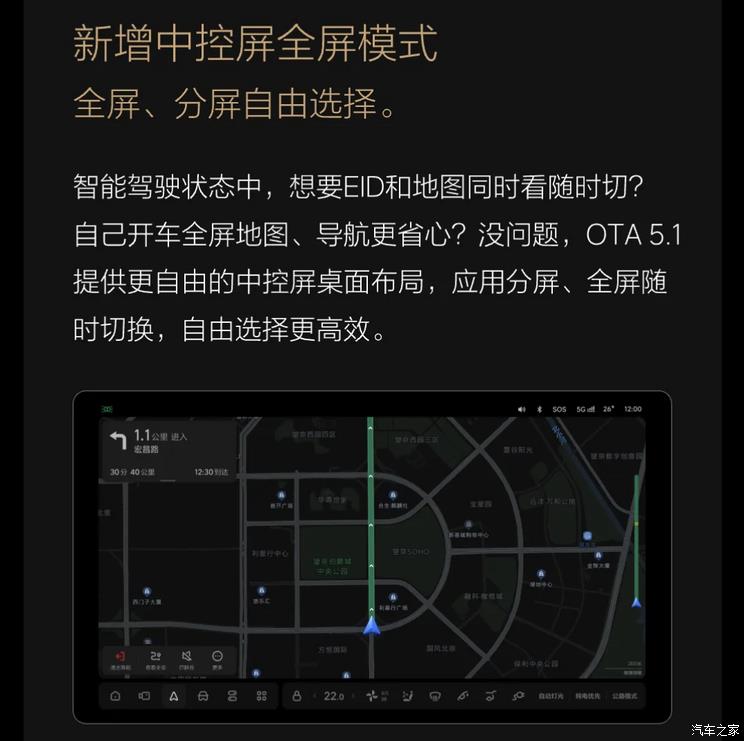

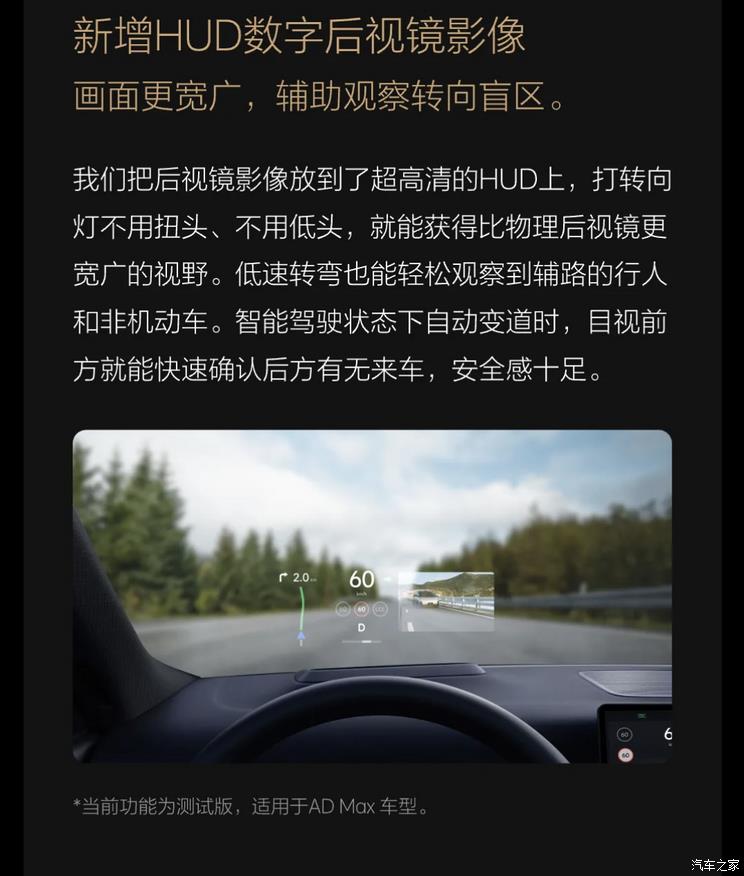

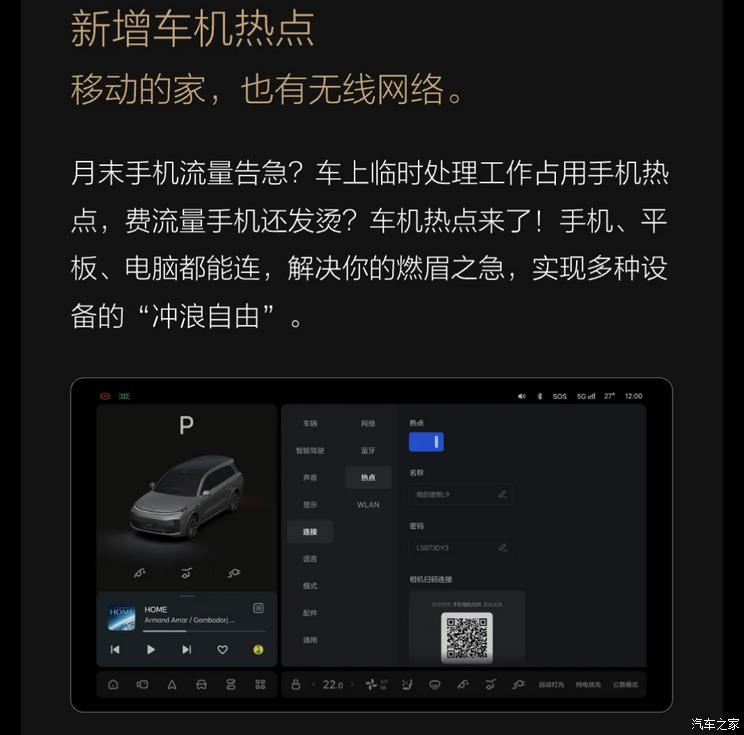

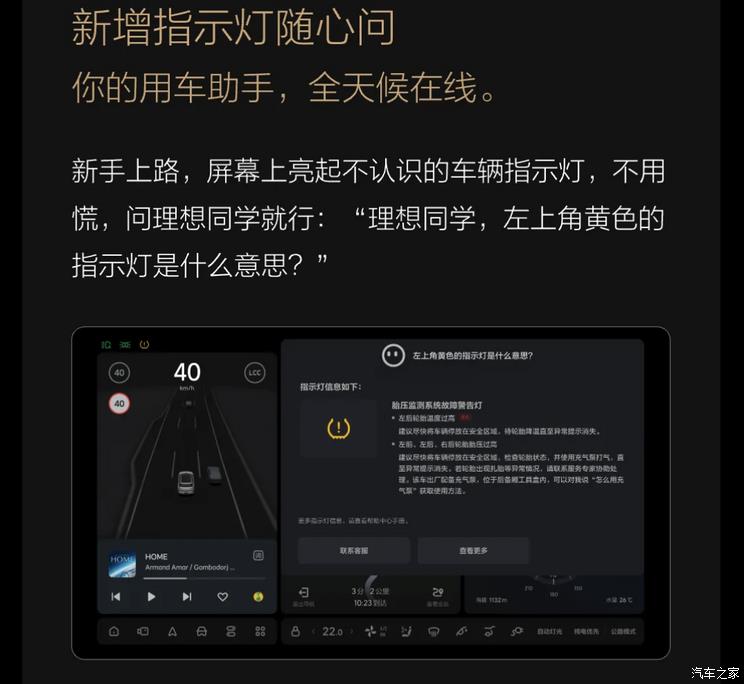

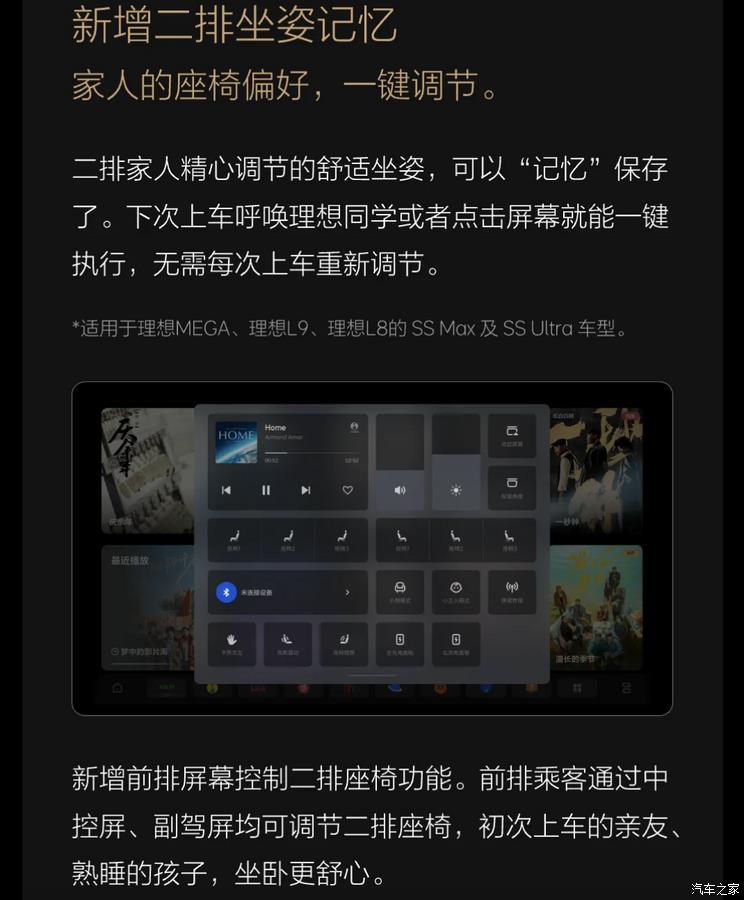

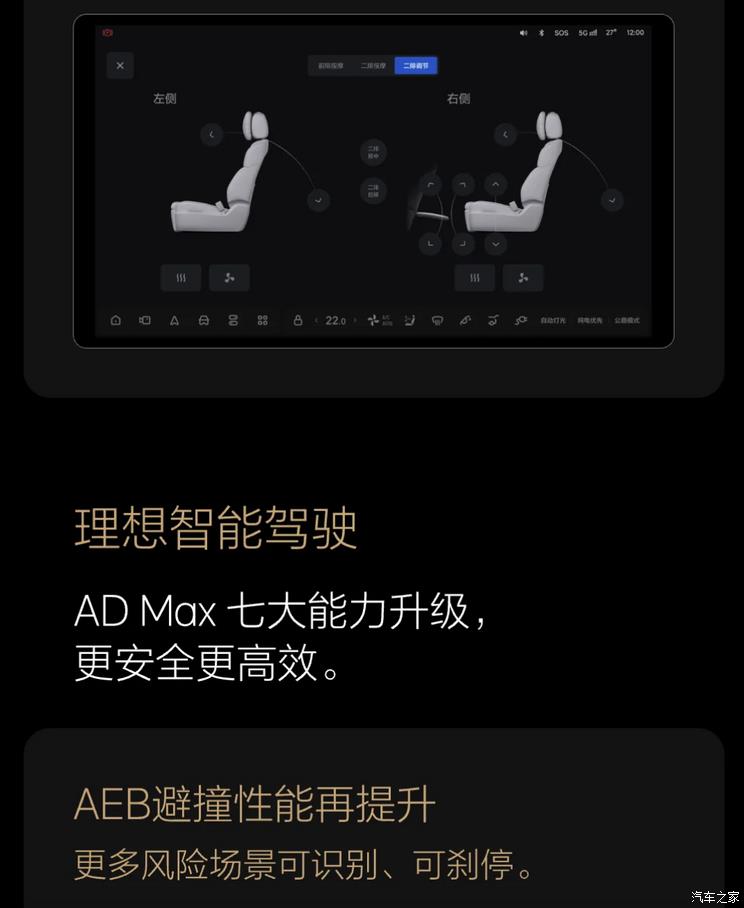

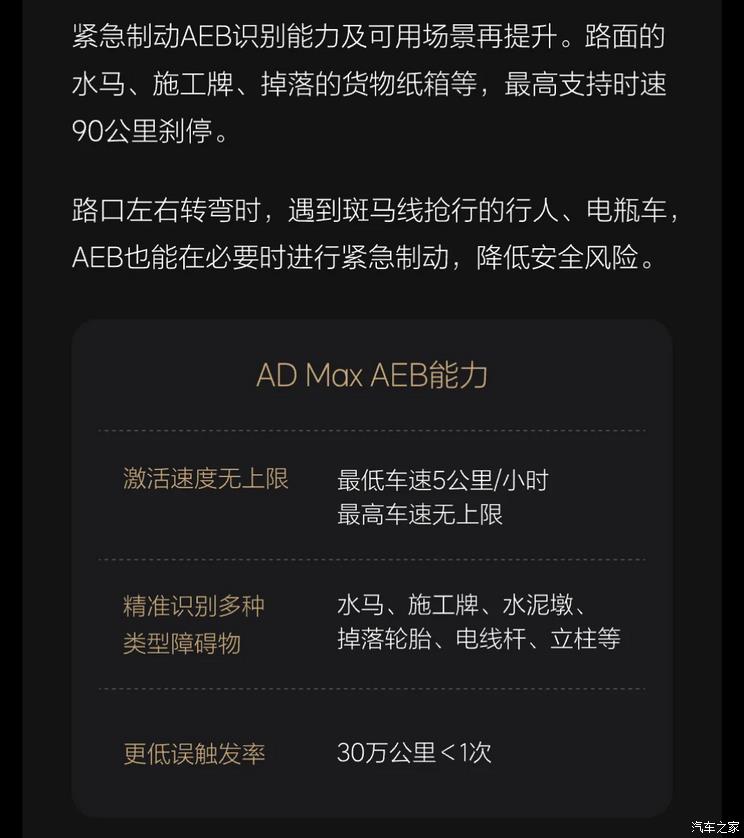

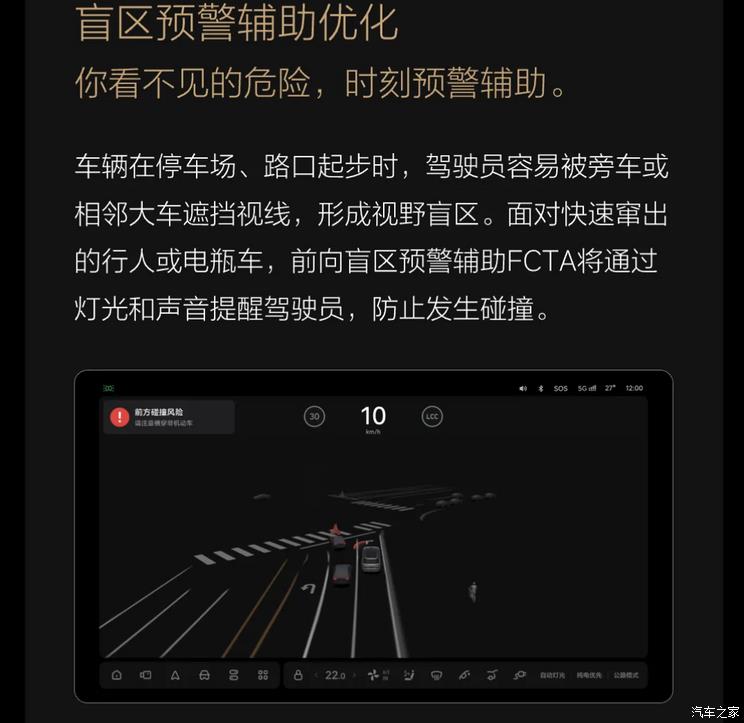

We learned from the official that the OTA 5.1 upgrade is ideal. This OTA involves the ideal L series and the ideal MEGA model, with 41 new functions and 27 experience optimizations, and the push will be started soon. Details are as follows:

According to the latest data, the cumulative delivery of 700,000 vehicles in LI officially reached a milestone, which took 51 months. Among them, the cumulative delivery volume of the ideal L9, L8 and L7 single models all exceeded 150,000, and the delivery volume of the first complete delivery week of the ideal MEGA exceeded 1,000 since it started delivery on March 11th.

● Tesla

OTA involves models:Tesla Model 3/Y

OTA content:Add three functions: air conditioning reservation, closing screen and restoring factory settings, and optimize the visual experience and the stability of the car system.

OTA push time:March 27

Tesla started the OTA upgrade of February 9, 2024, and began to push it in batches. This upgrade is mainly aimed at the optimization and upgrade of some detailed functions. Details are as follows:

1. Network security improvement: network security function update. Such as optimizing the stability of firewall, fixing the vulnerabilities of cache overflow and integer overflow.

2. The waiting time before charging is added to the vehicle: after arrival, when you plug in the power supply to prepare for charging, if your vehicle battery has not been fully warmed up, you will now see how long it will take before DC fast charging begins.

3. Add a reminder to plug the vehicle into the power supply at home: Now, when you park the vehicle at home and the charging amount is less than half of the charging limit, you will receive a reminder to plug the vehicle into the power supply on your mobile phone. To receive this notification, you must set up a residential location and have previously charged electricity at home.

4. Update of the vehicle’s estimated battery life: Your estimated battery life will now take into account other characteristics related to the aging of the battery.

5. Vehicles support ultra-wideband mobile phone keys: Now, mobile phone keys can use ultra-wideband (UWB) technology. Your mobile phone and vehicle can communicate more accurately to improve the performance of the mobile phone key.

6. The vehicle has added the warning function of coolant overflow inside the battery.

"Adaptive high beam function only applies to new Model 3 models"

7. The vehicle supports adaptive high beam: The high beam will now be adjusted to reduce the glare brought to other drivers and cyclists. High beam can now detect other road users and selectively dim individual pixels of headlights, so as to light up more often to improve visibility at night. (The adaptive high beam function is only applicable to the new Model 3 models.)

8. Map package version update CN-2024.8-14882.

● Intellectual world

OTA involves models:Zhijie S7

OTA content:Five core functions and optimization of 15+experiences

OTA push time:March 26

LUXEED Zhijie Automobile officially announced that the Zhijie S7 model will undergo OTA upgrade, which involves many technologies and functions, including five core functions and 15+experience optimizations.

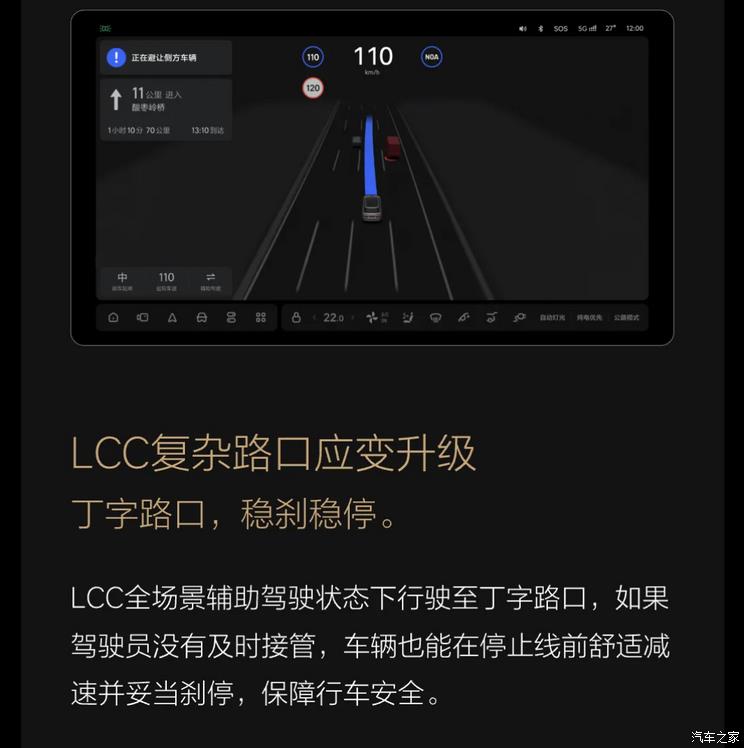

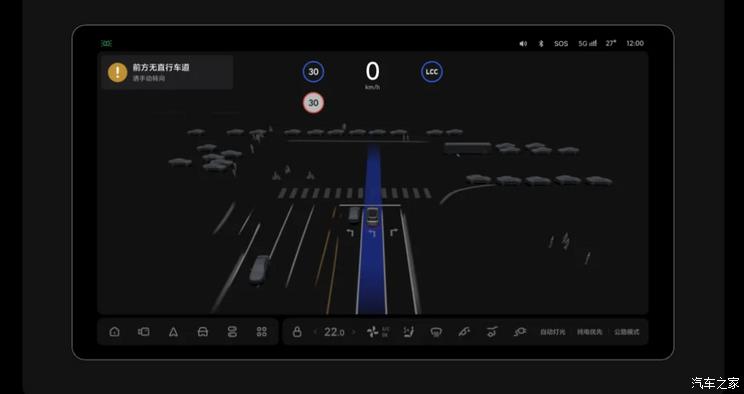

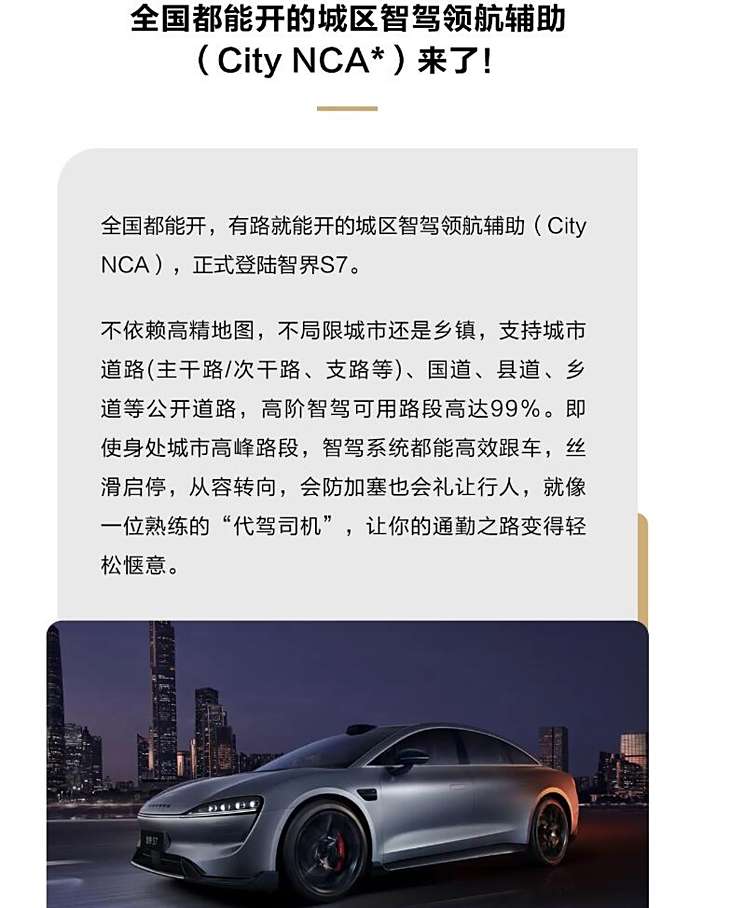

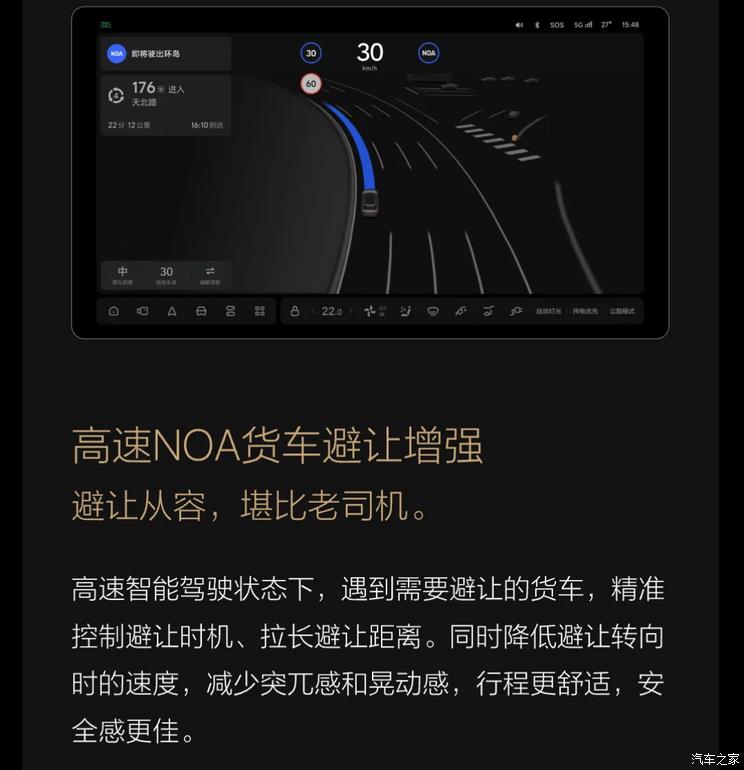

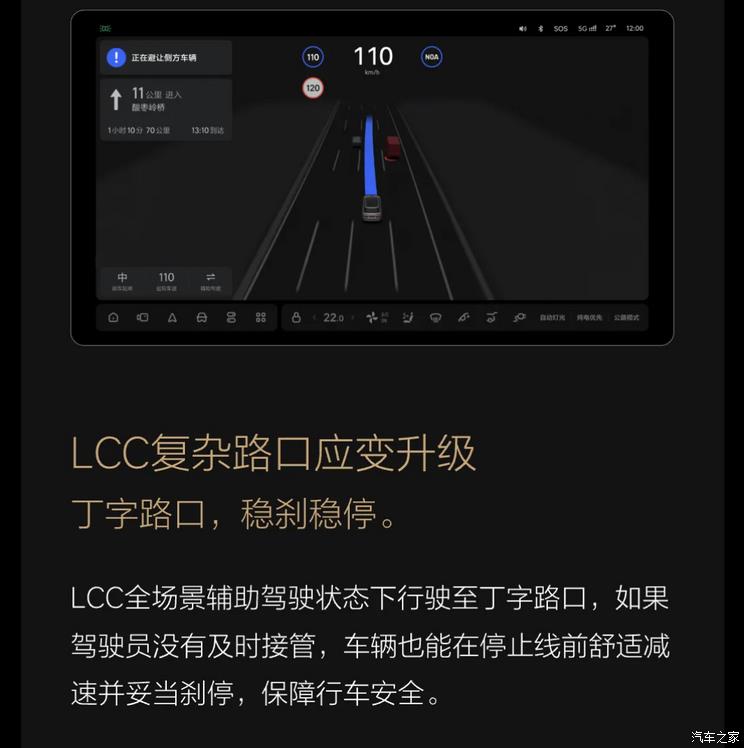

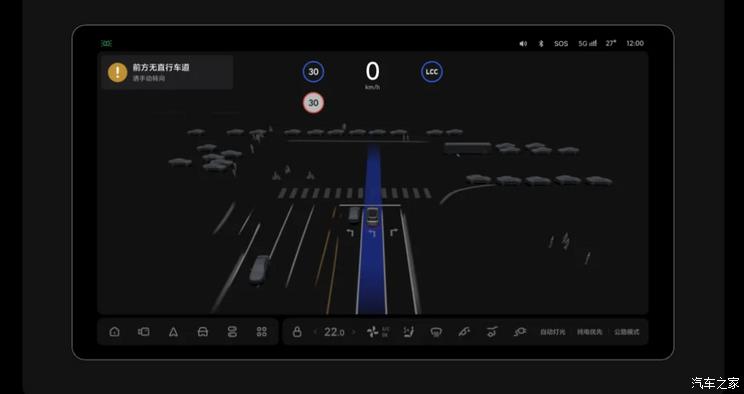

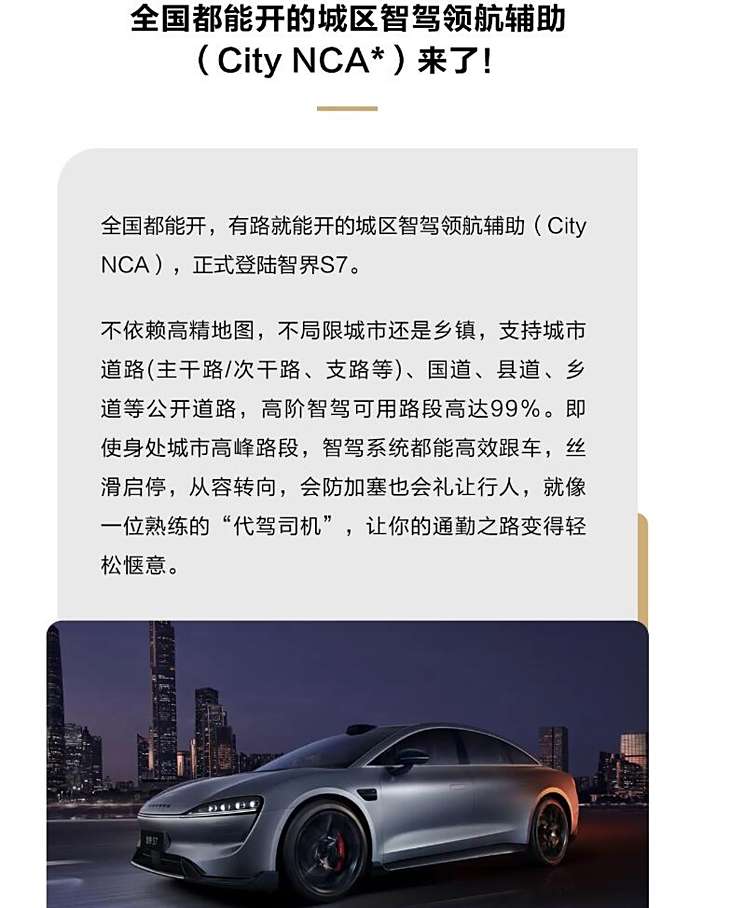

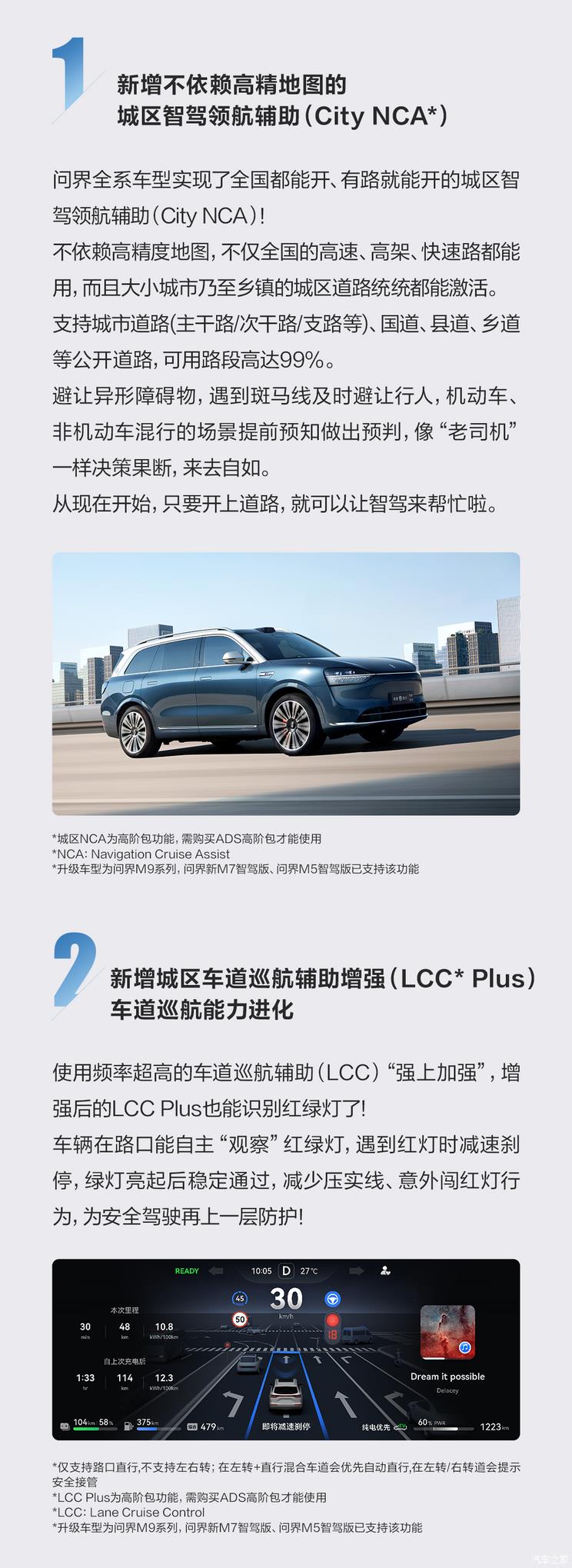

The official upgrade instructions show that a major concern of this OTA upgrade is to push the urban intelligent driving pilot assistance (urban NCA). Urban NCA can assist drivers to control vehicles to drive to their destinations independently according to navigation routes, and has the abilities of autonomous lane change, autonomous left-right turn, watching traffic lights crossing intersections, meeting zebra crossings to yield to pedestrians, avoiding obstacles of the opposite sex, and predicting and judging mixed traffic scenes in advance. Without relying on high-precision maps, NCA in urban areas supports the national high-speed, elevated and expressway; Support urban roads in large and small cities and towns; Support all urban roads (trunk roads/sub-trunk roads/branch roads, etc.), national roads, county roads, township roads and other open roads. The available sections are as high as 99%, which can be opened all over the country. The more beautiful it is, the more roads it can be opened.

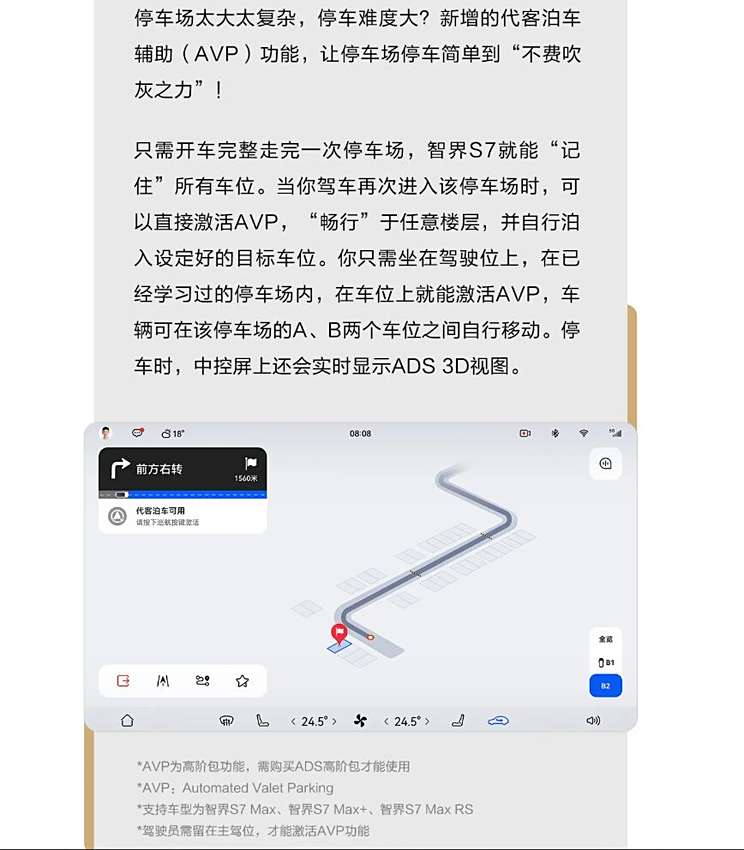

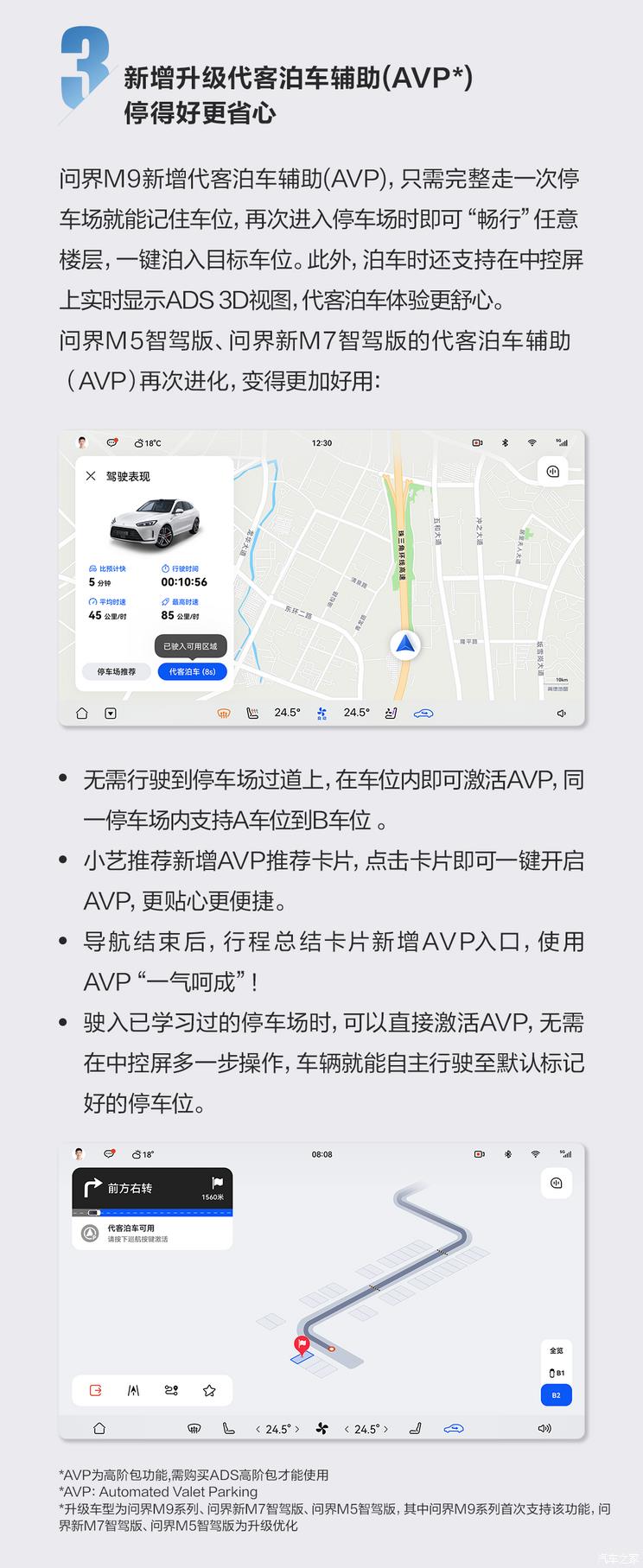

Another major concern of this upgrade is to push the parking service Assist (AVP) function. Whether it is a single-storey parking lot or a multi-storey parking building, you only need to drive a car to complete the parking lot study first. When you park in the target parking lot again, you can activate parking service assistance and cruise to the target parking lot for storage. However, the use of this function needs to meet the following requirements: ADS high-level function package has been opened; ; Upgraded to version V4.1.2.5; Parking service Auxiliary Examination has been completed on HarmonyOS Zhixing App; Before entering the garage, Huawei Smart Drive App needs to have an open and full-screen interface.

● BYD

OTA involves models:Byd song PLUS DM-i

OTA content:A number of functions have been added, such as input method and voice function. At the same time, many functions are optimized, including remote control, sound and other details.

OTA push time:March 22nd

BYD pushes OTA update of version 1.2 for Song Plus DM-I.. This update has added many functions, such as input method and voice function. At the same time, many functions are optimized, including remote control, sound and other details.

● New functions:

1. Add the setting item of the validity period of the system location service, which can be set in Privacy Management;

2. Add iFLYTEK input method (some models have been equipped);

3. Add voice reminder that the front hatch cover is not closed;

4. A continuous dialogue function is added. After the voice wakes up once, you can listen continuously for 20s (some models have been equipped).

5. Add mobile phone to forget voice broadcast, which can remind you when charging wirelessly (only for some models).

● Function optimization:

1. Third-party applications are optimized and updated to enhance the user experience;

2. Optimize the volume of the prompt sound;

3. Optimize the sound effect of the engine sound simulator to improve the user experience (some models have been equipped);

4. Optimize the instrument prompt function to improve the user’s driving experience;

5. Optimize Bluetooth to remotely turn on the air conditioner to shorten the response time;

6. Optimize the sound strategy to improve the listening experience (only for some models);

7. Optimize the switching logic of daytime running lights;

8. Improve the driving experience.

● BYD

OTA involves models:Song l

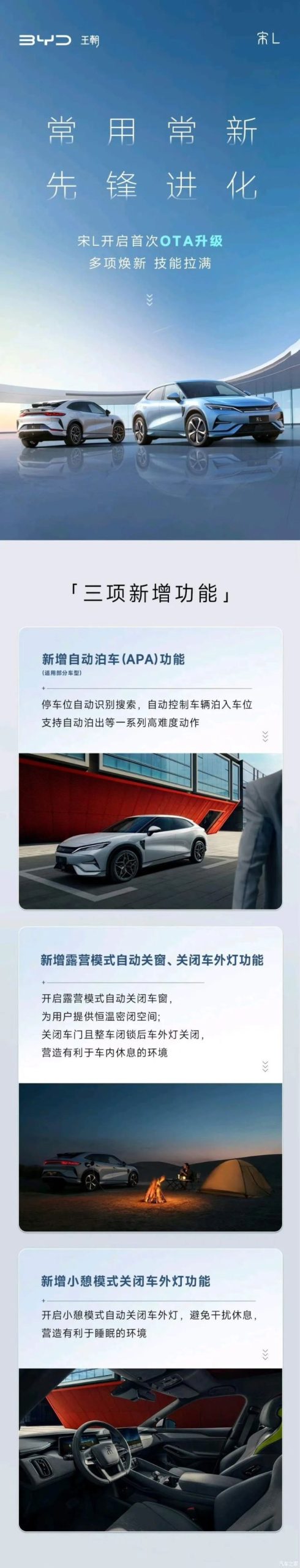

OTA content:Add three new functions: automatic parking (APA), automatic window closing/turning off exterior lights in camping mode and turning off exterior lights in nap mode.

OTA push time:March 20

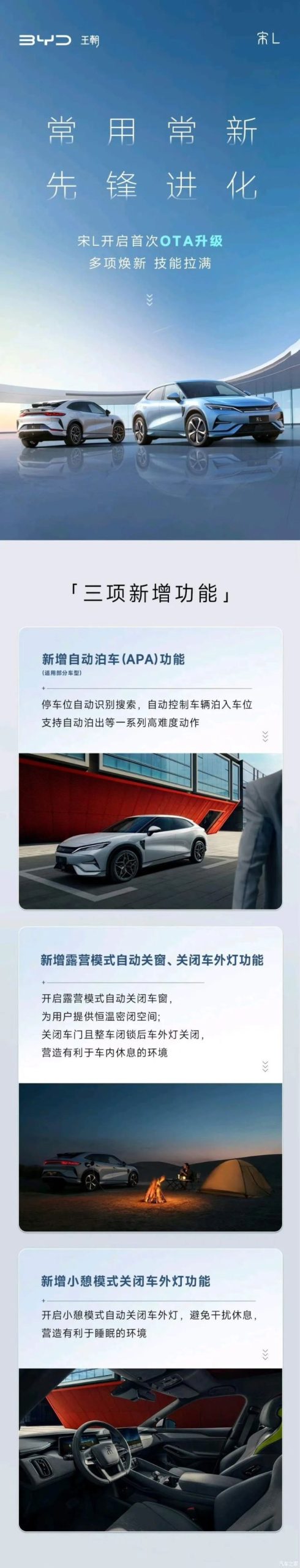

BYD Song L officially launched the first OTA upgrade, adding three new functions: automatic parking (APA), automatic window closing/off of exterior lights in camping mode, and off of exterior lights in nap mode. In addition, a number of functions were optimized. This OTA will be pushed nationwide in batches from now on (March 20th).

This new automatic parking function supports automatic parking space identification and search, automatic control of vehicle parking and automatic parking. Add the function of automatically closing windows and turning off lights in camping mode. When camping mode is started, the windows and doors can be automatically closed, and the exterior lights will be turned off after the whole vehicle is locked, creating an environment conducive to rest in the car. Turning on the nap mode will also automatically turn off the exterior lights.

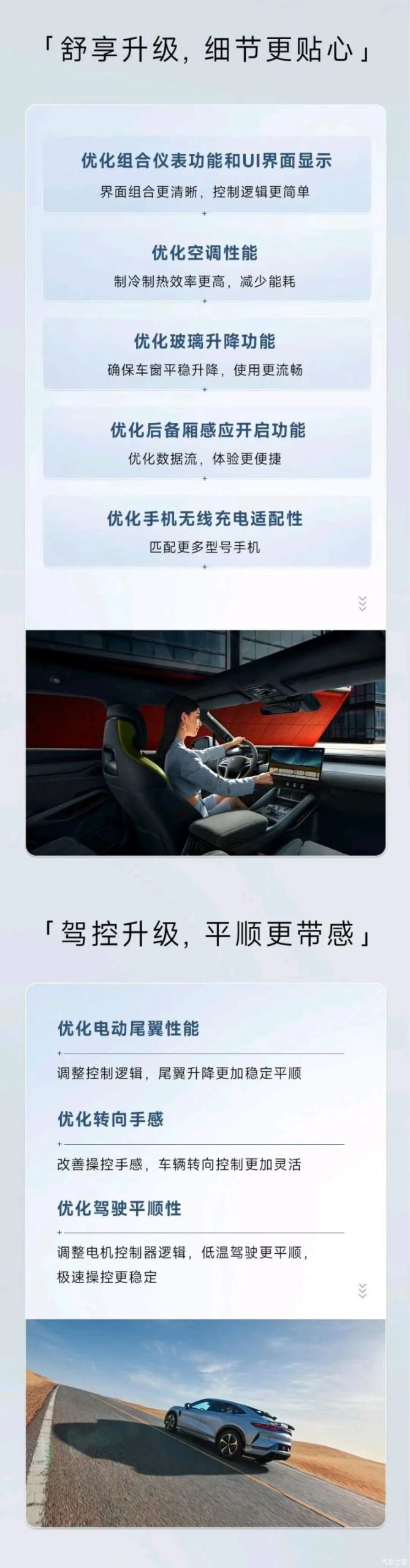

In addition to three new functions, this OTA has also been optimized and upgraded for a number of functions. There are five optimizations in the interior: 1. Optimize the function of instrument cluster and UI interface display. 2. Optimize the air conditioning performance, make the refrigeration and heating efficiency higher, and reduce energy consumption. 3. Optimize the glass lifting function. 4. Optimize the trunk induction opening function. 5. Optimize the wireless charging adaptability of mobile phones to match more models of mobile phones. There are three optimizations in driving: 1. Optimize the control logic of electric spoiler to make the lifting more stable and smooth. 2. Optimize the steering feel and make the vehicle steering control more flexible. 3. Optimize the ride comfort and adjust the logic of the motor controller, so that the low-temperature driving is smoother and the high-speed control is more stable.

This OTA has carried out three optimization upgrades for intelligent configuration: 1. Optimize the adaptive cruise function, monitor the surrounding road conditions in real time, intelligently control the driving of vehicles, and improve the driving safety. 2. Optimize the intelligent navigation function, actively follow the acceleration and deceleration of the preceding vehicle, and liberate the driver’s feet. 3. Optimize the lane change function of the shift lever, and automatically control the vehicle lane change by simply shifting the steering lever. In terms of security, two upgrades are ushered in: 1. Optimize the front radar function, with higher positioning accuracy and faster transmission speed. 2. Optimize the front-angle radar and blind spot monitoring function, enhance the signal stability and improve the comprehensive early warning function. Real-time display without dead spots can effectively eliminate the blind spots in the field of vision and reduce the collision risk.

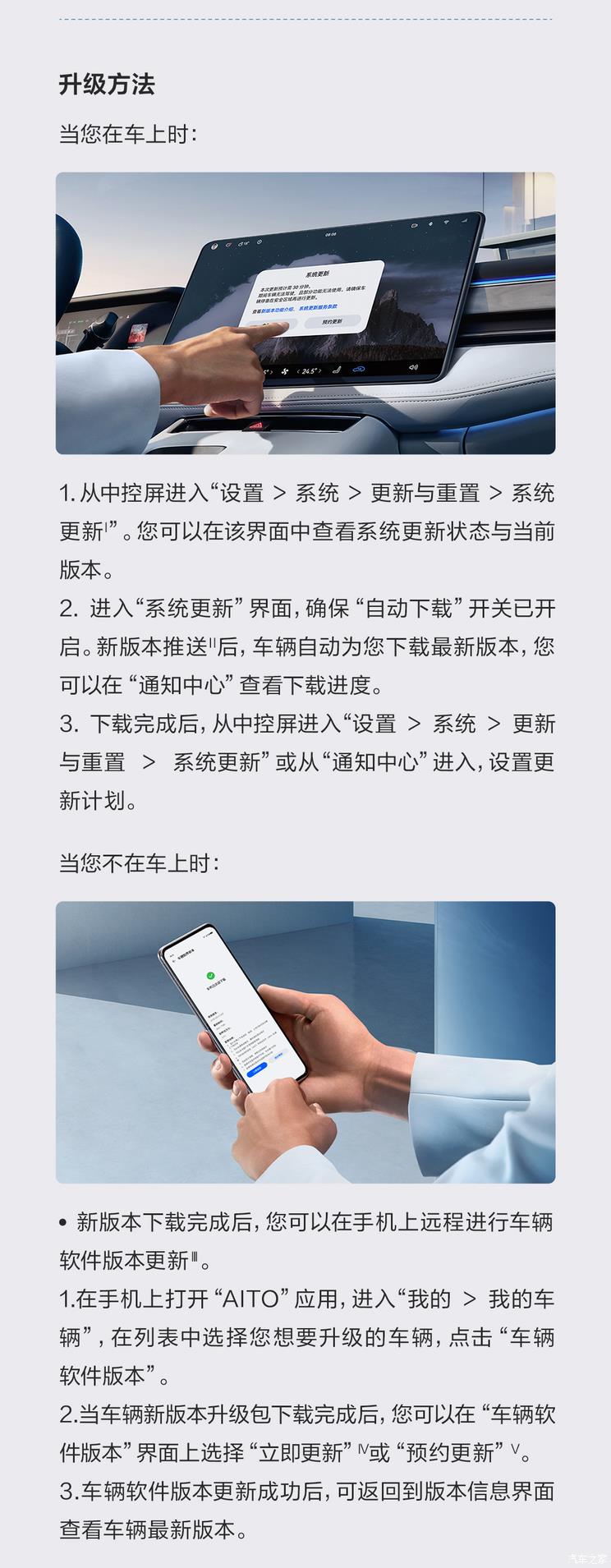

● AITO asks the boundary

OTA involves models:AITO Wen Jie quan che

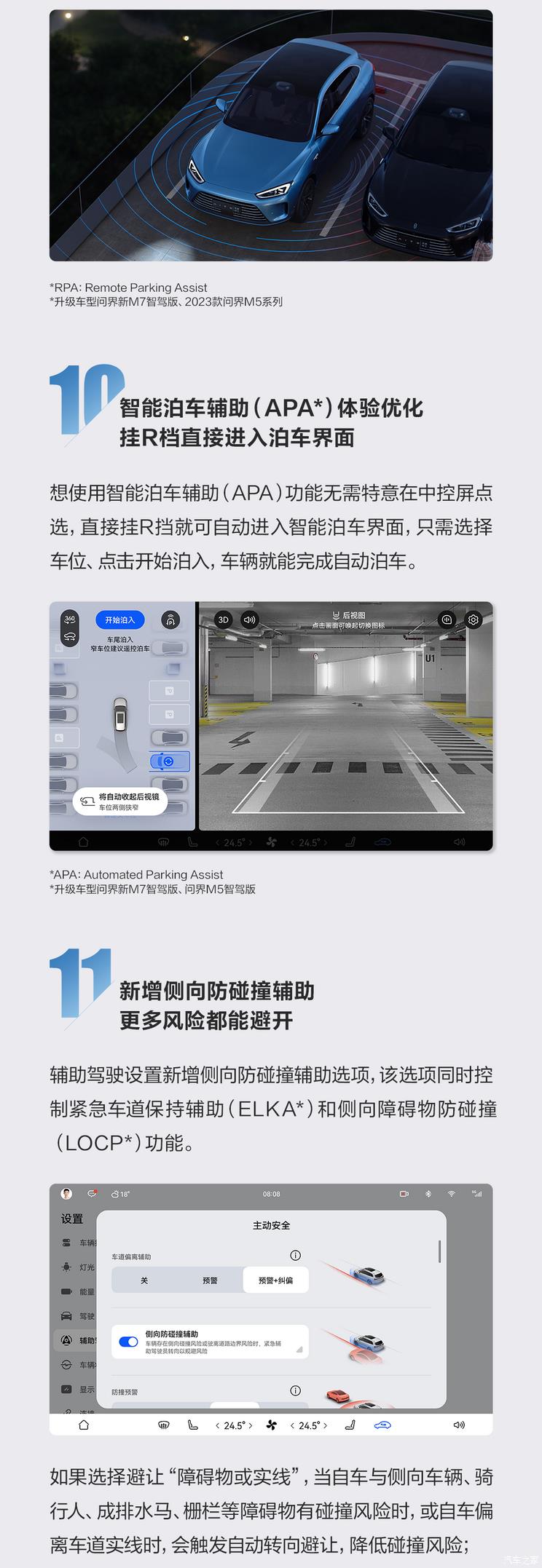

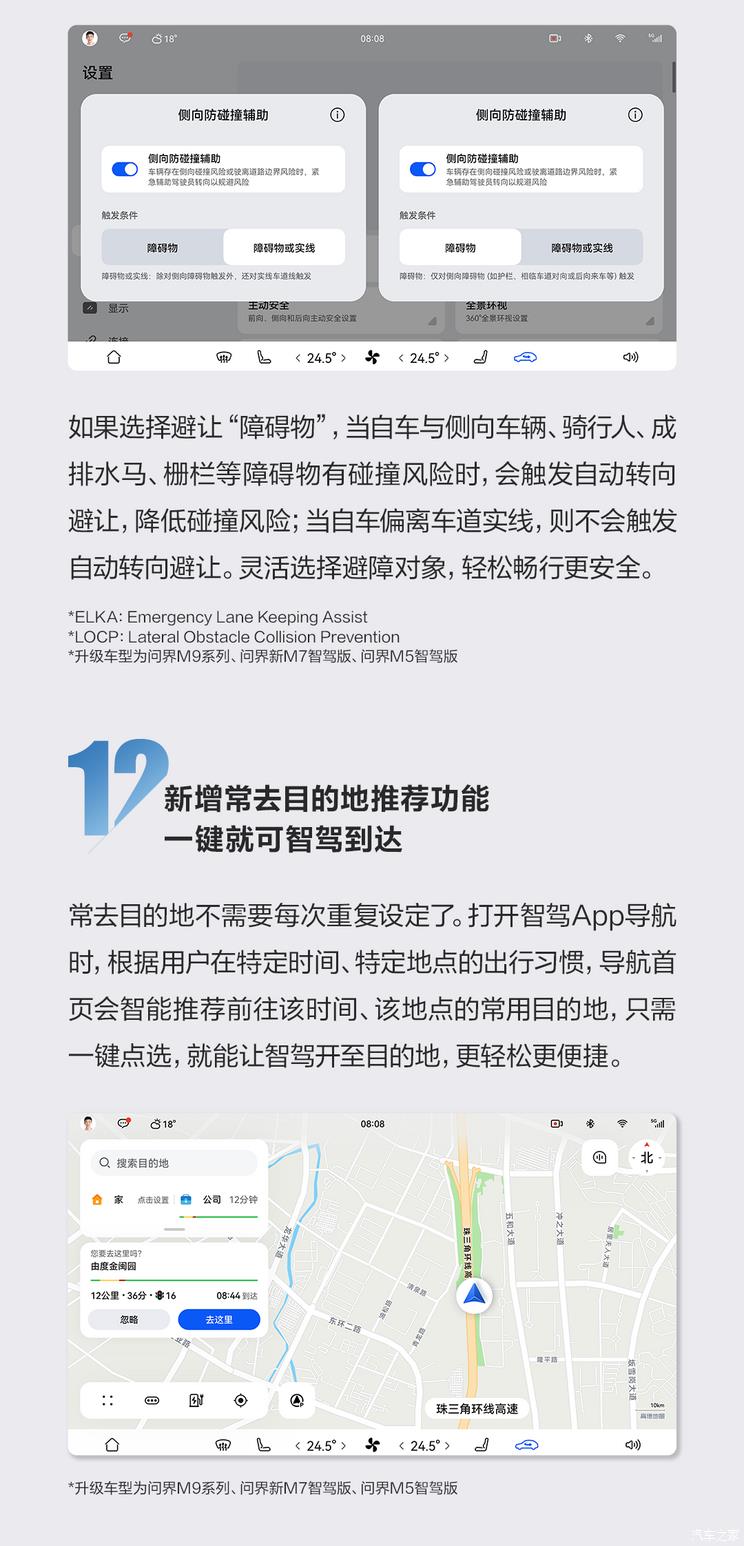

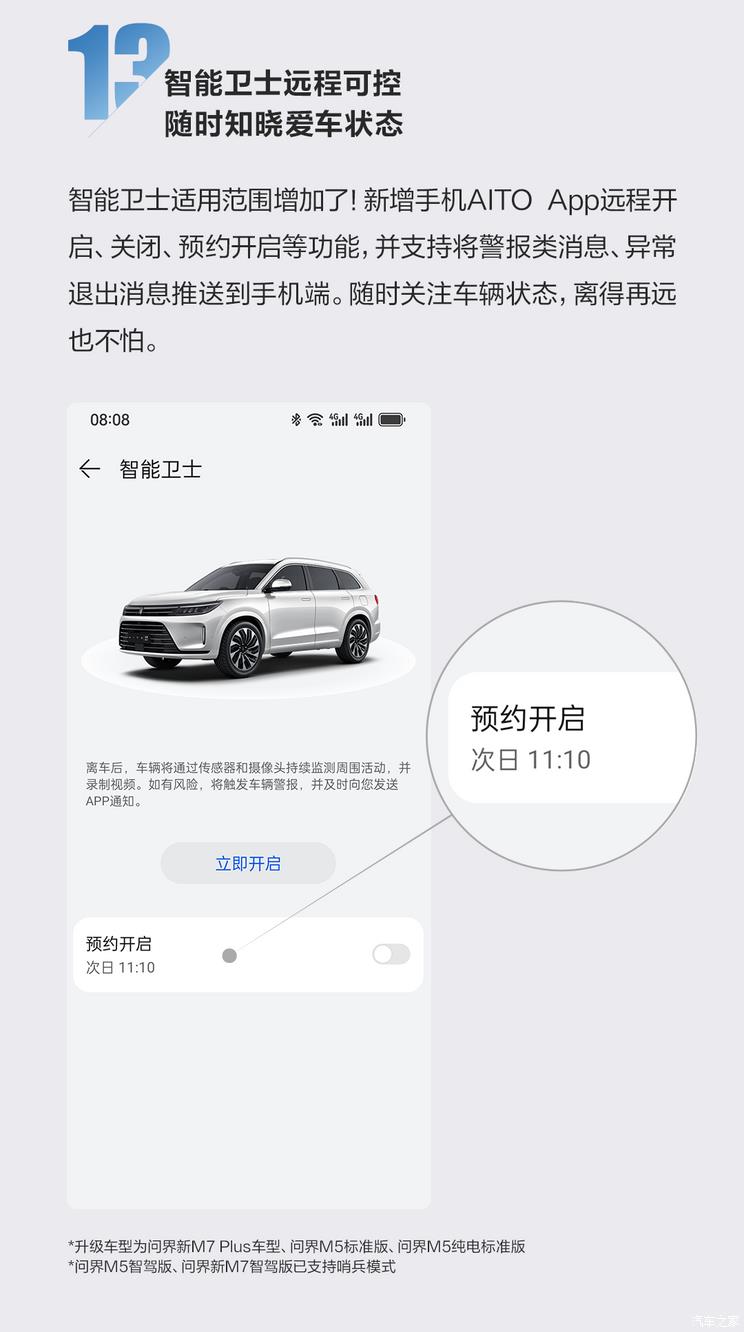

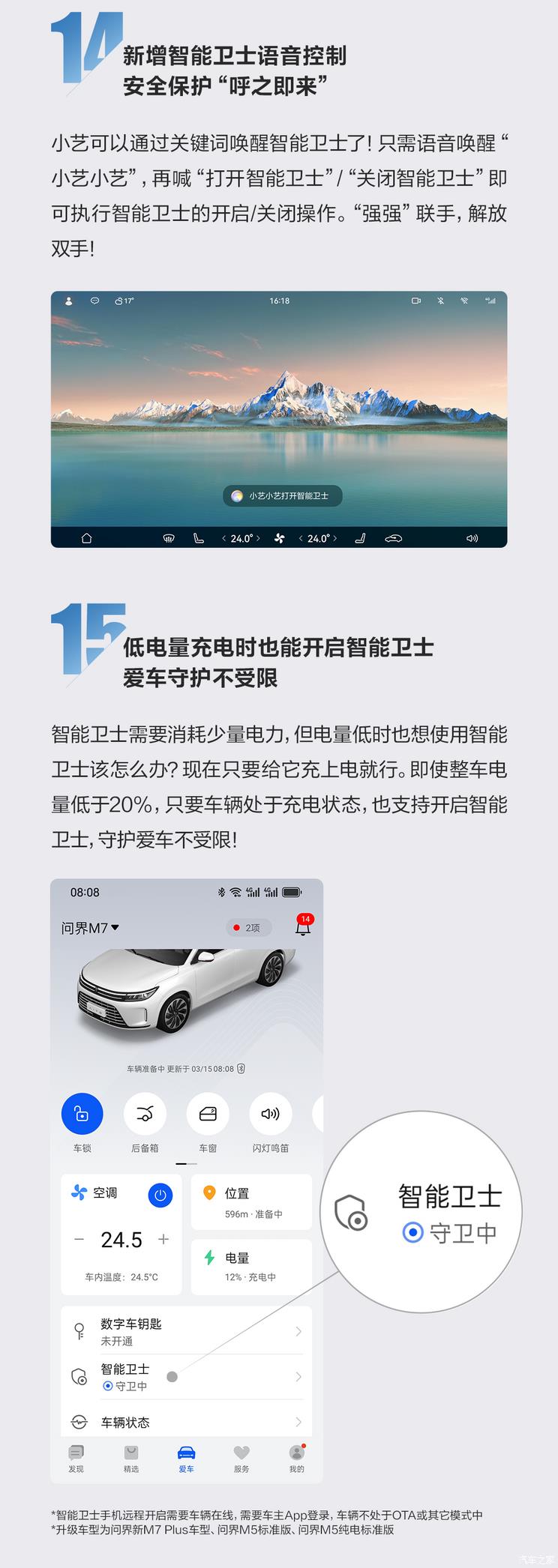

OTA content:Six function upgrades, including urban intelligent driving navigation assistance (NCA), urban lane cruise assistance enhancement (LCC Plus) and parking service assistance (AVP), and over 15 experience optimizations.

OTA push time:March 19th

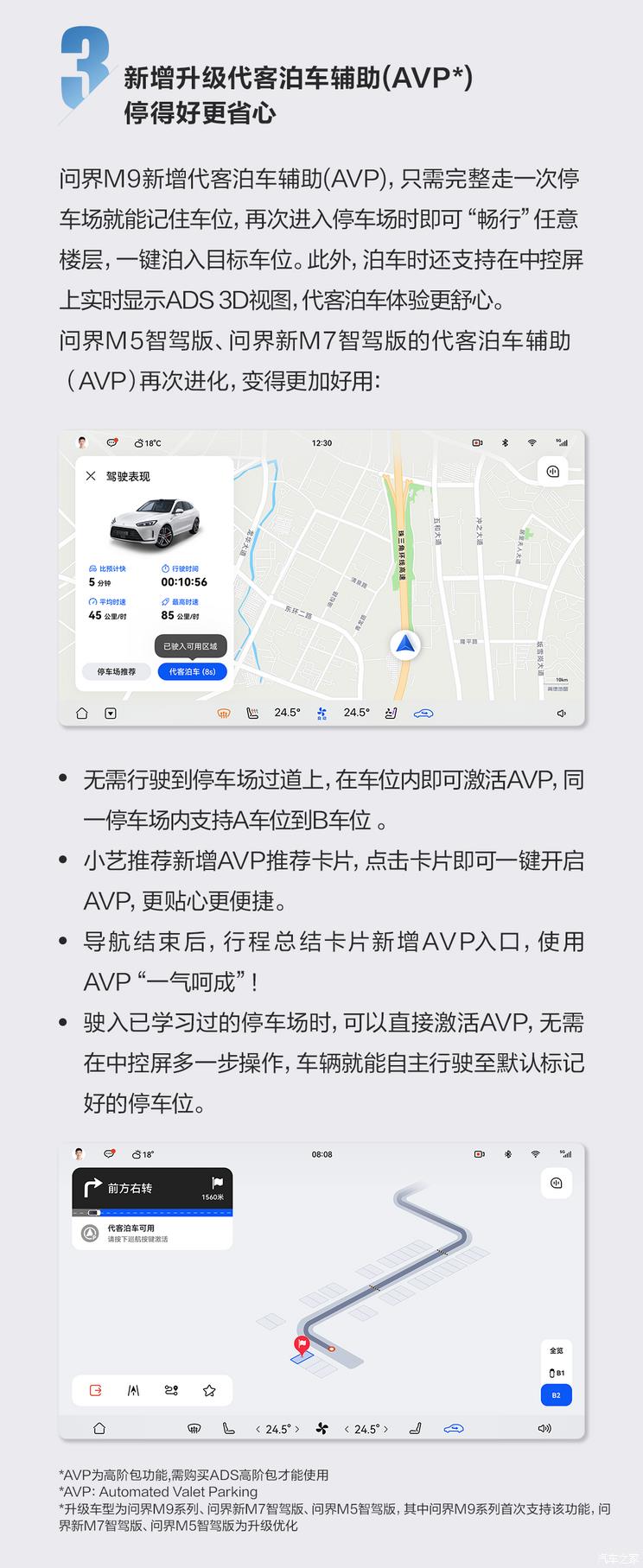

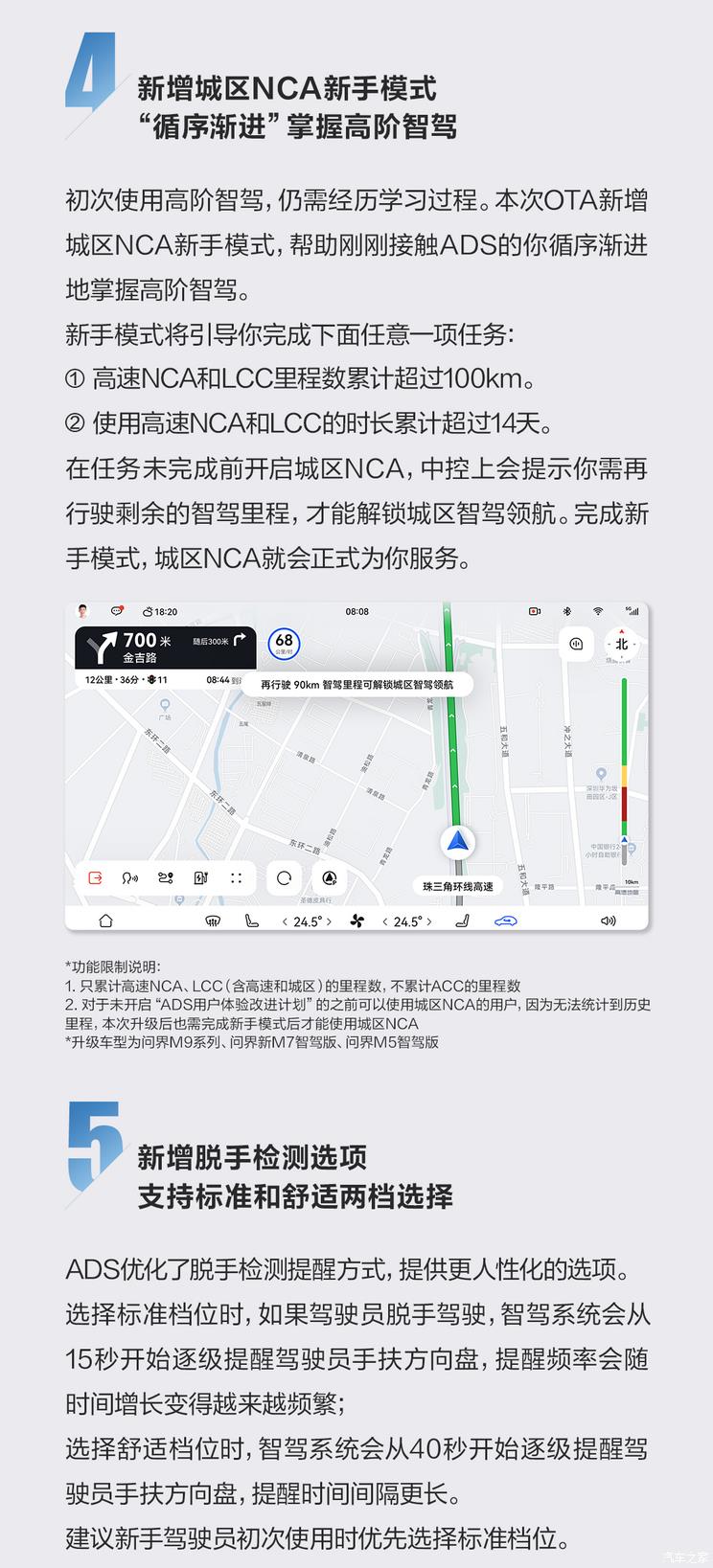

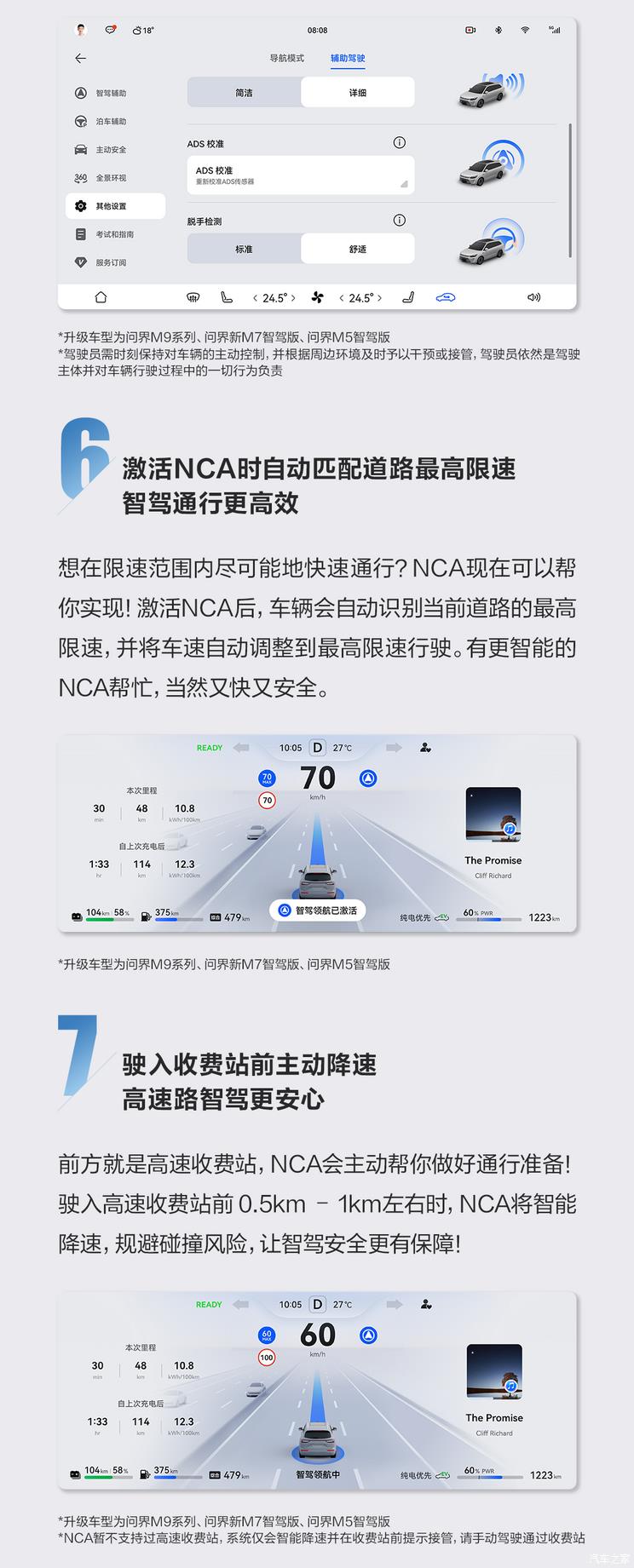

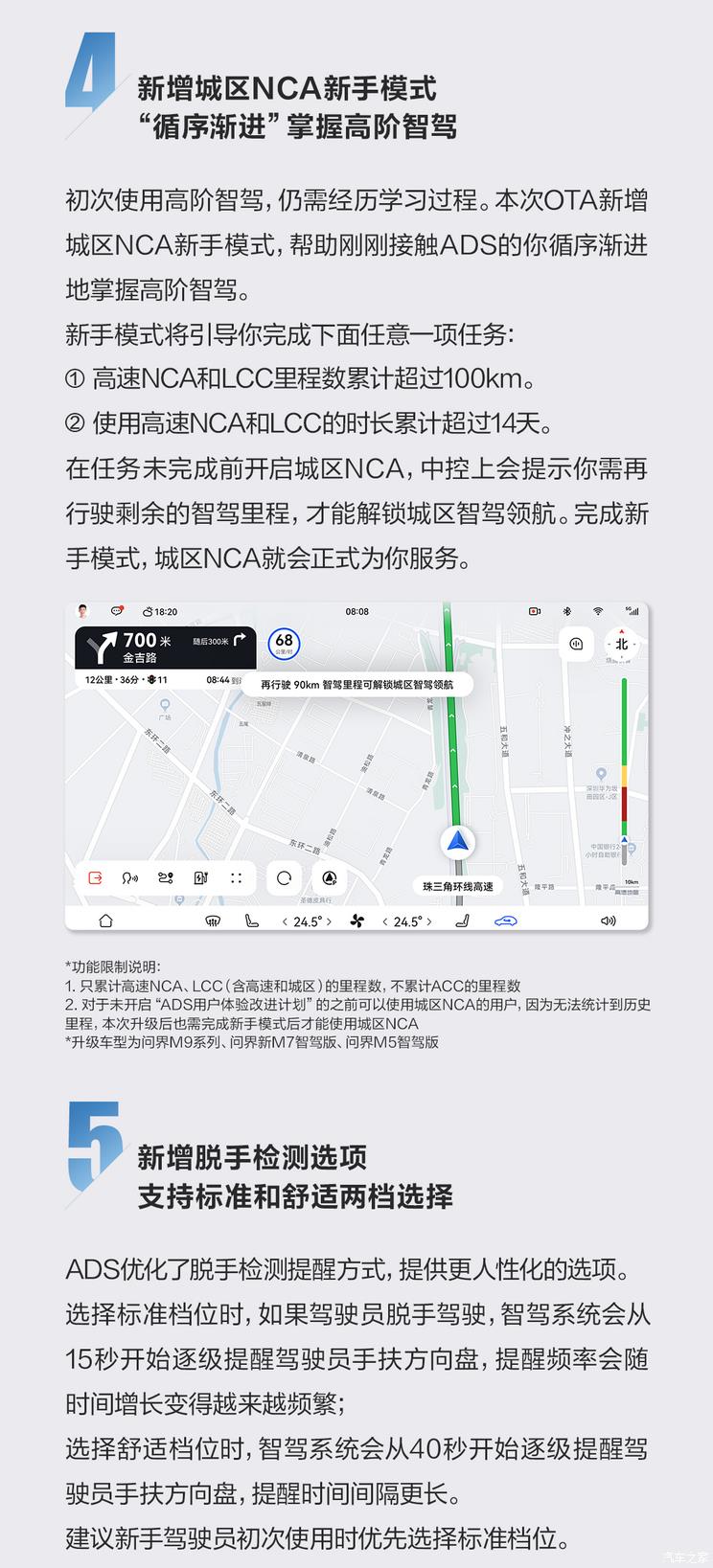

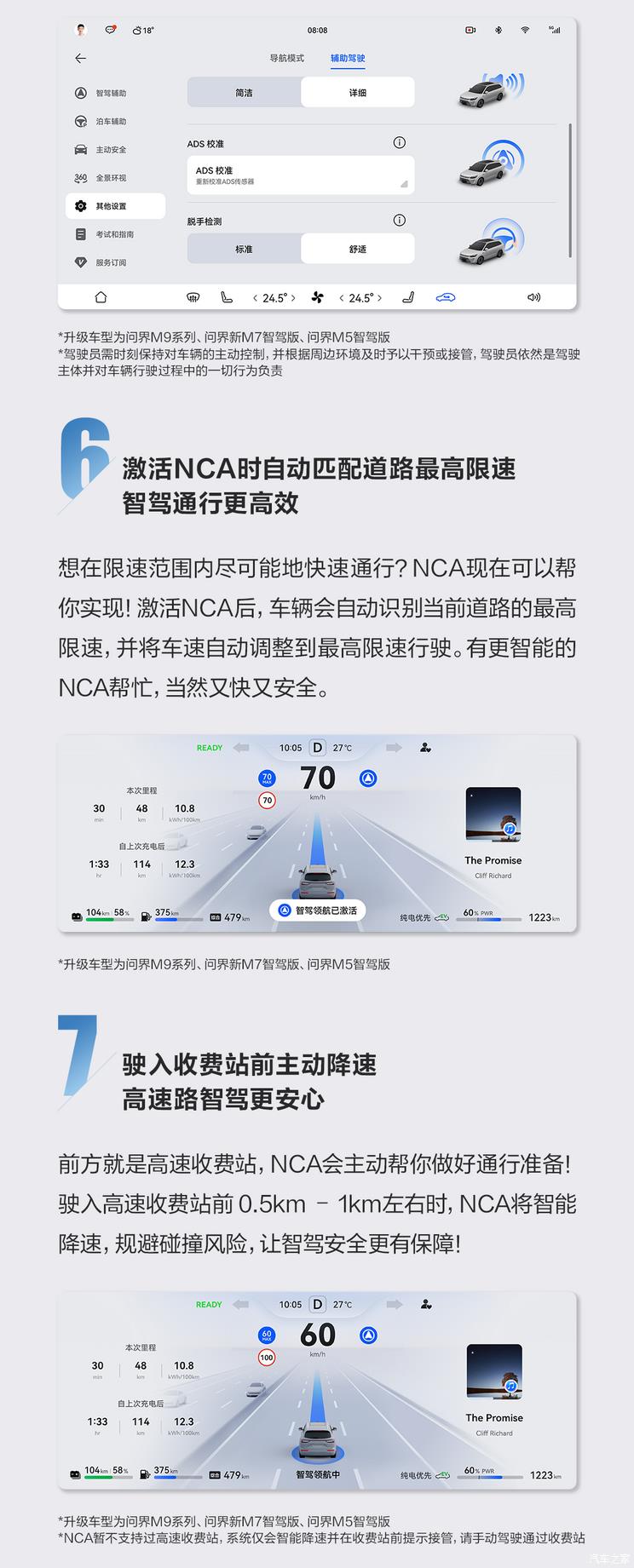

AITO asked all models in the world to welcome OTA upgrade. The OTA includes six function upgrades and over 15 experience optimizations, including urban intelligent navigation assistance (NCA), urban lane cruise assistance enhancement (LCC Plus) and parking service assistance (AVP). The details are as follows:

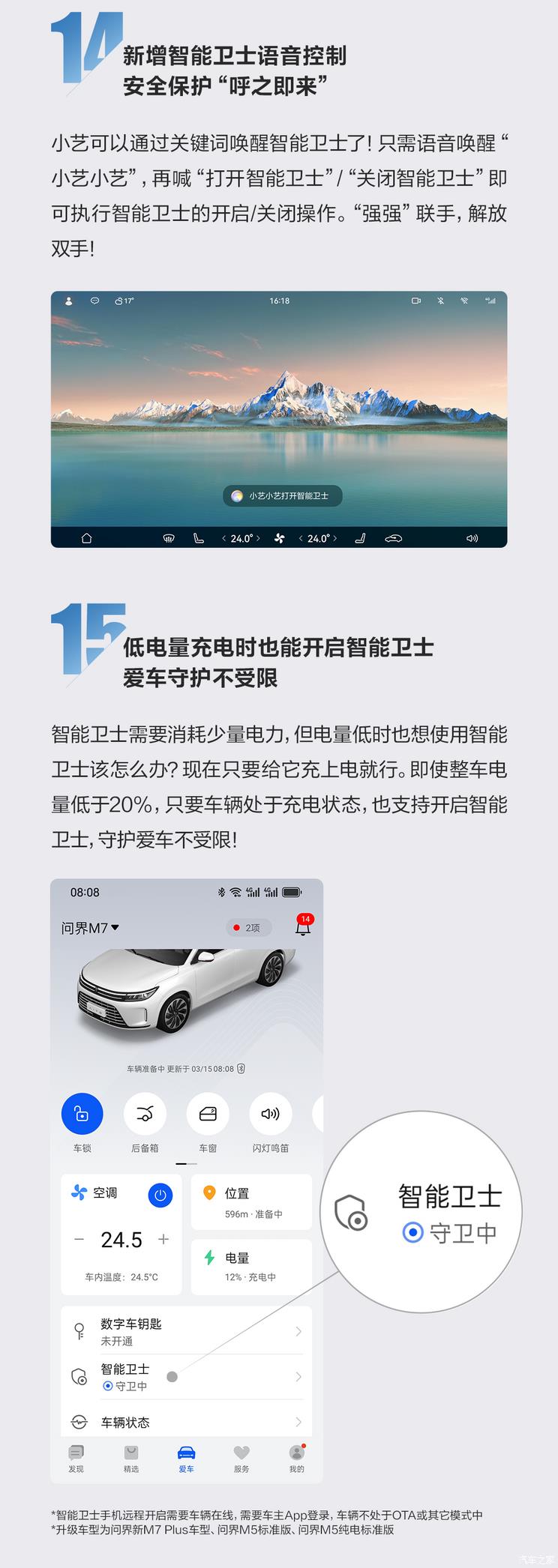

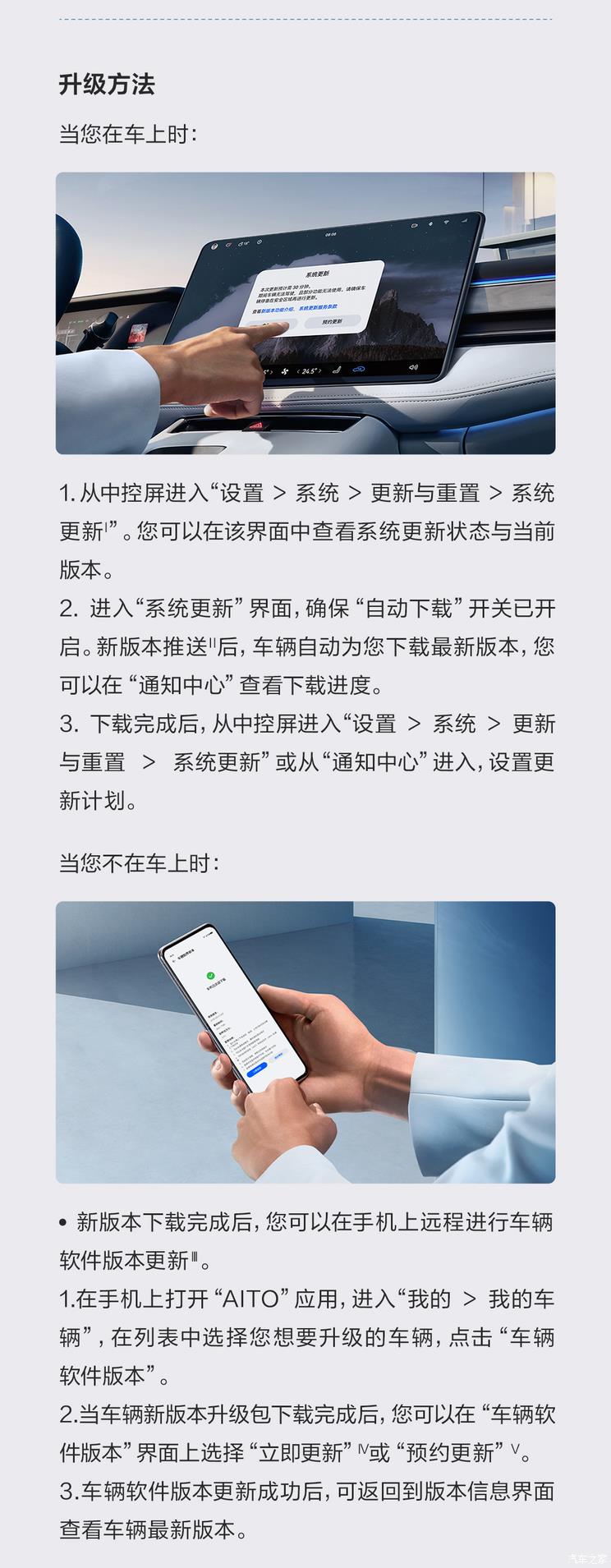

Note: When upgrading, please park the vehicle on a gentle (not uphill/downhill) road, turn off all entertainment audio-visual applications in the vehicle, and ensure that the vehicle network signal is good and the power is higher than 15%. During the upgrade process, it is normal that the vehicle may turn off the screen, the running lights are on, and the instrument panel fault lights are briefly prompted. Please do not intervene or train. You can lock the car and leave normally, and the car will automatically be powered off after the upgrade. After the upgrade is completed, if the dashboard prompts that the cruising range or tire pressure is abnormal, it will not affect the normal driving of the vehicle, and it can be restored after driving for a period of time.

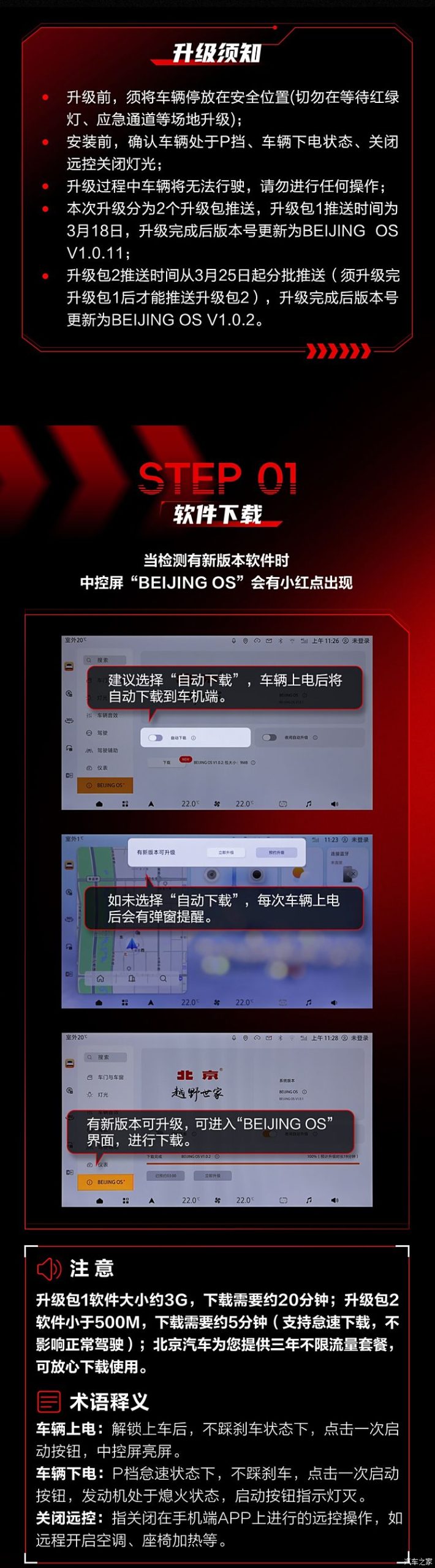

● Beijing Cross Country

OTA involves models:New Beijing BJ40

OTA content:1. The stability of vehicle-machine network connection is improved. 2. The accuracy of voice control response is improved. 3. The effect of intelligent lighting control is improved. 4. High and low four-wheel drive switching experience optimization. 5. Improved stability of intelligent driving.

OTA push time:March 20

The new Beijing BJ40 officially launched the second OTA upgrade. This OTA has been upgraded and optimized in five aspects: 1. The stability of vehicle-vehicle network connection has been improved. 2. The accuracy of voice control response is improved. 3. The effect of intelligent lighting control is improved. 4. High and low four-wheel drive switching experience optimization. 5. The stability of intelligent driving is improved.

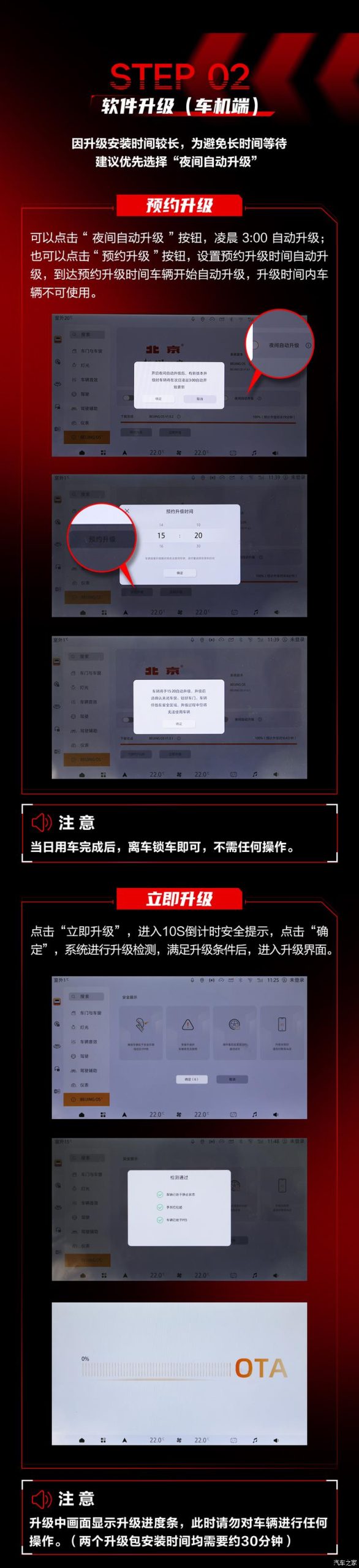

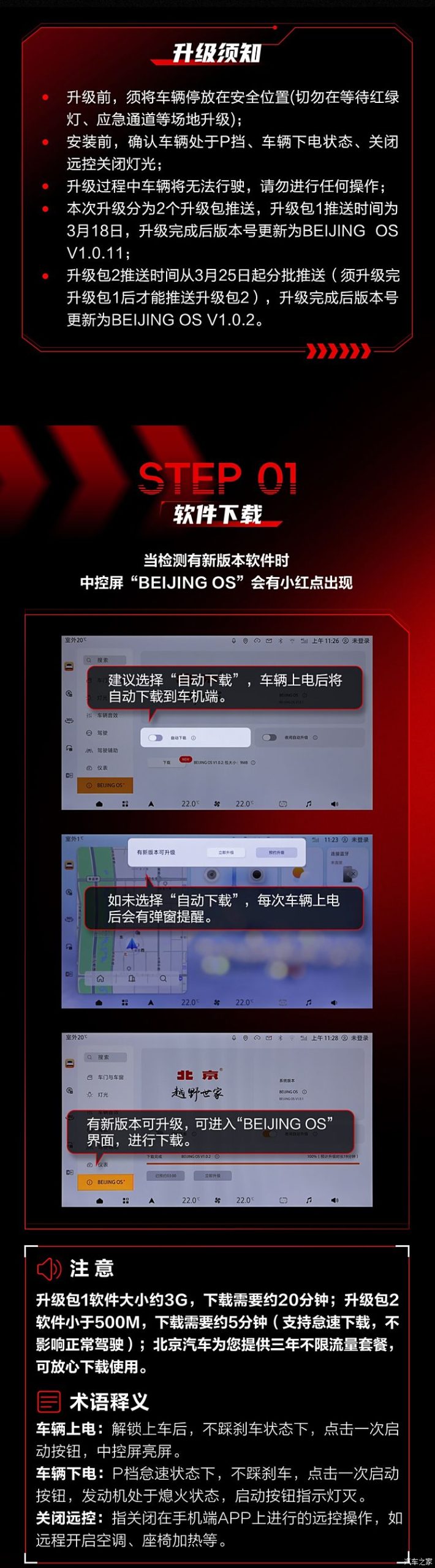

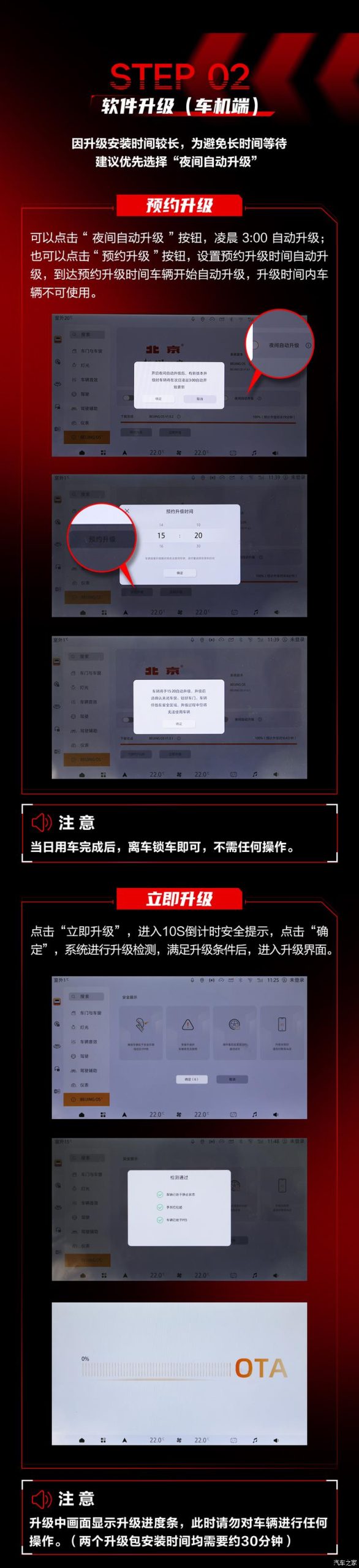

It should be noted that this upgrade is divided into two upgrade packages. The upgrade package 1 was pushed on March 18th, and the version number was updated to BEIJING OSV1.0.11 after the upgrade. The upgrade package 2 will be pushed in batches from March 25th (upgrade package 1 must be completed before the upgrade package 2 can be pushed), and the version number will be updated to BEIJING OS V1.0.2 after the upgrade. Before upgrading, the vehicle must be parked in a safe place (do not wait for traffic lights, emergency exits and other venues to upgrade). Before installation, make sure that the vehicle is in P gear, the vehicle is powered off, and the remote control and lights are turned off. During the upgrade, the vehicle will not be able to drive, so please do nothing. The specific upgrade steps are shown in the figure below.

This OTA has two options: automatic upgrade at night and immediate upgrade. Due to the long time of upgrade and installation, in order to avoid waiting for a long time, the official suggests giving priority to automatic upgrade at night. In addition, when the ambient temperature is lower than MINUS 15 degrees, the vehicle cannot pass the OTA upgrade test, and can wait until the ambient temperature is met before upgrading, or go to the Beijing Automotive 4S shop or authorized service station for offline updating.

● Xpeng Motors

OTA involves models:Tucki G6, G9 and P7i models.

OTA content:It involves intelligent assisted driving, intelligent parking, air conditioning and so on.

OTA push time:March 19th

Xpeng Motors announced the launch of OTA 4.6.0. This upgrade is aimed at Tucki G6, G9 and P7i, which involves intelligent assisted driving, intelligent parking and air conditioning.

For intelligent assisted driving, the official said that it has improved the intersection capacity by 72%, the vehicle flow avoidance capacity by 43%, the lane centering stability by 21%, and the lateral deviation avoidance range is perfect. In the intelligent parking part, aiming at irregular parking spaces such as potholes and slopes, the ability of vehicles to enter and leave the parking spaces is optimized, and the intelligent parking function realizes more parking scene coverage. In other aspects, the car-following distance is optimized at high speed and urban expressway, and the in-vehicle air purification system will automatically adjust the purification strategy according to the internal and external circulation state, and the tire pressure display and charging experience will be upgraded.

On March 16th, He Xiaopeng, Chairman of Xpeng Motors, disclosed for the first time at the committee of 100 High-level Forum on Electric Vehicles in China that Xpeng Motors is about to release a brand-new brand and formally enter the global automobile market of 100,000-150,000. The goal of the new brand is to subvert technological innovation in this market price band and create a new species of AI intelligence. The official released a new brand of new car preview, which will be positioned as a pure electric car. It is reported that the new brand will be named "MONA". In addition, in the second quarter of this year, the Tucki AI Intelligent Driving Model will officially "get on the bus".

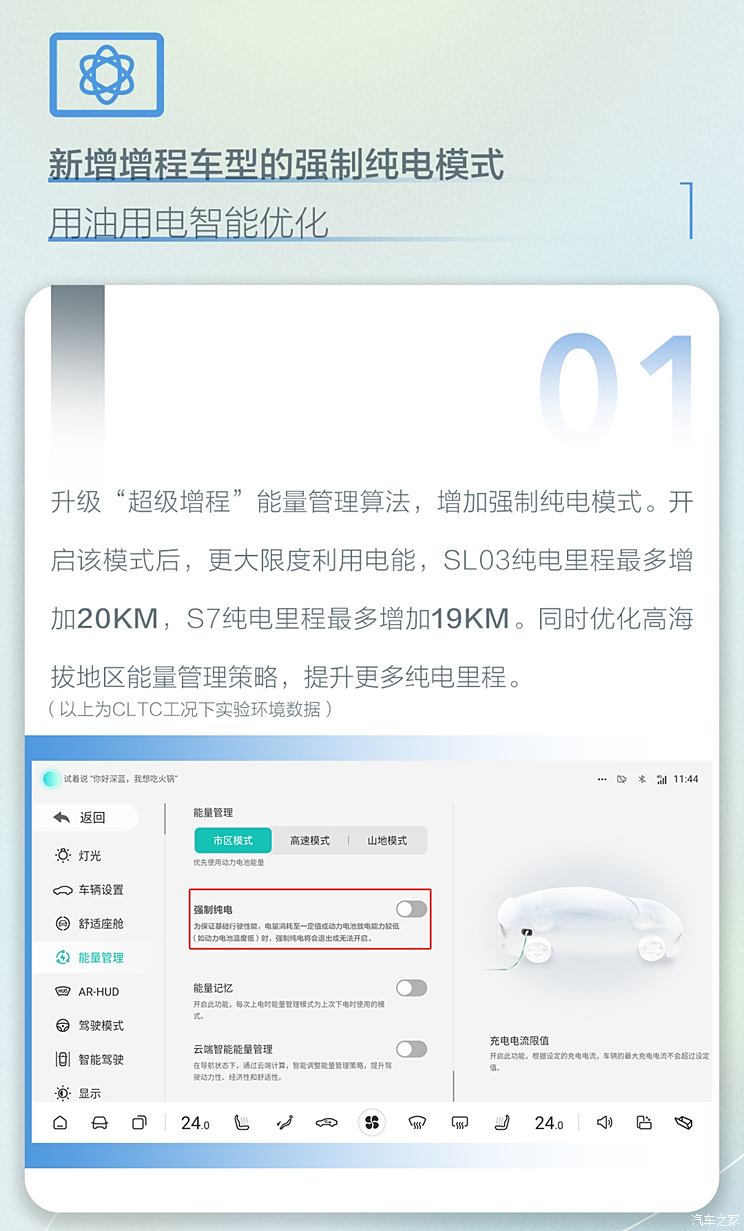

● Deep blue car

OTA involves models:Deep blue SL03/S7

OTA content:Add 7 practical functions and 9 experience upgrades.

OTA push time:March 18

On March 18th, we learned from WeChat official account, the official WeChat of Deep Blue Auto, that it launched the OTA upgrade of DEEPAL 0S 2.1 for its Deep Blue SL03 and Deep Blue S7, adding 7 practical functions and 9 experience upgrades, as follows:

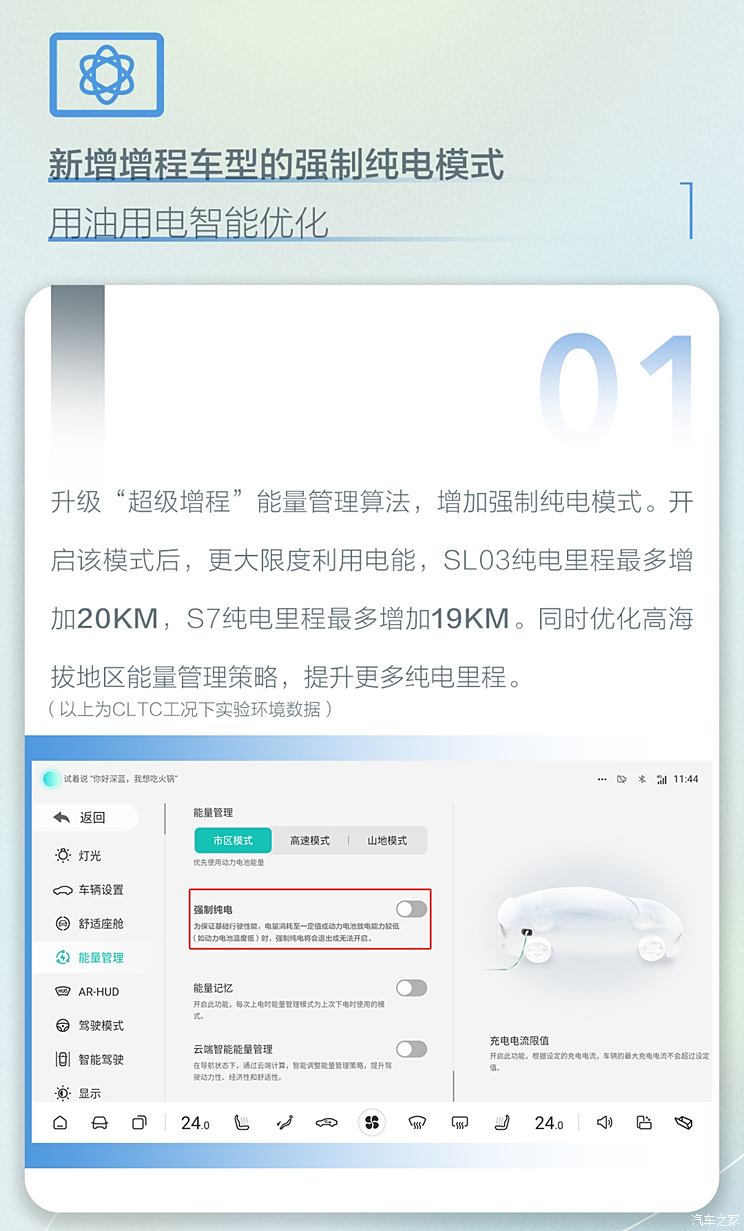

Compulsory pure electric mode of newly added extended-range vehicles: When this mode is turned on, the electric energy will be utilized to a greater extent, and the pure electric mileage of Deep Blue SL03 will increase by 20km at most, and that of Deep Blue S7 will increase by 19km at most. At the same time, optimize the energy management strategy in high altitude areas and increase more pure electric mileage.

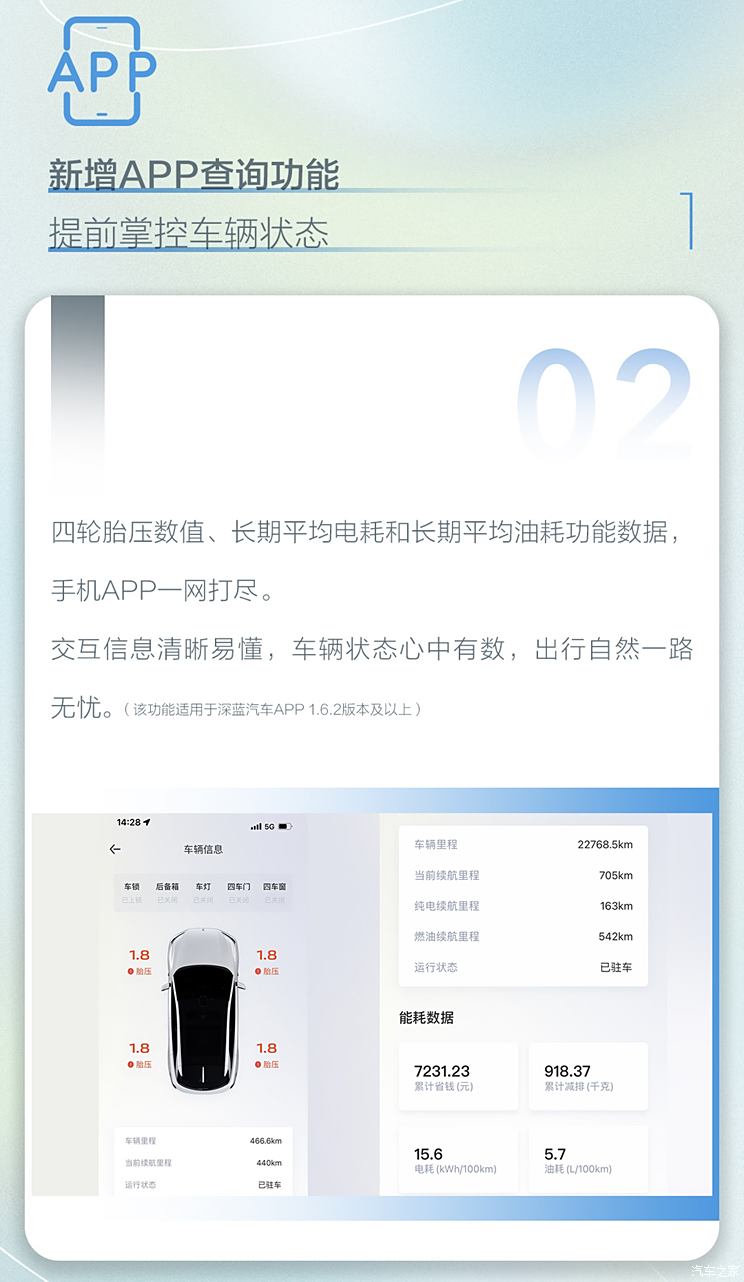

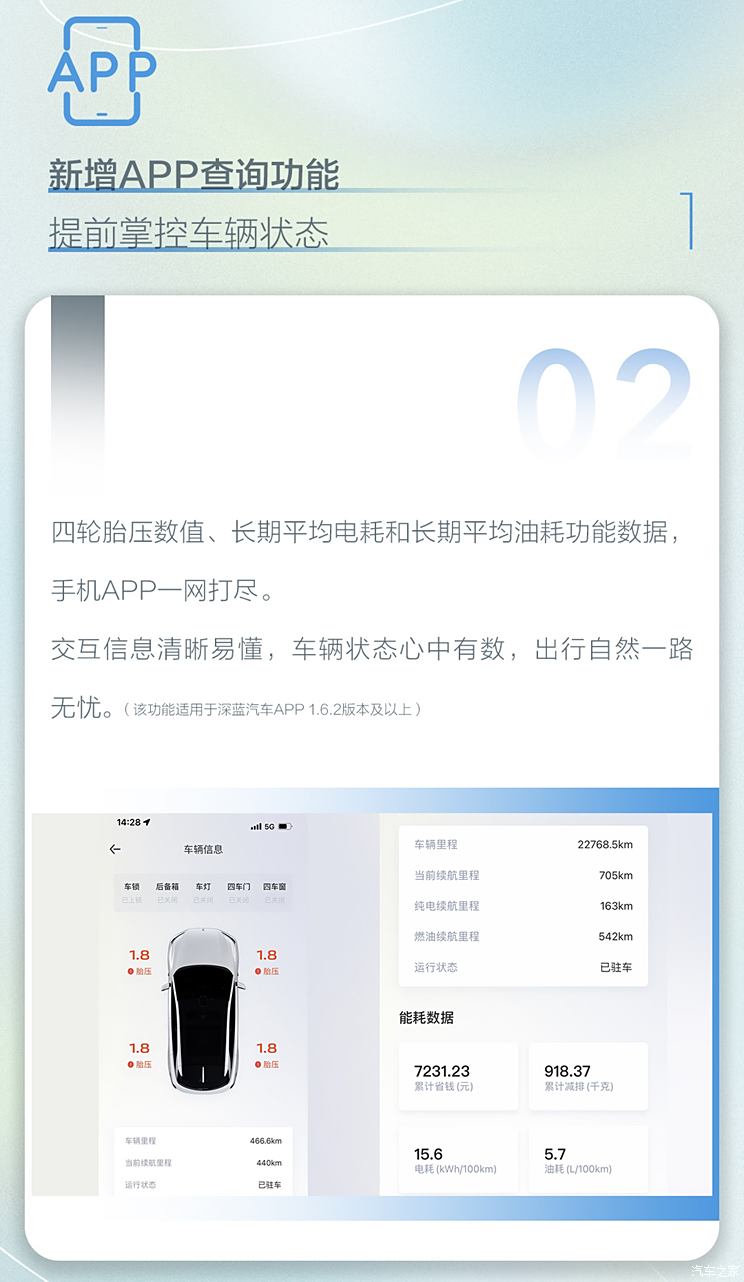

Add App query functionFour tire pressure values, long-term average power consumption and long-term average fuel consumption function data can be seen more clearly in the mobile App.Add IOS App car lock interface car control widget.: You can easily add common functions according to your preferences, and feel the smart car life brought by widgets.

New application ecology of vehicle end: The application ecology such as "smart children’s seat" and "cool coffee game" is launched on the car end, which brings more driving fun. You can set your favorite photos, selfies, beautiful scenery, family photos, etc. as desktop wallpaper.

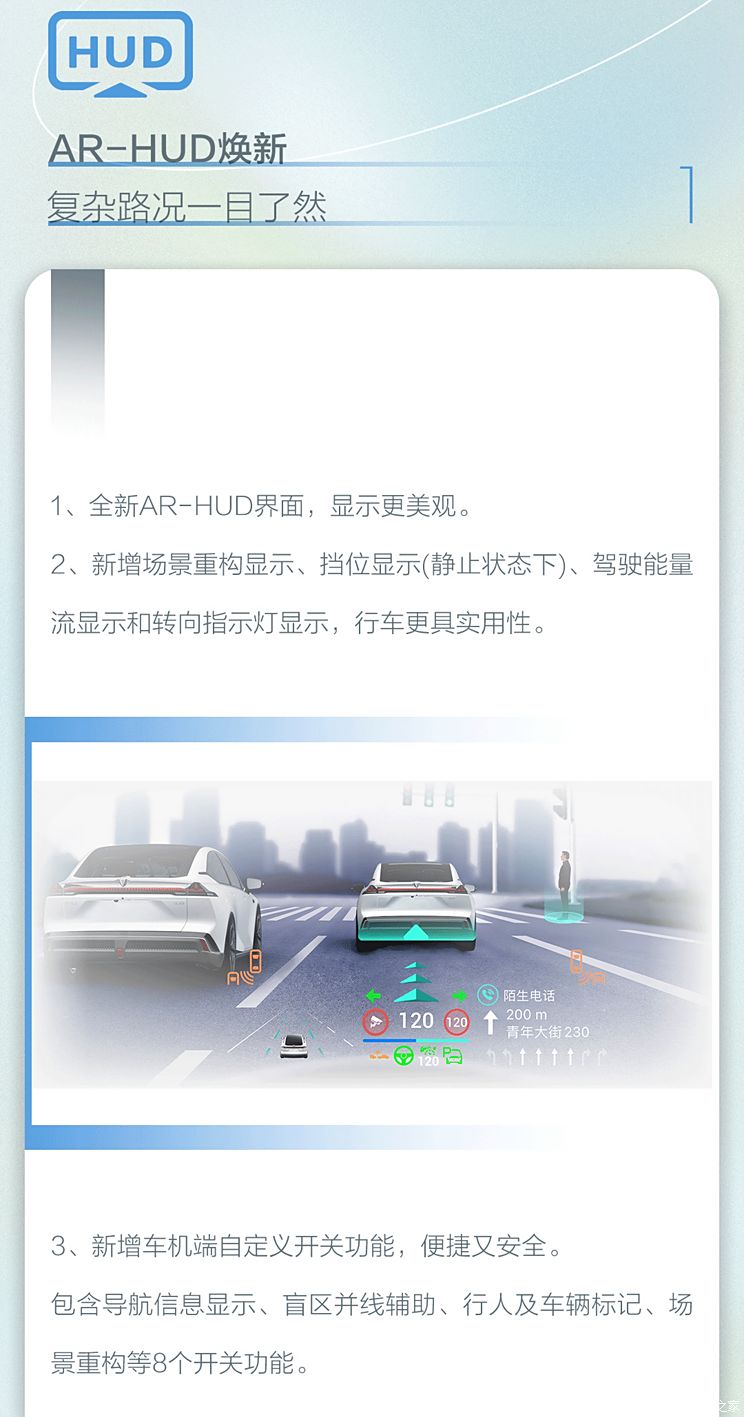

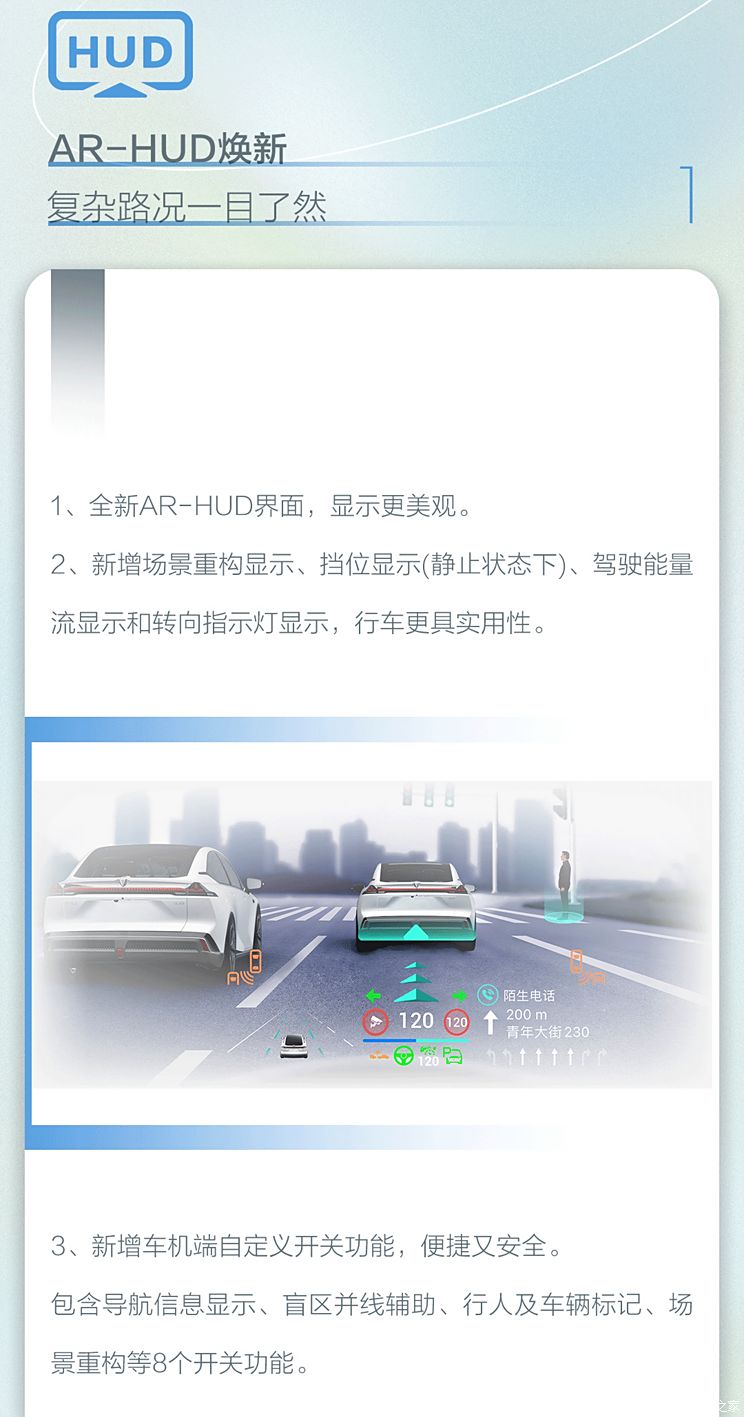

The auxiliary driver screen has added the function of playing iQiyi video; AR-HUD rejuvenation: 1. The brand-new AR-HUD interface makes the display more beautiful. 2. Add scene reconstruction display, gear display (at rest), driving energy flow display and turn indicator display, which makes driving more practical. 3. Add a custom switch function at the vehicle end, including eight switch functions, such as navigation information display, blind area merging assistance, pedestrian and vehicle marking, and scene reconstruction.

Other function optimization: 1. Optimize the desktop vision of the car. Including icon, application list layout, air conditioning interface and other optimizations. 2. Optimize the function of the status bar at the top of the locomotive. Support time, mobile network, Wi-Fi, camera and other customized display functions. 3. Optimize the vehicle prompt sound. 4. Fix the occasional silence when the mobile navigation route is pushed to the car map.

● Lingke

OTA involves models:Lingke 08 EM-P

OTA content:Including 22 additions and 60+ optimizations.

OTA push time:Within 3 months

Linke 08 EM-P OTA 1.3.0 officially launched the push, and this upgrade includes 22 additions and 60+ optimizations. In addition, the LEEK 08 time limited edition and the NOA function of the optional "technology is proud to enjoy the package" model are also under research and development testing, and will be officially pushed in subsequent versions; After the official push, the first batch of provinces and cities to be opened are Zhejiang, Jiangsu, Guangdong and Shanghai, and the functions can cover some high-speed and elevated roads supported by high-precision maps of the above provinces; Please refer to the official announcement for subsequent open areas.

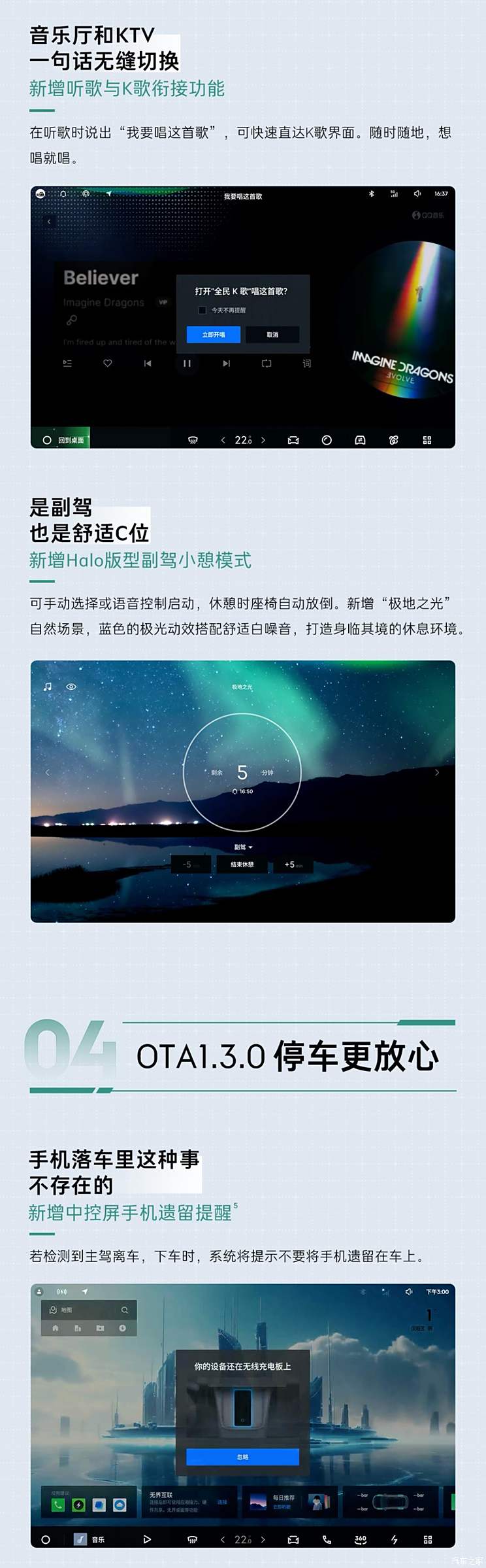

New super car-seeking function: car-seeking guide provides "distance guide", "direction guide" and "height guide" to guide users to reach the vicinity of the vehicle (within 20 meters). Add the function of UWB digital key: After adding the digital key through FlymePay, the UWB digital key will automatically unlock near the vehicle and automatically lock away from the vehicle.

New cross-end clipping function: the address copied on the mobile phone can be directly pasted into the car map of Gaode, making navigation and search more efficient. Add Carlink mobile phone interconnection function: it can realize the interconnection between Xiaomi /vivo/OPPO mobile phone and car machine, and extend the application and service of mobile phone to Link 08. New traffic light status and green wave speed guidance reminder: the new version of Gaode map is online, and navigation provides car owners with speed and fast traffic advice by obtaining traffic light change information at intersections within a certain range.

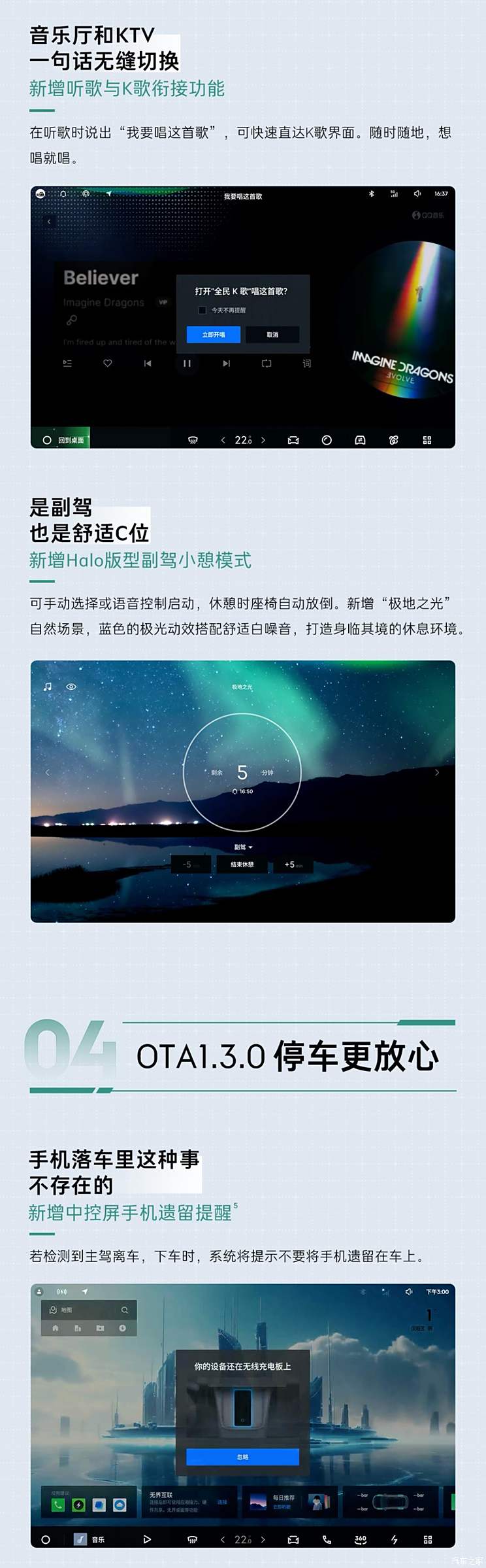

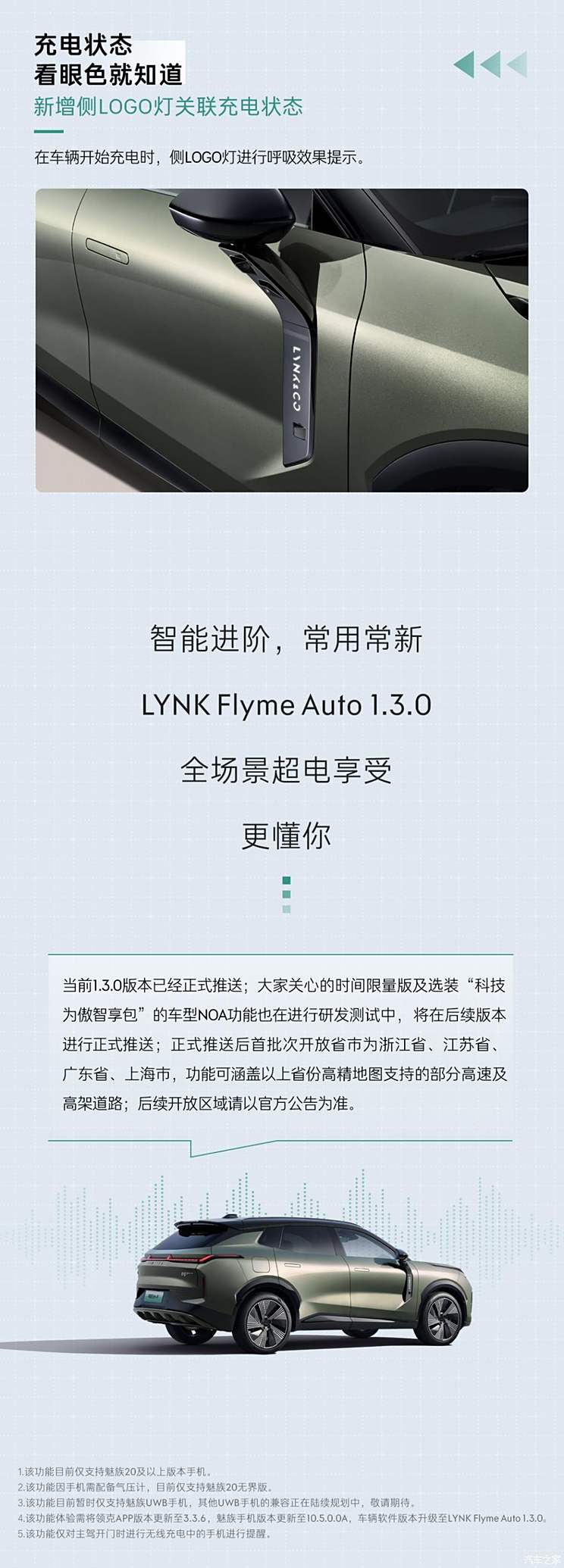

Add unbounded photo album: photos in the mobile phone photo album can be synchronized to the car photo album, making cross-end circulation more efficient. Add WeChat to send music to the car: You can send the music shared by your friends to the car in real time through mobile phone WeChat. In addition, the new functions include the connection between listening to songs and K songs, the Halo version of the co-pilot nap mode, the reminder left by the central control screen mobile phone and the related charging status of the side LOGO lights.

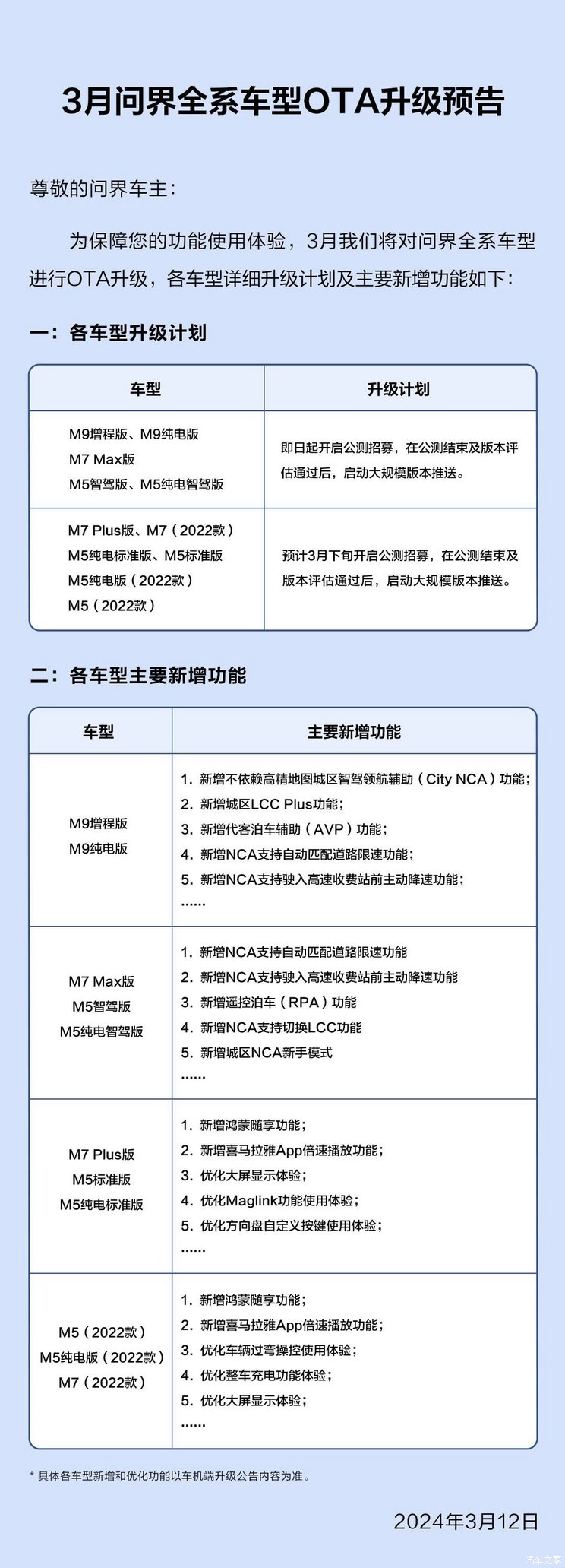

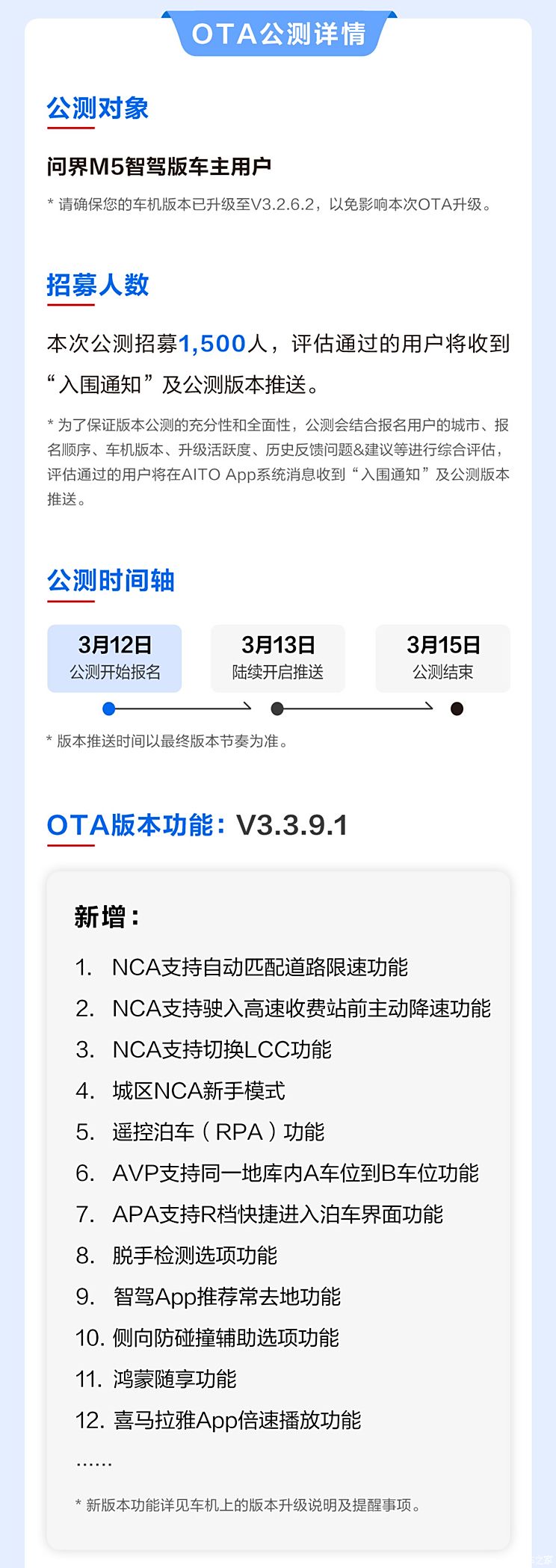

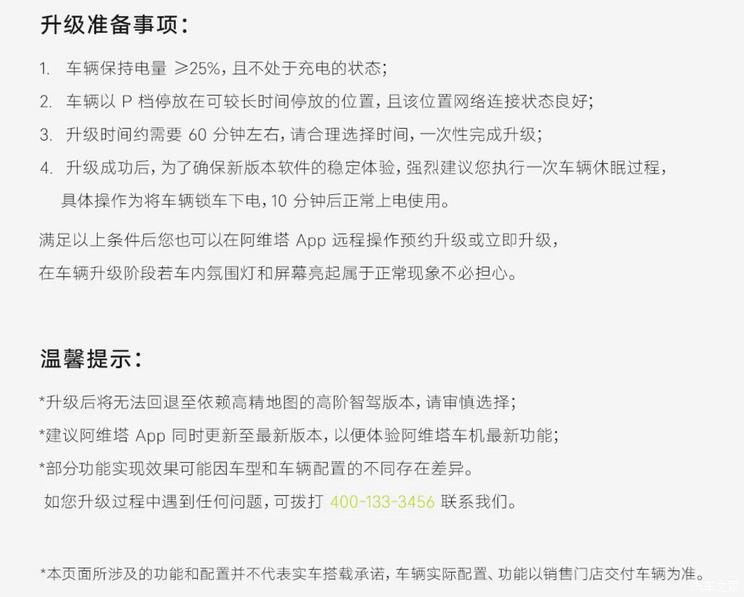

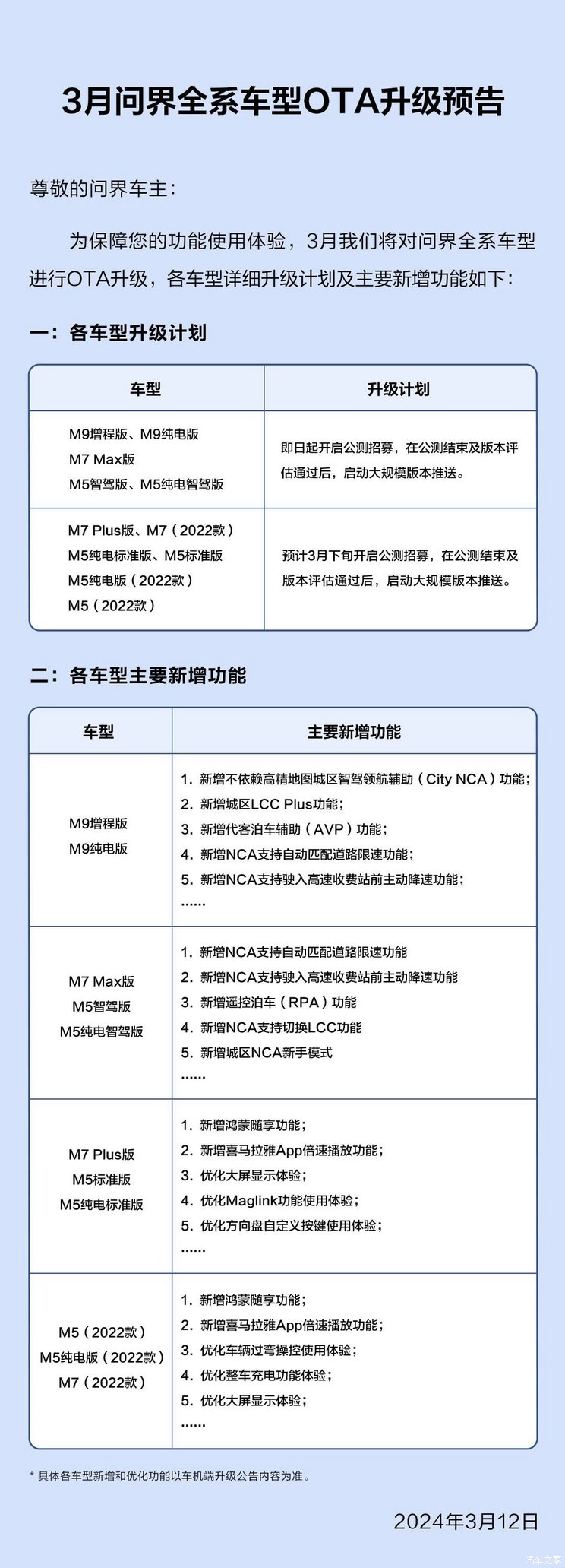

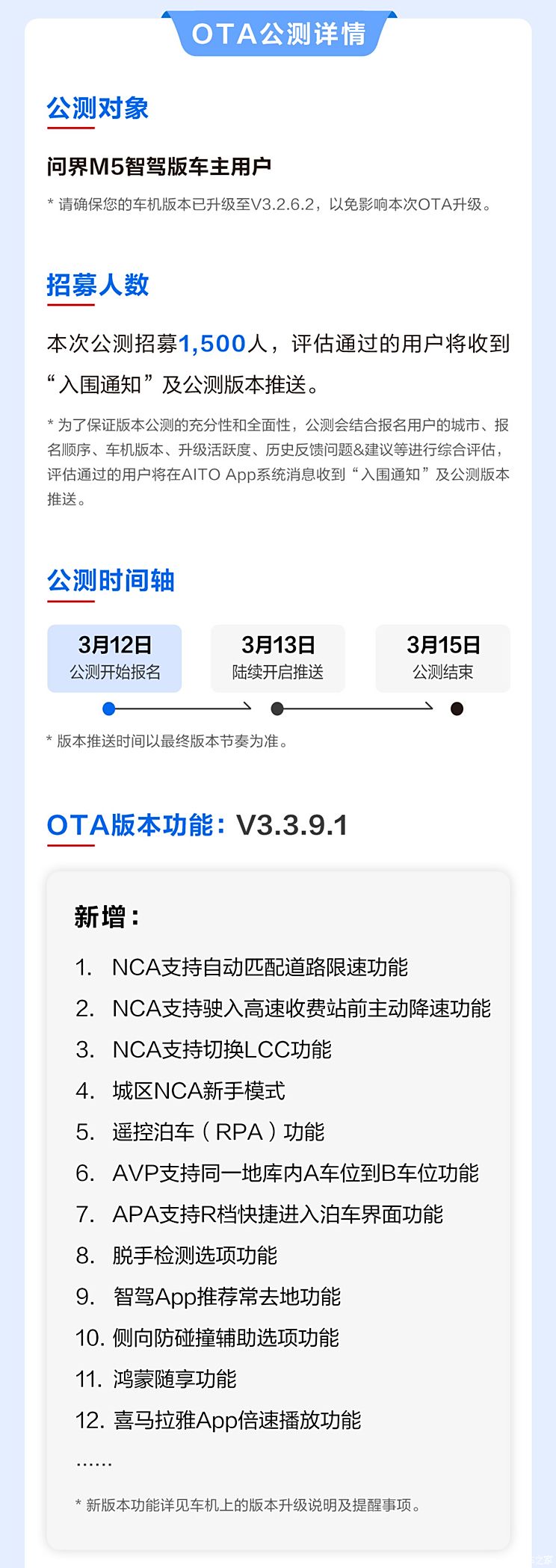

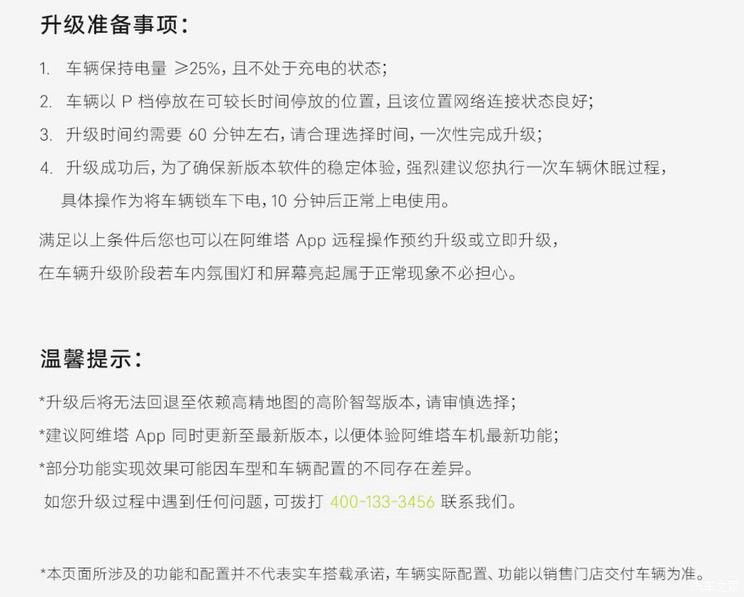

● ask the car.

OTA involves models:Wujie M5 Intelligent Driving Edition, Wujie M5 Pure Electric Intelligent Driving Edition, Wujie M7() Max Edition, Wujie M9 Extended Range Edition and Wujie M9 Pure Electric Edition.

OTA content:Remote Parking (RPA) and NCA support functions such as automatic matching of road speed limit.

OTA push time:Within 3 months

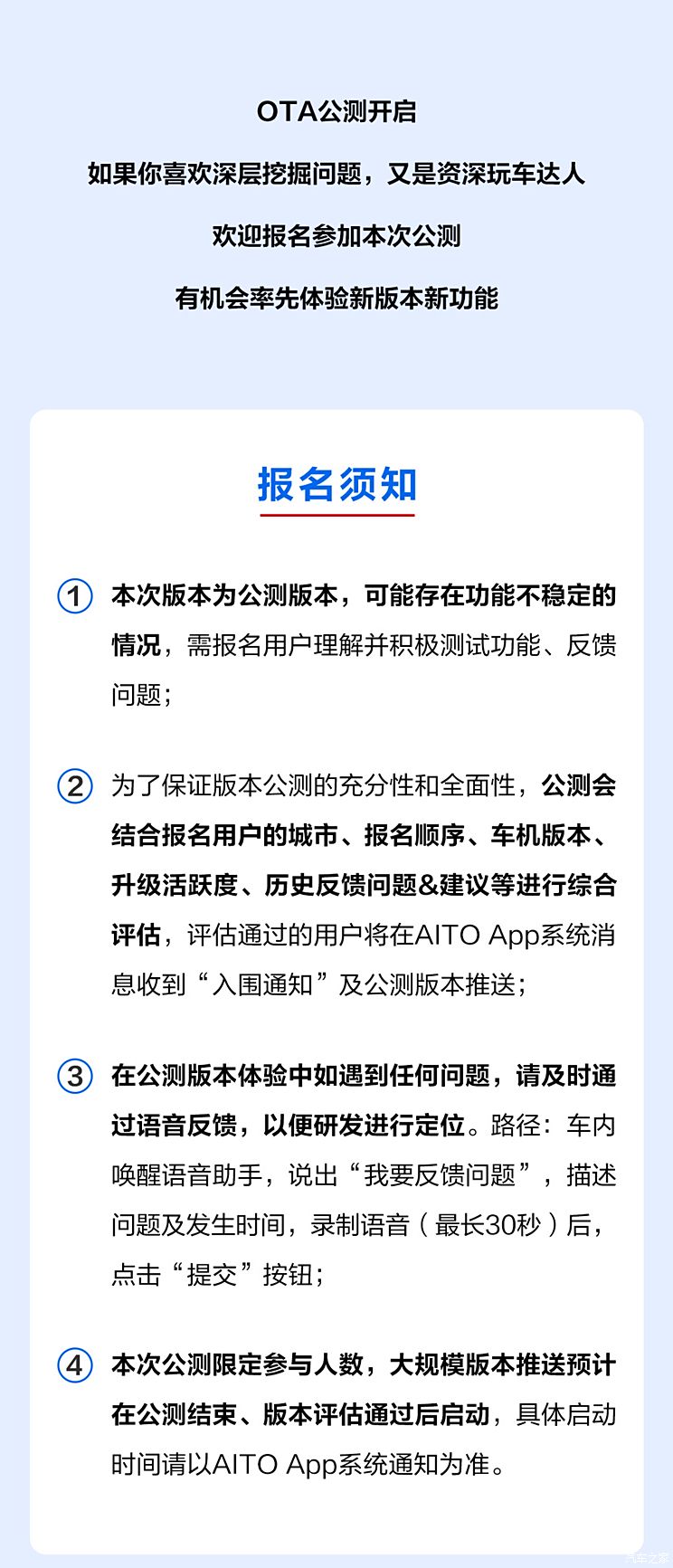

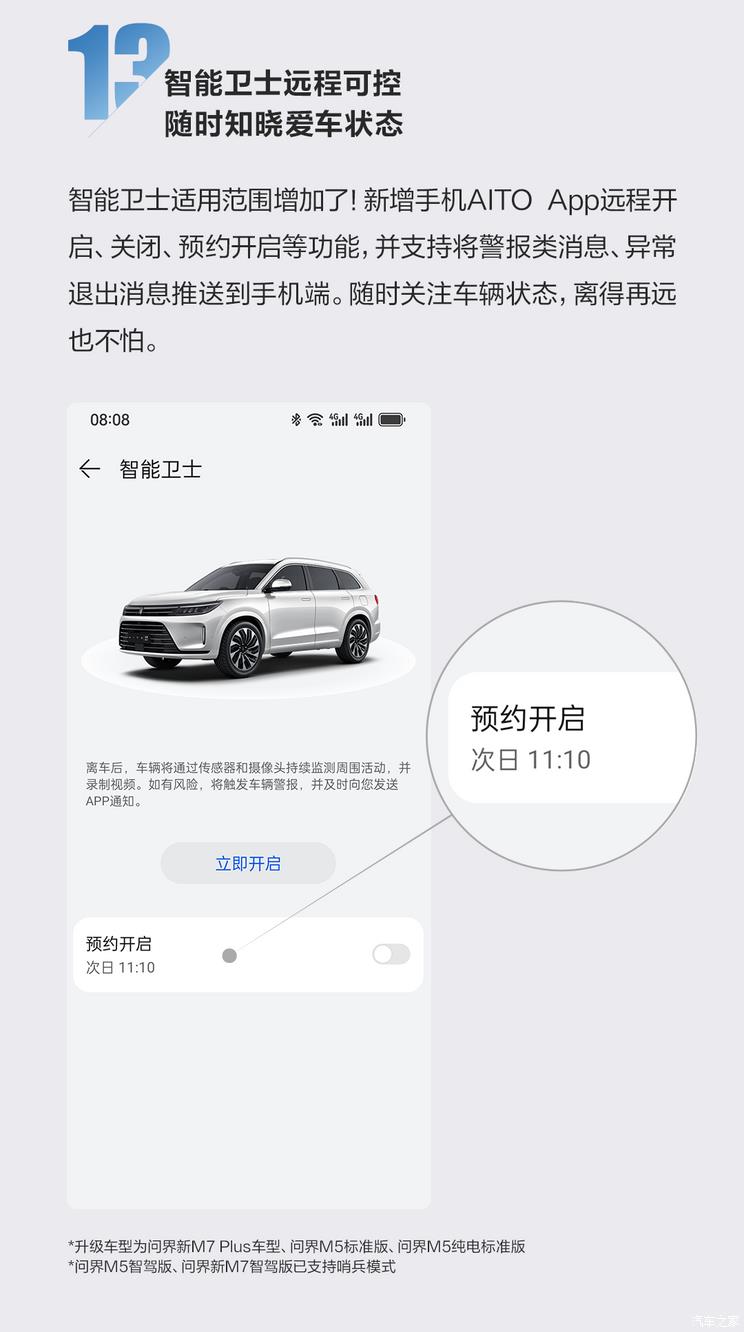

We learned from the official that the 3.3.9.1/4.2.0.7 version of OTA will be released in March, and the public beta activity is officially launched. The intelligent driving version series OTA public beta covers five models: intelligent driving version M5, pure electric intelligent driving version M5, M7 Max, extended range version M9 and pure electric version M9. At present, the public beta of this version will be registered at 20: 00 on March 12, 2024, and the large-scale version push will be started after the public beta is over and the version evaluation is passed.

The 3.3.9.1 version of OTA will update the functions of remote parking (RPA) and NCA to support automatic matching of road speed limits. This OTA covers three models: Wujie M5 Intelligent Driving Edition, M5 Pure Electric Intelligent Driving Edition and M7 Max Edition. The 4.2.0.7 version of OTA will be updated without relying on the functions of high-precision map intelligent driving navigation assistance (City NCA), urban LCC Plus and parking service Assistance (AVP). This OTA covers two models: the extended-range version of Wenjie M9 and the pure electric version of Wenjie M9.

● Warrior

OTA involves models:Warrior 917

OTA content:It will be improved in smart cockpit, charging experience, power and vehicle response.

OTA push time:March 20

Warrior announced that the Warrior 917 model has pushed the first OTA update, with version V1.0.05. This update will improve the smart cockpit, charging experience, power and vehicle response (see the end of the official announcement).

Intelligent cockpit experience section. The experience of wading mode is upgraded. Under the new wading mode, the low volume of audio and video in the car can be manually adjusted; Optimize the animation of vehicle display, optimize the animation of suspension jumping, and the visual effect is better; The new function of remote car control adds the function of cloud diagnosis, which is intelligent, efficient and remote escort; The function of face recognition is optimized, and the algorithm is optimized to improve the recognition efficiency.

Charging experience section. The optimization of power display improves the estimation accuracy of battery remaining power, and the display of power is more accurate. The algorithm of charging module is improved, and the compatibility and stability of more charging piles are improved.

Power domain control part. The logic optimization of the four-wheel drive system can automatically match the road switching. The upgrade of battery power saving algorithm can improve the endurance level and power saving effect of vehicles. The performance of cooling fan is improved, and the operation of vehicle fan is more efficient.

Vehicle response part. Vehicle remote control optimization, more stable. Vehicle positioning optimization, positioning information is more accurate. Vehicle network optimization improves network stability.

● Deep blue car

OTA involves models:Deep blue S7

OTA content:Add the compulsory pure electric mode of the extended-range vehicle, and add the App to inquire about the four tire pressure values of the vehicle.

OTA push time:March 20

Deep blue S7 ushered in a new round of OTA upgrade, and the version will be upgraded to Deepal OS 2.1, which will bring a number of functional upgrades and optimizations, such as the mandatory pure electric mode of new extended-range vehicles, and the addition of App to inquire about the four tire pressure values of vehicles. Specific function optimization and experience upgrade are as follows:

Brand new function

1. Add the compulsory pure electric mode for extended-range vehicles (more battery power can be used to improve the pure electric cruising range, but the power becomes weaker at low battery power, and the extended-range noise becomes larger after exiting). Upgrade the "super extended range" energy management algorithm to optimize the car experience in high altitude areas.

2. Add App to inquire about the tire pressure value, long-term average power consumption and long-term average fuel consumption of vehicles. (This function is applicable to Deep Blue Auto App 1.6.2 and above)

3. Add the car control widget of the iOS App lock screen interface. (This function is applicable to Deep Blue Auto App 1.6.2 and above)

4. Add a button to switch wallpaper/map mode in the status bar at the bottom of the vehicle terminal.

5. Add the custom function of "My Wallpaper" on the car terminal, and you can set your favorite pictures as desktop wallpapers.

6. The auxiliary driver screen has added the function of playing iQiyi video.

AR-HUD upgrade

1. The UI of AR-HUD has added theme 2, as well as electronic eye/speed limit and driving energy flow prompt switch.

Other optimization

1. Optimize the desktop vision of the car. Including icon, application list layout, air conditioning interface and other optimizations.

2. Optimize the function of the status bar at the top of the locomotive. Support time, air quality, mobile data, Wi-Fi, camera and other customized display functions.

3. Optimize the vehicle prompt sound.

4. Fix the occasional silence when the mobile navigation route is pushed to the car map.

According to the official of Deep Blue Auto, the OTA upgrade rate of Deep Blue S7 Deepal OS 2.1 has exceeded 70%, and the upgrade of Deep Blue SL03 Deepal OS 2.1 is still in the sampling stage, so you can wait a little.

As a reference, Deep Blue S7 provides extended range version and pure electric version. The extended range version is a 1.5L naturally aspirated engine with the maximum power of 70kW, the peak power of the driving motor of 175kW, the pure electric battery life of 121km and 200km respectively, and the maximum comprehensive cruising range of 1120km. The pure electric version is equipped with a single motor, which has two specifications, the maximum power is 160kW and 190kW respectively, and the cruising range is 620km and 520 km respectively (CLTC working condition).

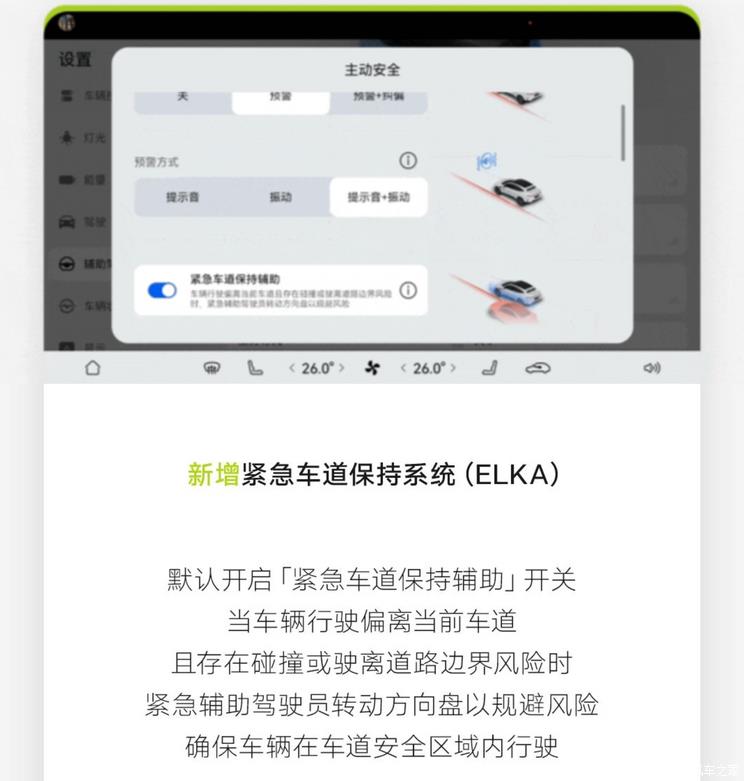

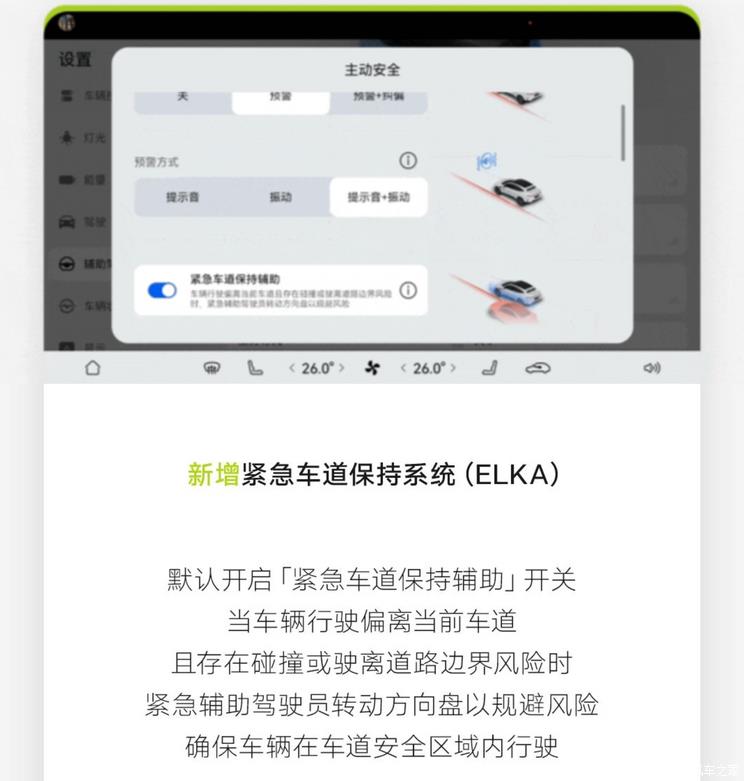

● Aouita

OTA involves models:Aouita 11

OTA content:Add custom parking function, add emergency lane keeping system (ELKA), optimize lane change strategy of intelligent driving and navigation assistance (NCA), and optimize lane selection logic of lane cruise assistance (LCC).

OTA push time:Within 3 months

We learned from the official that Aouita 11 started the OTA upgrade. According to the official, the intelligent driving navigation aid that does not rely on high-precision maps is now on. In addition, the OTA also added custom parking function, added emergency lane keeping system (ELKA), optimized lane change strategy of intelligent driving navigation assistance (NCA), optimized lane selection logic of lane cruise assistance (LCC), optimized trajectory planning strategy of intelligent parking assistance (APA), and improved automatic emergency braking (AEB) identification accuracy. Details are as follows:

Aouita is a brand created by Changan Automobile in cooperation with Huawei and Contemporary Amperex Technology Co., Limited, and Contemporary Amperex Technology Co., Limited is the second largest shareholder of Aouita. Huawei provides Aouita with a full-stack smart car solution through HI mode. Aouita 11 is positioned as a medium and large SUV, which is built based on the new generation intelligent electric vehicle technology platform CHN. At present, there are 5 models on sale in 2024, and the price range is 300,000-390,000 yuan. According to different configurations, the battery life provides 580km, 630km, 700km and 730km for consumers to choose from.

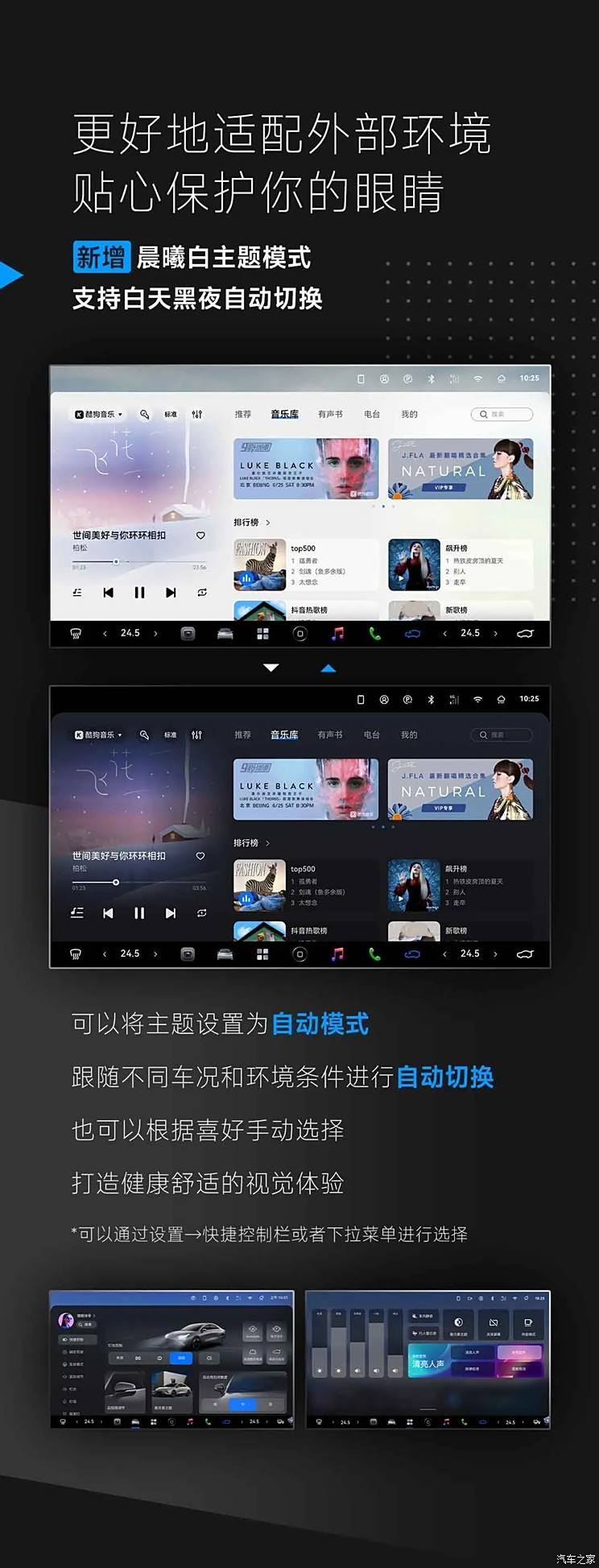

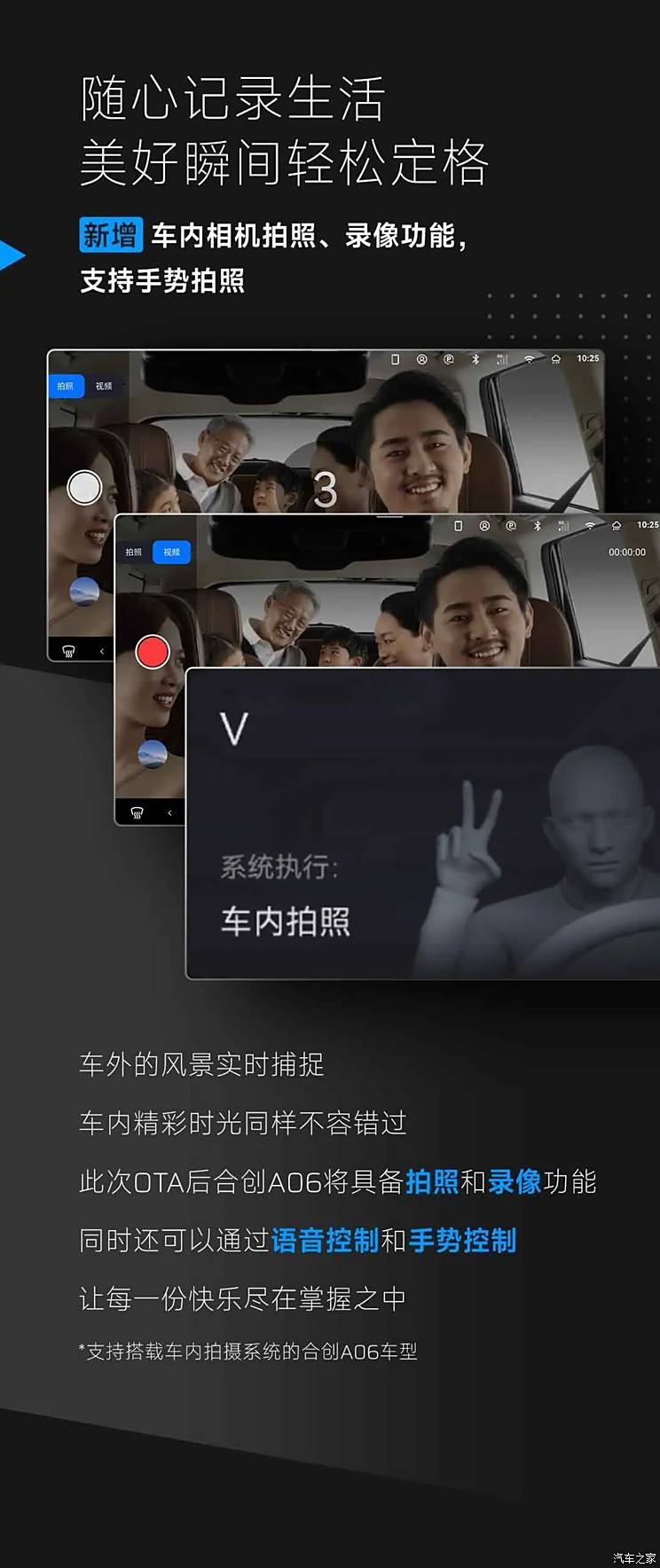

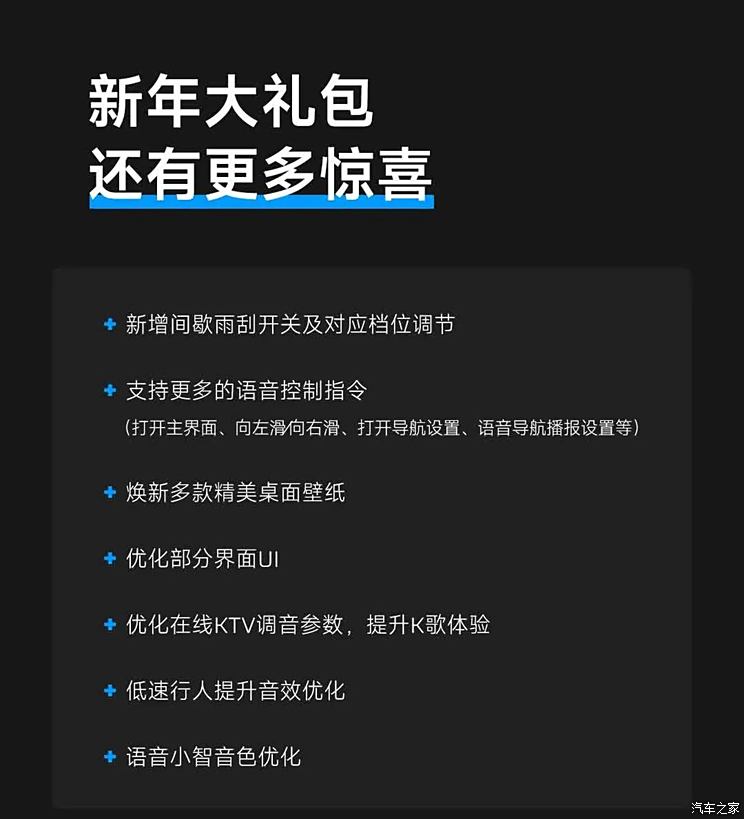

● Co-creation

OTA involves models:Hechuang A06

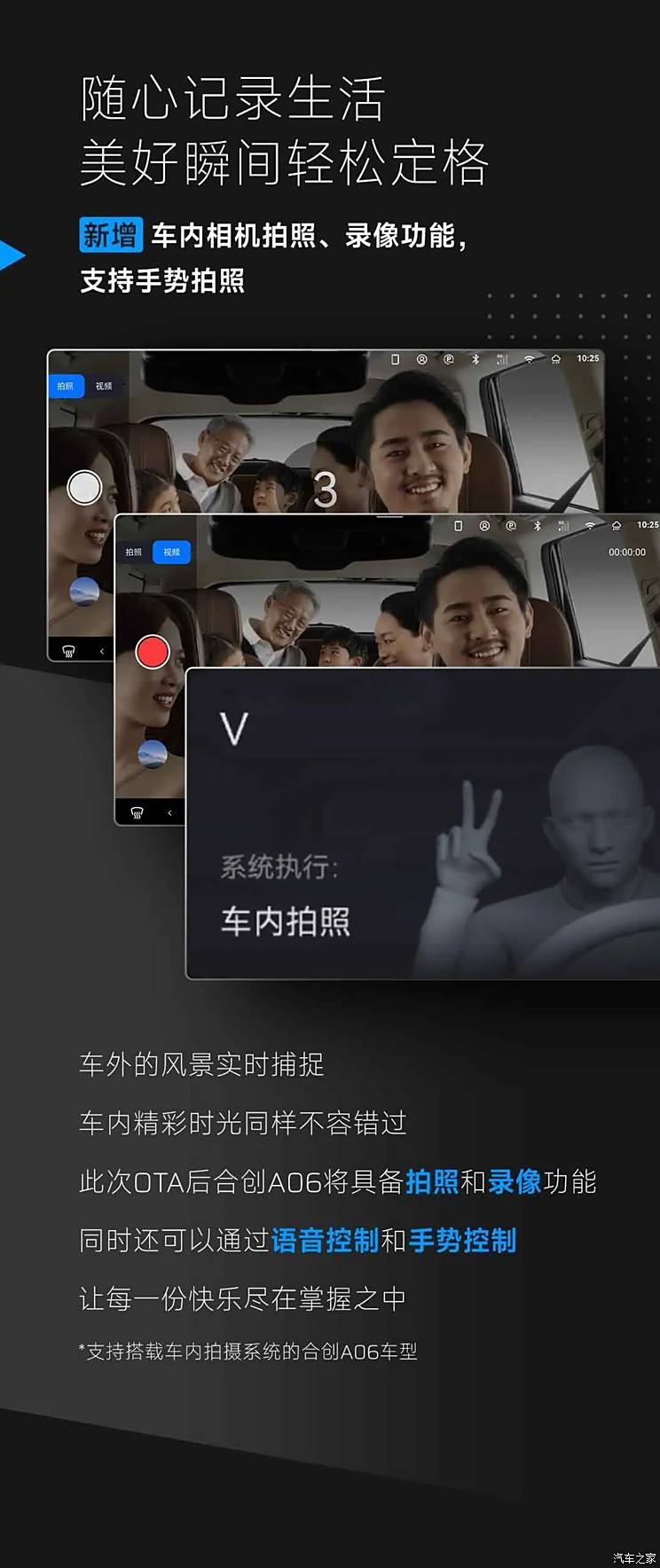

OTA content:The camera in the car has been added with the functions of taking photos and recording videos, supporting gesture photos, adding the visual guidance of lane-changing auxiliary instruments with turn signals, and adding more than 10 application stores for shelving and updating.

OTA push time:March 20

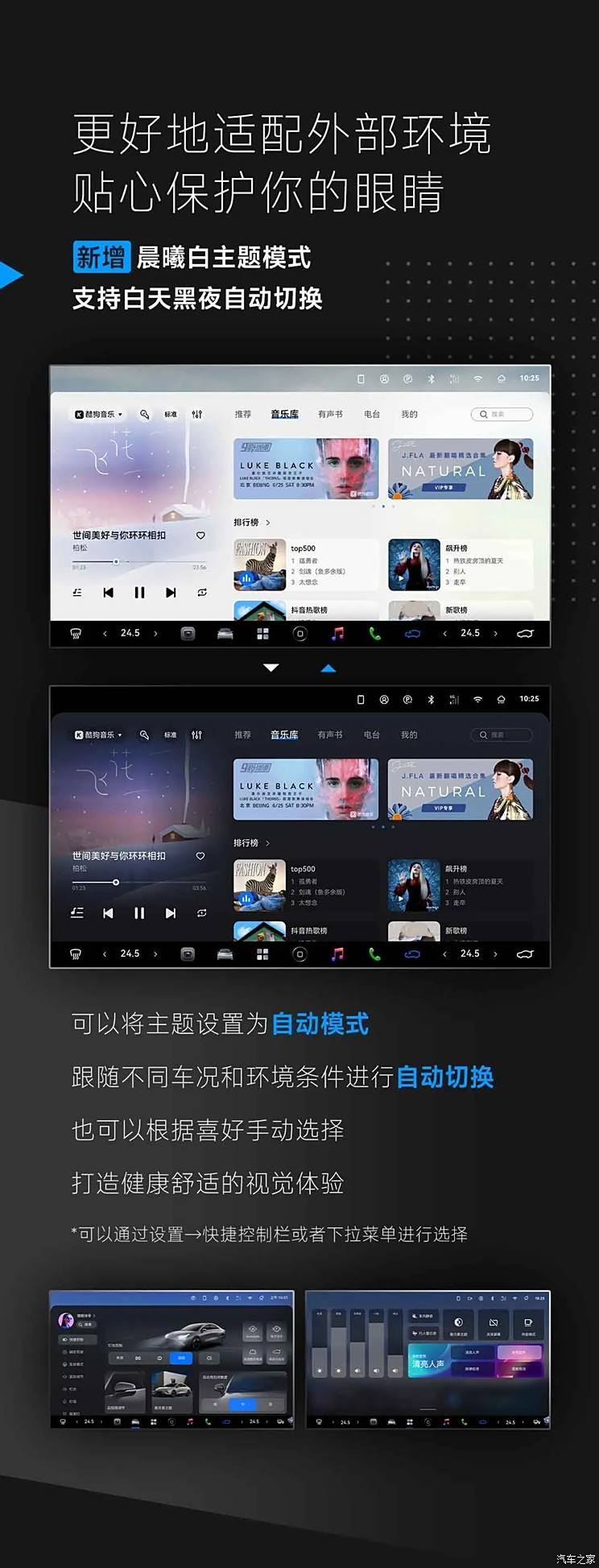

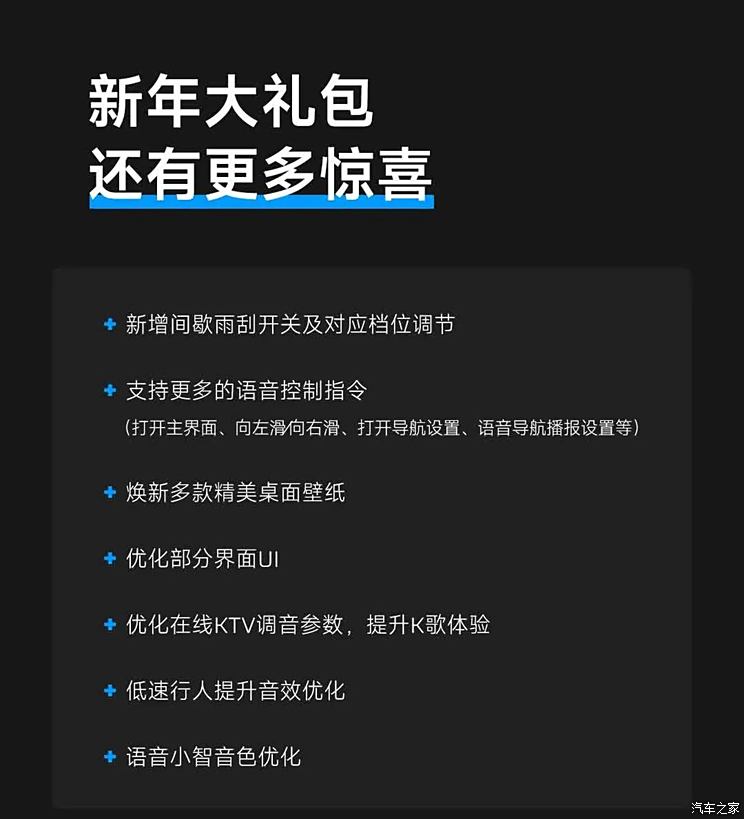

We learned from the official that Hechuang A06 is about to update OTA 2.3. In this update, the white theme mode of dawn is added, which supports automatic switching between day and night, adding the function of taking a shot outside the car, adding the function of taking pictures and recording with the camera inside the car, supporting gesture photography, adding the visual guidance of lane-changing auxiliary instruments with turn signals, adding more than 10 application stores to be put on shelves and updated, upgrading the i-Dock ultra navigation bar, and supporting the customization of more functions. Details are as follows:

Hechuang A06 positioning brand’s medium-sized pure electric car starts at 179,800 yuan. The new car is the first model based on the Hechuang H-GEA architecture, and the acceleration of the high-performance version of 0-100km/h takes only 3.7 seconds.

● Baojun

OTA involves models:Bao jun yun duo

OTA content:Four new functions were added, and more than 25 performances were optimized, covering four sections: intelligent parking, intelligent driving, intelligent navigation and human-computer interaction.

OTA push time:March 1st.

Baojun Yunduo OTA 2.0 was officially launched. Through the in-depth optimization of algorithms and structural models, various intelligent driving functions were advanced in an all-round way. This OTA is aimed at Linxi version, adding four functions and optimizing more than 25 performances, covering four sections: intelligent parking, intelligent driving, intelligent navigation and human-computer interaction.

This OTA has added three major parking functions to optimize a number of parking performances. Among them, the new vertical parking space is completely out of the library, and the outbound is in place in one step, and the trip is one step faster; The wheel side visual angle display under the condition of adding intelligent parking, and the blind area of intelligent parking is under control; Add the parking function of the front of the inclined train station, adjust measures to local conditions and respond intelligently, and shorten the average parking time of the inclined train station by 9 seconds. Optimize the efficiency of intelligent parking, on the basis of the original "30s efficient parking", the average comprehensive parking time will be shortened by 5 s; Optimize the parking performance of parking spaces in the side space, and easily park the side parking spaces on the street without lines; Optimize the parking performance in narrow parking spaces and night environment, and identify and park in a narrow vertical parking space only 60 cm wider than the car body and a narrow horizontal parking space 90 cm longer than the car body, and further expand the parking available range under night/dark conditions; At the same time, improve the imaging quality of 360 panoramic images and improve the memory parking and cruising ability.

Comprehensively improve the ability of intelligent driving assistance, optimize the ability to keep the lane centered in various use scenarios, and accurately control the driving trajectory and direction; Optimize the intelligent lane-changing performance, adjust the lane-changing strategy, increase the detection distance of lane lines by 20%, improve the recognition accuracy of virtual and real lines by 20%, and make the lane-changing response smarter; Optimize the performance of sideslip obstacle avoidance, increase the detection distance of static obstacles by 30%, and adjust the obstacle avoidance strategy for adjacent lanes to make driving more comfortable and safe. Optimize a number of ramp strategies to comprehensively improve the ability of intelligent navigation to enter and exit the ramp. On-ramp driving is more intelligent, the detection distance of diversion belt is increased by 25%, and it supports intelligent acceleration and deceleration to find lane change space and time according to the traffic situation of the main road, which makes the lane change decision more decisive and improves the confluence efficiency and success rate by 5%.

Add a pop-up window of dirty camera cleaning prompt to highlight the camera to be cleaned, which is convenient for accurate positioning and cleaning, improves the stability of visual display, and makes the screen display more accurate and smooth; Optimize the visual color matching of intelligent driving interface, so that the screen can be seen clearly under strong light conditions, and the driving interface is more intuitive and easy to read. (Compile/car home Zhouyi)